This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Bahrain, Macquarie, China Oil and Others Price Bonds

January 28, 2026

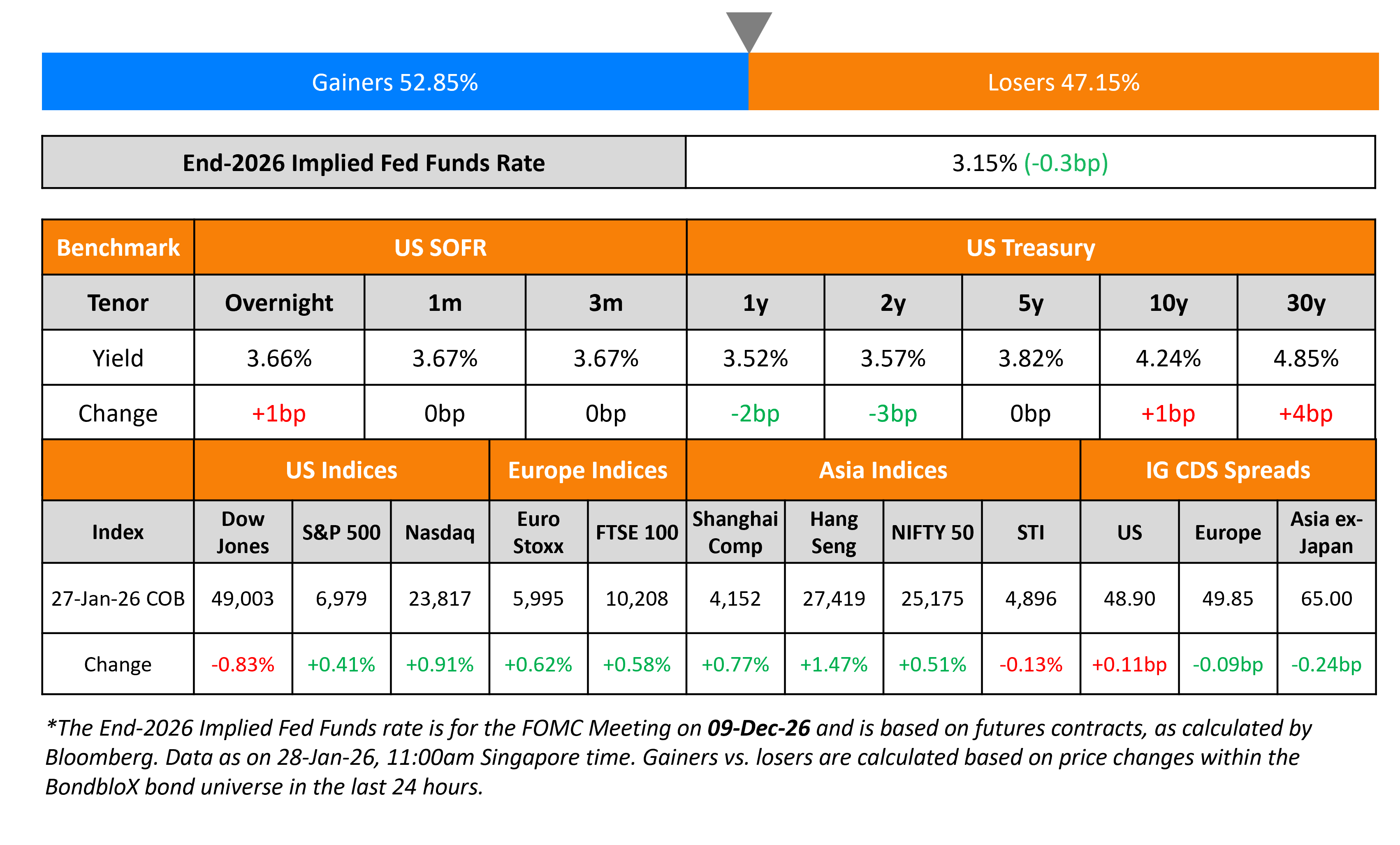

The US Treasury yield curve steepened, with the 2Y down 3bp while the 30Y rose 4bp. The CB Consumer Confidence Index for January came in lower at 84.5, versus expectations of 91.0 and a prior reading of 89.1. The US dollar slumped to its lowest level since early 2022 after President Donald Trump indicated he is comfortable with its recent decline, while gold breached the $5,000/oz level. Markets are expecting no rate cut at the FOMC meeting, which began yesterday.

Looking at US equity markets, the S&P rallied by 0.4% and Nasdaq ended 0.9% higher. US IG CDS spreads widened by 0.1bp and HY CDS spreads were 0.7bp wider. European equity indices ended higher as well. The iTraxx Main CDS spreads were 0.1bp tighter and the Crossover CDS spreads were 0.9bp tighter. Asian equity markets have opened mixed this morning. Asia ex-Japan CDS spreads were tighter by 0.2bp.

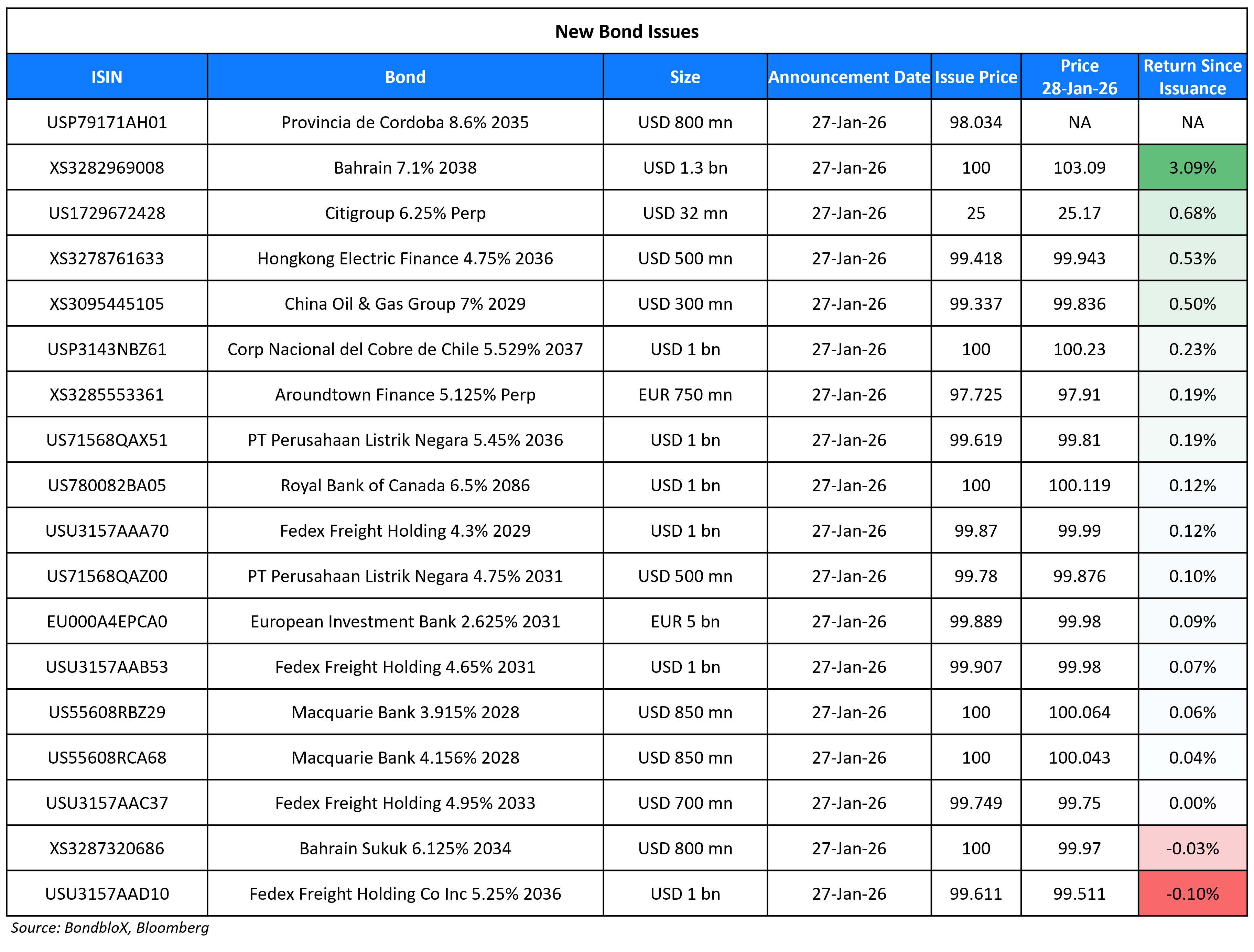

New Bond Issues

Bahrain raised $2.1bn via a two trancher. It raised $800mn via a long 8Y sukuk at a yield of 6.125%, 50bp inside initial guidance of 6.625%. It also raised $1.3bn via a 12Y bond at a yield of 7.1%, 40bp inside initial guidance of 7.5% area. The senior unsecured bonds are rated B/B+ (S&P/Fitch) and received combined orders of over $8.1bn, ~3.9x issue size. The long 8Y sukuk was priced 45.5bp tighter to its 5.625% 2034s that currently yield 6.58%.

Macquarie Bank raised $1.7bn via a two-part deal. It raised $850mn via a 2Y bond at a yield of 3.915%, 25bp inside initial guidance of T+60bp area. It also raised $850mn via a 2Y FRN at SOFR+48bp vs. initial guidance of SOFR equivalent area. The senior unsecured notes are rated Aa2/A+/A+(Moody’s/S&P/Fitch). Proceeds will be used for general corporate purposes.

Hongkong Electric Finance raised $500mn via a 10Y bond at a yield of 4.824%, 40bp inside initial guidance of T+100bp area. The senior unsecured bond is rated A-(S&P). Proceeds will be used for general corporate purposes, including refinancing of existing indebtedness.

China Oil & Gas raised $300mn via a 3NC2 bond at a yield of 7.25%, in line with initial guidance of 7.25% area. The bond is rated Ba3/BB (Moody’s/S&P). Proceeds will be used to repay outstanding 2021 notes, including funding the concurrent offer to purchase, with the remainder for general corporate purposes.

PT Perusahaan Listrik Negara raised $1.5bn via a two-part deal. It raised $500mn via a 5Y bond at a yield of 4.80%, 35bp inside initial guidance of 5.15% area. It also raised $1bn via a 10Y bond at a yield of 5.5%, 35bp inside initial guidance of 5.85% area. The senior unsecured notes are rated Baa2/BBB (Moody’s/Fitch). Proceeds will be used to partially fund capital expenditure for transmission, distribution and non-coal-related generation projects in support of accelerated electricity infrastructure development, as well as for general corporate purposes restricted to non-coal-related projects.

Citigroup raised $800mn via a PerpNC5 preference share at a yield of 6.25%, 25bp inside initial guidance of 6.5% area. The preferred shares are rated Ba1/BB+/BBB- (Moody’s/S&P/Fitch) and could be redeemed by the bank on any dividend payment date on or after 15 February 2031.

Royal Bank of Canada (RBC) raised $1bn via a 60NC7 bond at a yield of 6.5%, 18.75bp inside initial guidance of 6.625%-6.75% area. The junior subordinated note is rated Baa2/BBB/BBB+. If not called by 24 May 2033, the coupon will reset to the prevailing 5Y US Treasury plus 245bp. Proceeds will be used for general business purposes.

Provincia de Cordoba raised $800mn via a 9Y bond at a yield of 8.95%, 30bp inside initial guidance of 9.25% area. The senior unsecured bond is rated B3/B- (Moody’s/Fitch). Proceeds will be used to repurchase the notes due 2027 validly tendered and accepted in the tender offer, with the remainder to finance infrastructure projects and/or repay existing liabilities.

Codelco raised $1.25bn via a two-part offering. It raised $1bn via a 11Y bond at a yield of 5.529%, 35bp inside initial guidance of T+165bp area. It also raised $250mn via a tap of its 6.3% 2053 bond at a yield of 6.156%. The senior unsecured notes are rated Baa2/BBB+. Proceeds will be used for general corporate purposes.

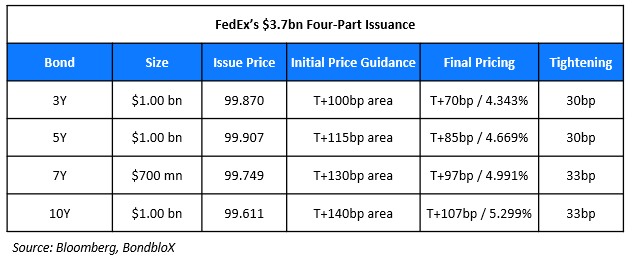

FedEx raised$3.7bn via a four-trancher. It raised:

The issuer is Fedex Freight Holding Co Inc. while FedEx Corporation is the guarantor. Proceeds will be distributed to FedEx as part of the consideration for the contribution of assets in connection with the spin-off. Pending completion of the spin-off, net proceeds will be held in a segregated account.

European Investment Bank (EIB) raised €5bn via a 5Y bond at a yield of 2.649%, 2bp inside initial guidance of MS+9bp area. The senior unsecured bond is rated Aaa/AAA/AAA.

Aroundtown Finance raised €750mn via a PerpNC5.5 hybrid bond at a yield of 5.625%, 43.75bp inside initial guidance of 6.00%–6.125% area. The subordinated bond is rated BB+(S&P). If not called by 3 August 2031, the coupon will reset to 5Y Mid-Swap plus 304.1bp. The coupon will step-up by 25bp if not called by 3 August 2036 and another 75bp if not called by 3 August 2051. Proceeds will be used for general corporate purposes, including funding the concurrent tender offer.

New Bonds Pipeline

- Muthoot hires for $ bond

Rating Changes

- Biocon Biologics Ratings Raised To ‘BB+’, Off CreditWatch; Outlook Stable

- Moody’s Ratings upgrades Ecuador’s rating to Caa1 from Caa3; maintains stable outlook

- Fitch Upgrades Port of Newcastle to ‘BBB’; Outlook Stable

- Moody’s Ratings upgrades Kenya’s ratings to B3 from Caa1, changes outlook to stable

- Fitch Downgrades Ukrainian Railways’ 2028 LPNs to ‘D’ on Uncured Coupon Non-Payment

- Kosmos Energy Ltd. Downgraded To ‘CCC’ On Elevated Restructuring Risk; Outlook Negative

- Fitch Downgrades Mercer International Inc.’s IDR to ‘B-‘; Outlook Negative

- Nine Energy Services Inc. Downgraded To ‘CCC-‘ From ‘CCC+’ On Deteriorating Liquidity; Outlook Negative

- Fitch Revises Multibank’s LT IDRs to Rating Watch Positive Following Merger Plans

Term of the Day: Preference Shares

Preference shares are a type of security issued by corporates that has features of both bonds and common stock. In terms of capital structure, preference shares pay dividends and have seniority over common stock but are subordinated to bonds. They do not have voting rights unlike common equity and pay dividends out of each year’s net profits. There are various types of preference shares – non-cumulative, redeemable/irredeemable, convertible, participating etc. In the case of cumulative preference shares, the company can pay cumulative dividends in the following year if the particular year’s profits are not enough. Preference shares may differ from AT1s. For example, they are based on the income statement while AT1s are balance sheet based. For instance, a bank making a loss after tax in a year may be able to pay interest on AT1s if capital levels are satisfactory but not dividends on preference shares. Alternatively, a bank making some profits could pay preferred dividends but may not be able to pay up on AT1s if capital levels are unsatisfactory and thus may get triggered. Differences of preference shares as against perpetual bonds, may include characteristics like step-ups etc. besides capital structure seniority of the latter. Citigroup raised $800mn via a PerpNC5 preference share at a yield of 6.25%.

Talking Heads

On Bond Market Contrarians Looking to Buy UST 30Y

Ed Al-Hussainy, Columbia Threadneedle

“The big debate internally is how much do we sell the front-end and when do we buy the 30-year. The firm is “waiting for 5% on the 30-year — it has been our line in the sand.”

Tim Magnusson, Garda Capital Partners

“The US long end right now is cheap and is a bargain, given yield levels. The 20-year auction was pretty good and that’s the most unloved security in the market.”

On US Dollar’s Relentless Slide

James Lord, Morgan Stanley

“You’re moving into a world where unconventional catalysts are driving the dollar weaker. The slump in the greenback echoes that seen early last year, as ‘policy uncertainty’ buffets investor appetite for US assets.”

Karl Schamotta, Corpay

“Washington’s protectionist pivot and diminished security commitments are spurring other nations to boost defense expenditure and sharpen their competitive focus, compressing the growth and interest rate differentials that previously favored the greenback.”

On Emerging Markets Becoming Less Correlated with US

James Athey, Marlborough Investment Management

“I don’t see US real yields as a binding constraint at all right now. There’s the potential for more decoupling between EM bonds and Treasuries, as more investors look to diversify and hedge their dollar-based assets.”

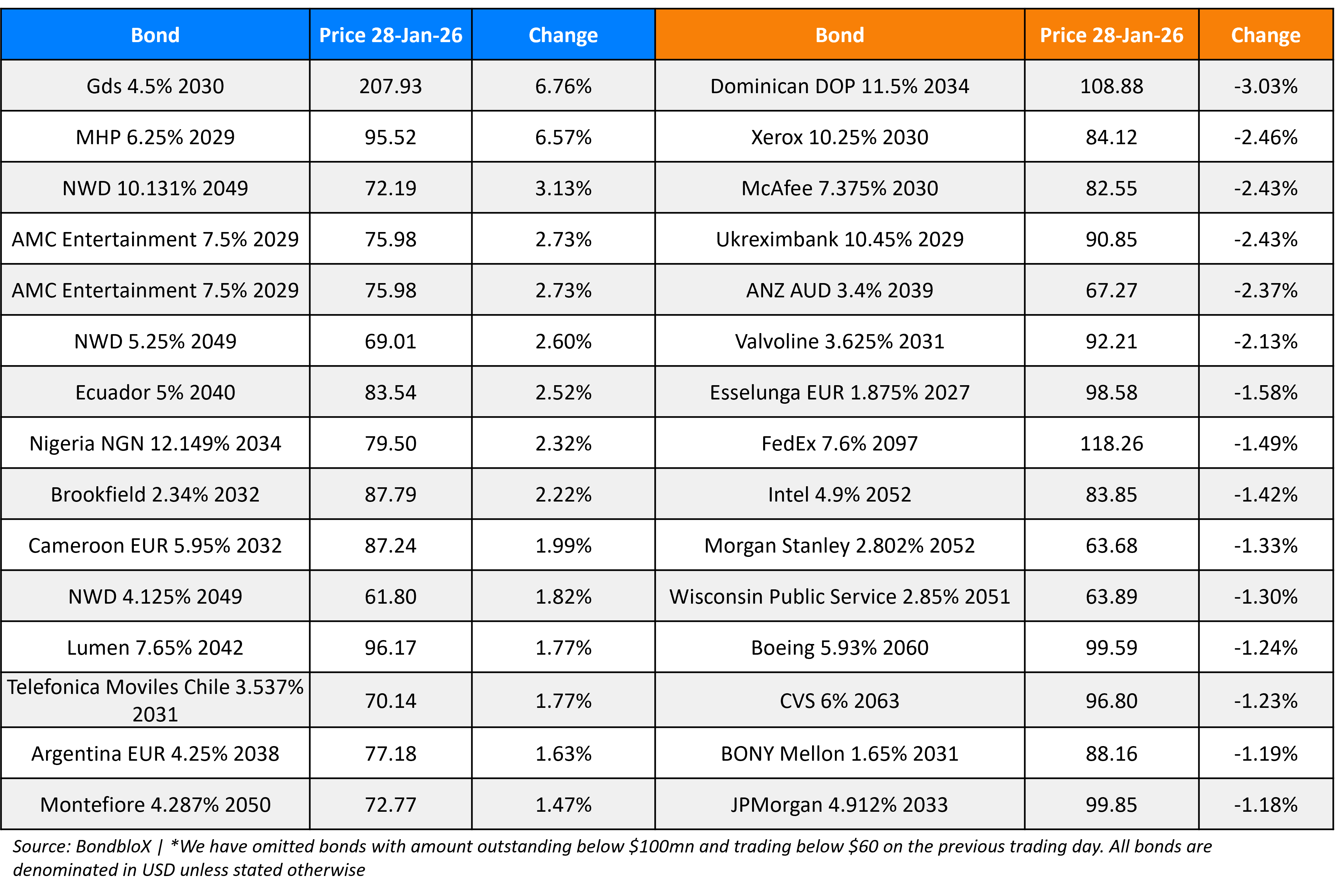

Top Gainers and Losers- 28-Jan-26*

Go back to Latest bond Market News

Related Posts: