This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Barclays Launches S$ PerpNC6; US CPI Softer than Expected

October 27, 2025

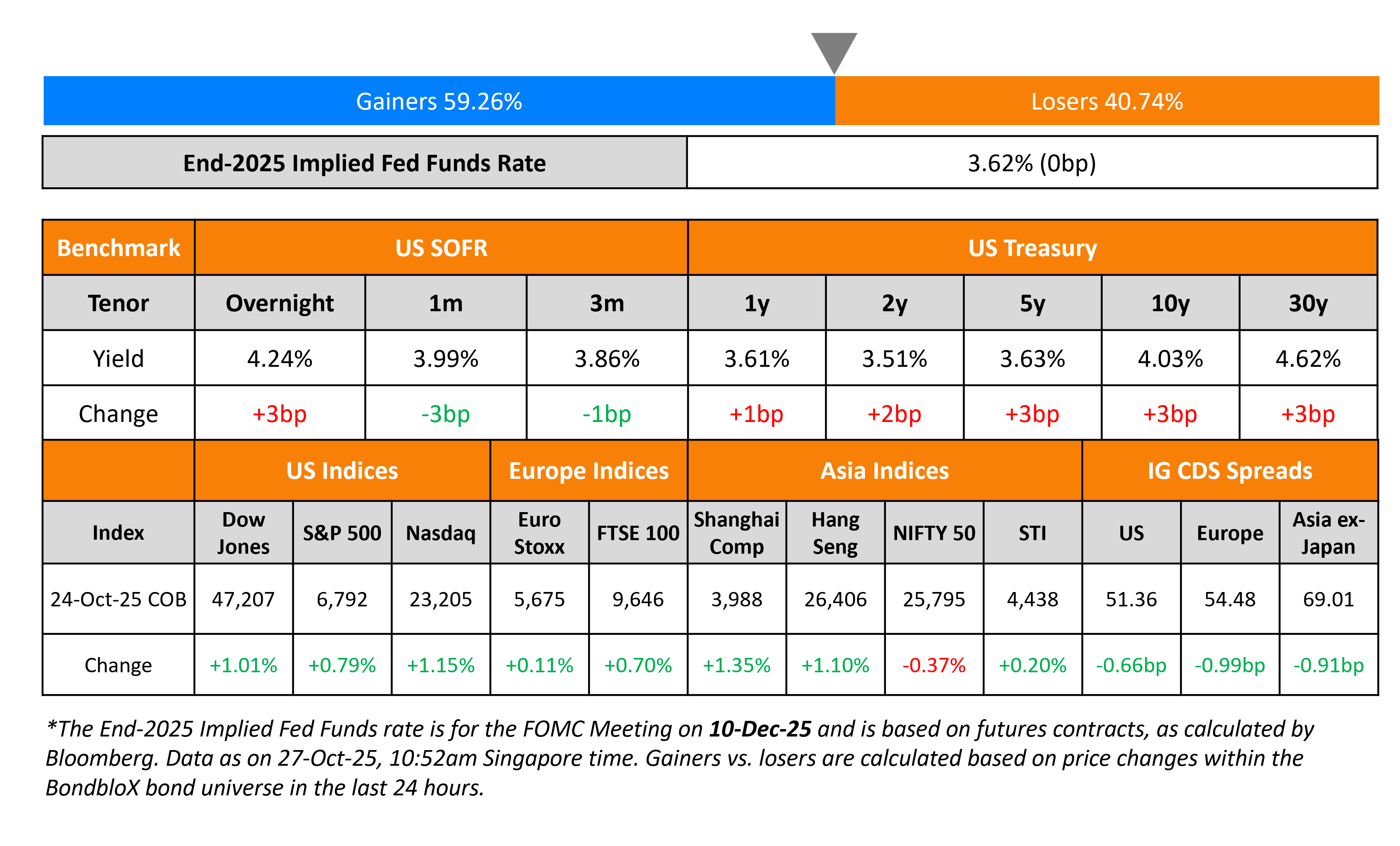

US Treasury yields were higher by 2-3bp across the curve. The US CPI YoY reading for September came-in at 3.0%, lower than expectations of 3.1%, but higher than the previous month’s 2.9% print. Core CPI YoY came-in at 3.0%, lower than expectations and the prior month’s 3.1% print. However, the relatively soft CPI readings were partially offset by stronger than expected readings on the preliminary S&P Manufacturing and Services PMIs. The former came-in at 52.2 vs. the surveyed 52.0 and the latter at 55.2 vs. the surveyed 53.5. Separately, US Treasury Secretary Scott Bessent said that the US had worked out a framework agreement with China regarding rare earths and tariffs.

Looking at equity markets, the S&P and Nasdaq closed 0.8% and 1.2% higher. The US IG and HY CDS spreads tightened by 0.7bp and 4.5bp respectively. European equity indices ended higher too. The iTraxx Main and Crossover CDS spreads were 1bp and 3.4bp tighter respectively. Asian equity markets have opened in the green today. Asia ex-Japan CDS spreads were 0.9bp tighter.

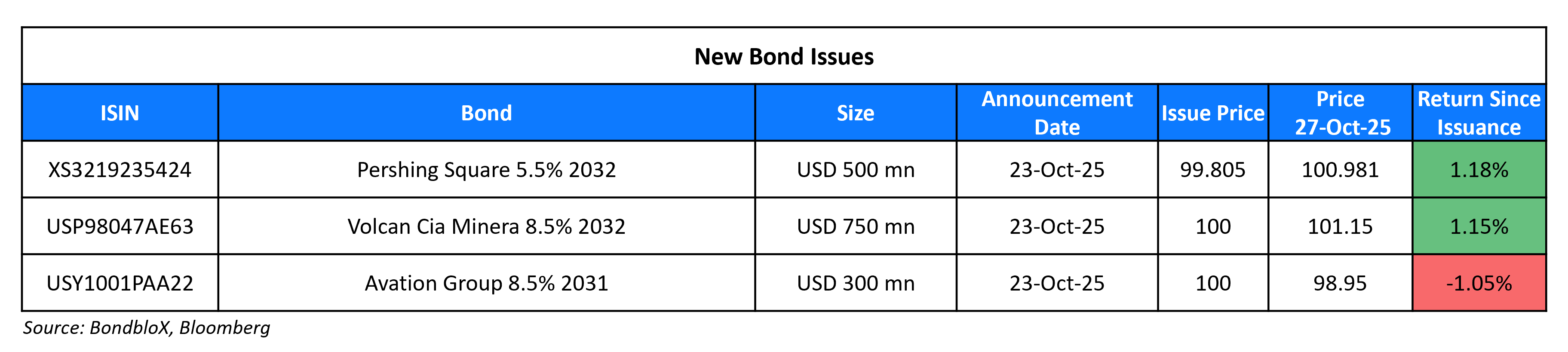

New Bond Issues

Volcan Compañía Miner raised $750mn via a 7NC3 bond at a yield of 8.5% vs. initial guidance of the mid-high 8% area. The senior unsecured note is rated B3/B- (Moody’s/Fitch). Proceeds will be used to repurchase all of its 2030s under its tender offer, fully repay the entire principal amount outstanding of its syndicated term loan facility, repay its outstanding 4.375% 2026s, repay other short and medium-term debt, and for general corporate purposes.

New Bonds Pipeline

-

Hon Hai € 6Y offering

Rating Changes

- Fitch Upgrades Piraeus Bank to ‘BBB-‘; Outlook Stable

- Fitch Upgrades Alpha Bank to ‘BBB-‘; Outlook Stable

- Fitch Upgrades Bread Financial Holdings, Inc. to ‘BB’; Outlook Stable

- Banco Nacional de Costa Rica Upgraded To ‘BB’ From ‘BB-‘ On Similar Sovereign Action; Outlook Stable

- Intuit Inc. Upgraded To ‘A’ On Strong Operating Performance; Outlook Stable

- Barbados Long-Term Rating Raised To ‘B+’ From ‘B’ On Stronger Governance; Outlook Is Stable

- Fitch Downgrades Raizen to BBB-; Places IDRs on Rating Watch Negative

- Fitch Downgrades Shanghai Commercial Bank to ‘BBB+’; Outlook Stable

- Fitch Revises Eurobank’s Outlook to Positive; Affirms at ‘BBB-‘

- Fitch Revises NBG’s Outlook to Positive; Affirms at ‘BBB-‘

- Moody’s Ratings changes France’s outlook to negative, affirms Aa3 ratings

Term of the Day: MREL

MREL stands for Minimum Requirement for Own Funds and Eligible Liabilities. This is set by resolution authorities (like the Bank of England or the EU’s Single Resolution Board) to ensure that a bank maintains sufficient eligible instruments to facilitate the implementation of its preferred resolution strategy at all times. This was initiated to ensure that a failing bank has sufficient resources to absorb losses and recapitalize itself instead of requiring a public bailout using taxpayer money.

MREL involves two-parts – a loss absorption amount and a recapitalisation amount. Firms are essentially required to maintain a minimum level of equity and eligible debt, typically above minimum capital requirements (MCR), so they can be ‘bailed in’ rather than bailed out.

Talking Heads

On Current Level of Rates Being Appropriate – ECB’s Escrivá

“What the ECB is communicating in its statements after each meeting, and we’ll have one soon, is that as inflation is truly at the target, which is 2%, we think it’s a good time to look ahead and consider the current level of interest rates appropriate”

On Inflation Bond Market Facing ‘Debt-Limit Equivalent’ in CPI Delay

Jonathan Hill, Barclays Capital

“I’ve been saying this is the debt-limit equivalent for the TIPS market — something we all need to pay attention to and hopefully doesn’t come to pass”

Aryaman Singh and Matthew Hornbach, Morgan Stanley

“As the data quality of CPI deteriorates, the demand for TIPS decreases as investors believe that they aren’t getting hedged against true inflation”

On The Bond Market’s Favorite Recession Signal Not Working

Campbell Harvey, Duke University

“Massive fiscal spending – that’s so different historically… fairly unusual… The yield curve predicted the last eight recessions. At some point it’s going to deliver a false signal. But eight out of nine is pretty good”

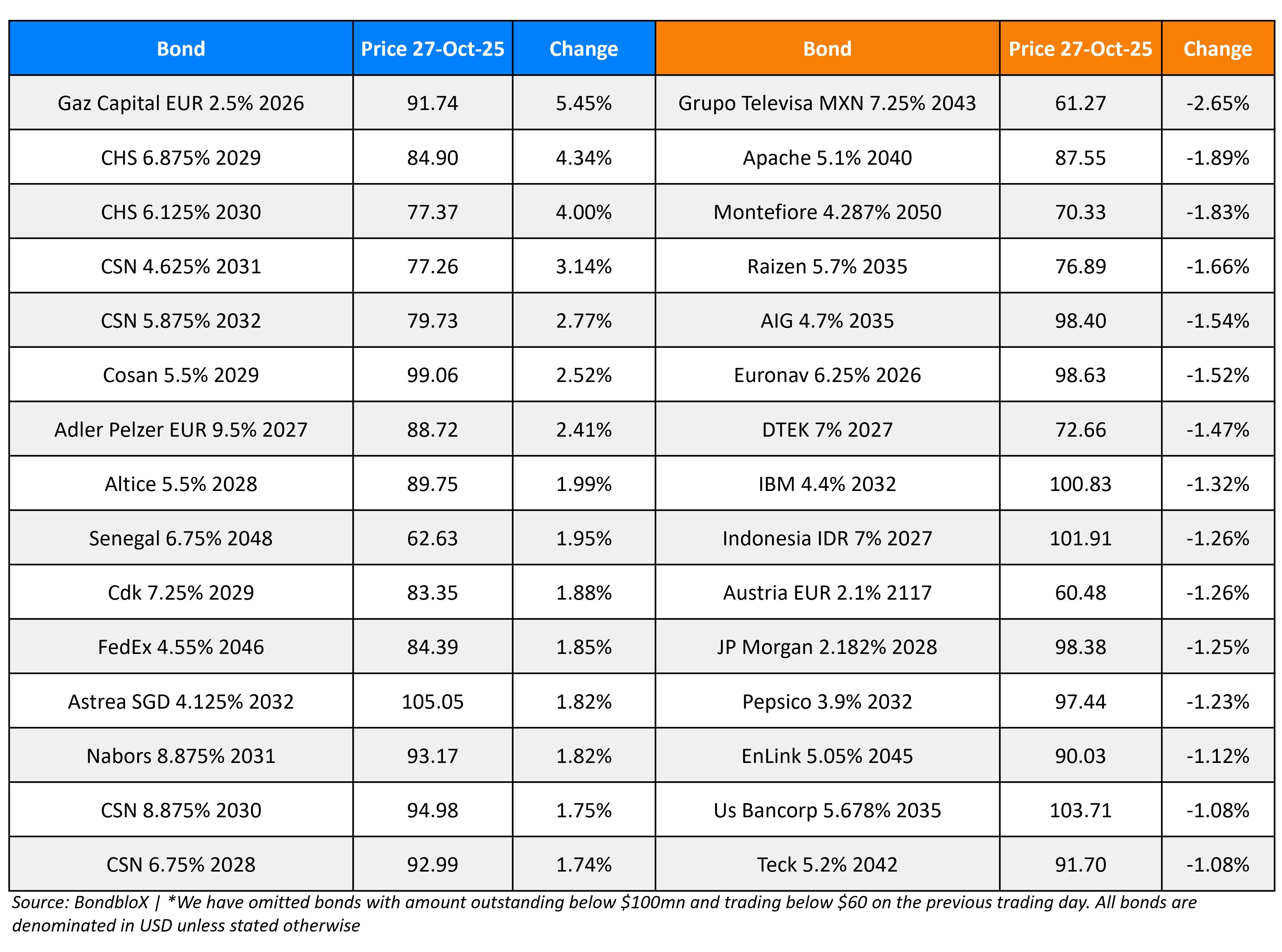

Top Gainers and Losers- 27-Oct-25*

Go back to Latest bond Market News

Related Posts: