This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Banca Monte-UniCredit Merger Prospects Recede; Monte’s bonds fall 4%

July 16, 2021

FT reports that merger prospects between UniCredit and Banca Monte Paschi dei Sienna (BMPS) are receding after the Italian government refused conditions attached by UniCredit’s new CEO Andrea Orcel. Orcel’s demands were considered too costly despite the Treasury offering favourable terms. They included guarantees that a deal would not reduce UniCredit’s capital strength and that it be indemnified from any legal risks tied to BMPS’s collapse. Orcel also informed that he wanted BMPS to cancel all its bancassurance and consumer credit agreement with other companies at no cost to UniCredit. A policymaker source said, “The sale to UniCredit, which has been the preferred option until now, seems to have been shelved.” Another policymaker said that while the conditions are unfavorable, a deal is still possible as negotiations are ongoing. Separately, UniCredit said it will create a standalone domestic division separating its from its German, Austrian and Central & Easter Europe banking operations.

Banca Monte’s 10.5% 2029s and 5.375% 2028s were down ~4% to 105.75 and 77.25 respectively. UniCredit’s bonds were stable with its 8% Perp at 111.3, yielding 3.8%.

For the full story, click here

Go back to Latest bond Market News

Related Posts:

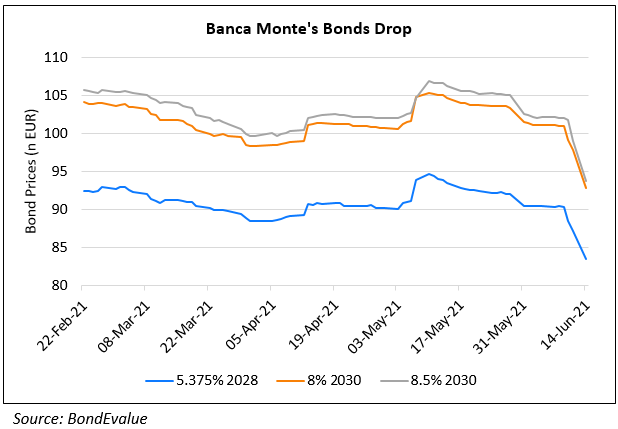

Banca Monte’s Bonds Fall ~5%

June 14, 2021

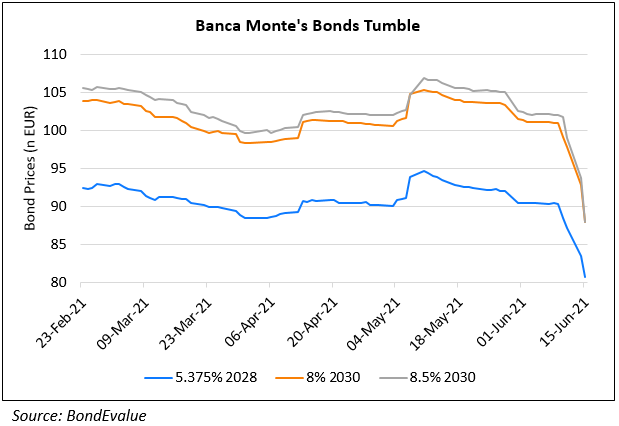

Banca Monte Bonds Plummet On Uncertainty Over Sale

June 15, 2021