This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Bahamas Upgraded to BB- by S&P

September 29, 2025

The Commonwealth of the Bahamas (Bahamas) has been upgraded by a notch to BB- from B+ by S&P. The upgrade comes on the back of a stronger economy, propelled by strong cruise tourism and large-scale investment projects across the Family Islands. Also, the government’s tax compliance efforts have helped reduce the fiscal deficit and contain the sovereign’s debt burden, S&P noted. The Bahamas’ economy expanded by 3.4% in 2024, and their GDP growth is expected to remain above potential at 2.1% in 2025, supported by buoyant tourism. Its fiscal performance has improved, with the 2024 deficit narrowing to 1.3% of GDP due to stronger tax compliance. The Bahamas lacks corporate and personal income taxes, though a 15% corporate minimum tax rate takes effect in fiscal year 2025-26. Revenue gains may be offset by VAT cuts on essential foods and expenditure pressures especially from state-owned entities remain high. According to S&P, Bahamas’ debt sustainability has improved, with net debt projected to decline to 66.3% of GDP by 2025 from 77.8% in 2020. Refinancing risks are manageable, supported by domestic banks and multilateral lenders, though high short-term debt, external vulnerabilities, and hurricane exposure remain key risks.

Bahamas’ 8.25% 2036s traded stable at 106.7, yielding 7.33%.

For more details, click here

Go back to Latest bond Market News

Related Posts:

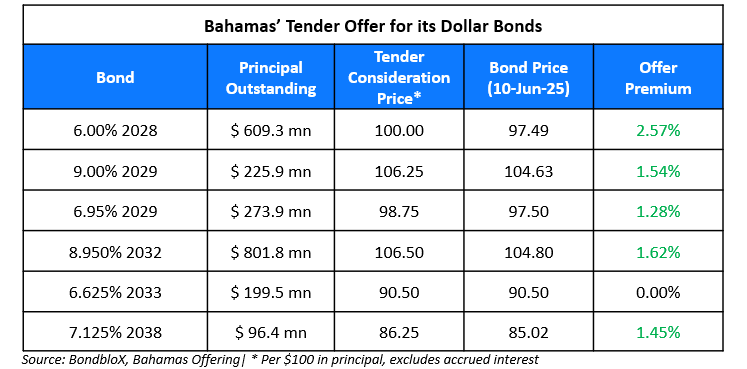

Bahamas Launches Tender Offer for Its Dollar Bonds

June 10, 2025

Credit rating boost for Ireland & Portugal: EU inches towards recovery

September 20, 2017

China Refutes S&P Downgrade Action

September 26, 2017