This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Bahamas, UniCredit, Hyundai Price New Bonds; Retail Advance Sales Drop by 0.9% in May

June 18, 2025

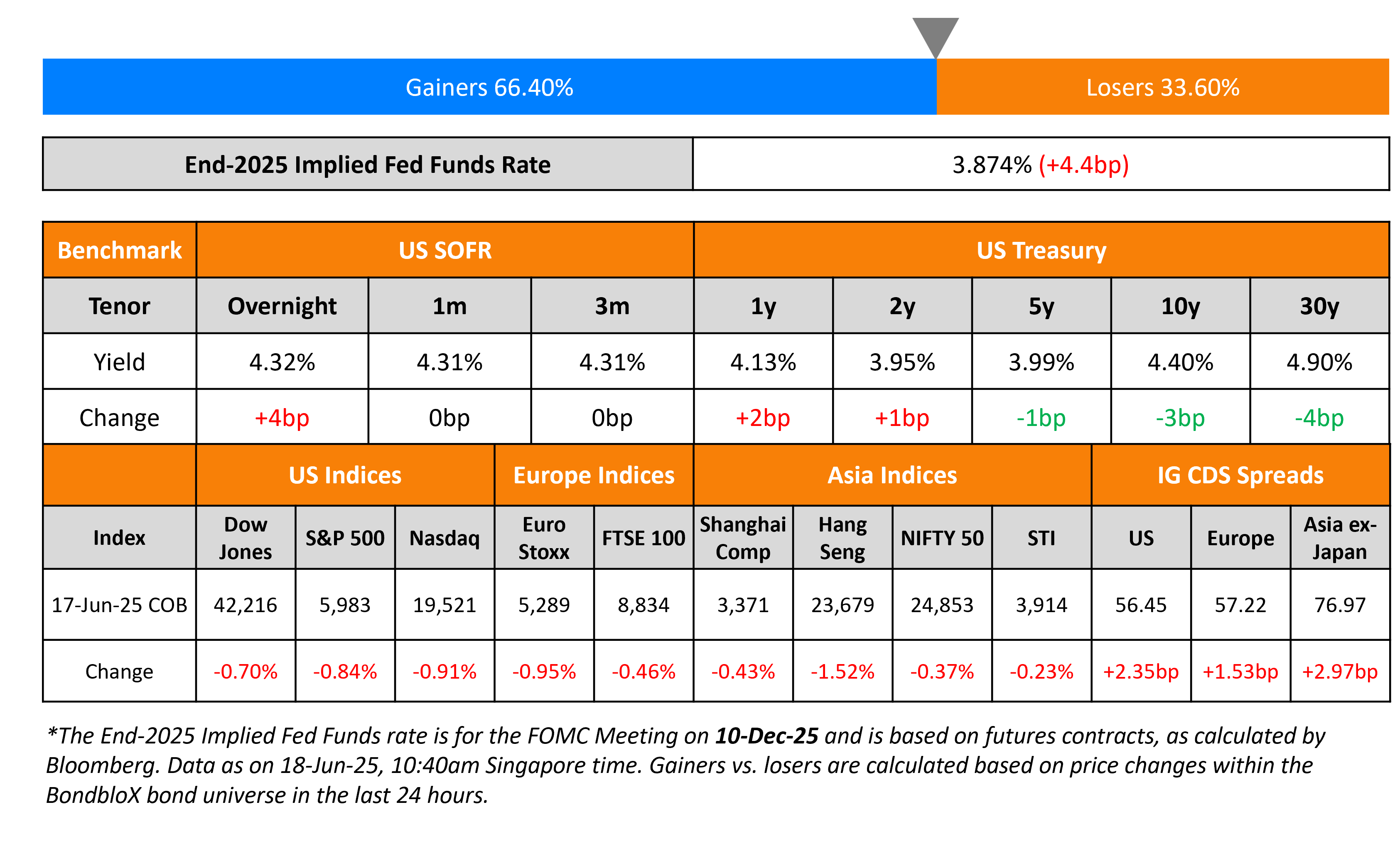

US Treasury yields fell slightly in the longer end of the curve, with the 2Y10Y spread flattening by 4bp. Retail Advance Sales for May declined by 0.9% MoM, vs. expectations of negative 0.6%. The prior reading of 0.1% for April has been revised to -0.1%. This is the biggest pullback in the last four months, showing weakness in consumer sentiment amid tariff uncertainty. US President Donald Trump calls for Iran’s “unconditional surrender” as the Israel-Iran war enters the sixth day. Trump also iterated that his early departure from the G7 summit had nothing to with the ongoing war.

Looking at the US equity market, S&P and Nasdaq closed lower by 0.84% and 0.90% respectively. In credit markets, US IG CDS spreads and HY CDS spreads widened by 2.4bp and 12.6bp respectively. European equity markets ended lower too. The iTraxx Main CDS spreads and Crossover CDS spreads widened by 1.5bp and 6.1bp respectively. Asian markets have broadly opened lower today, with HSI down by 1.20% at the time of writing. Asia ex-Japan CDS spreads widened by 3bp.

New Bond Issues

Bahamas raised $1.067bn via a 11Y bond at a yield of 8.25%, 12.5bp inside guidance of 8.375% area. The senior unsecured bond is rated B1/B+/BB-. Proceeds will be used to fund the purchase of its 2028, 2029, 2032, 2033 and 2038 notes under the tender offer and any remaining net proceeds to fund national development objectives including infrastructure development projects. Details of the tender offer launched on 10 June can be found here. The new 11Y bonds priced inside Bahamas’ existing curve, with its older 6.625% 2033s yielding 8.28%.

UniCredit raised €1bn debt via 12NC7 Tier 2 bond at a yield of 4.187%, 35bp inside the initial guidance of MS+215bp area. The subordinated notes are rated Ba1/BBB-/BBB-, and they received orders of €2.1bn, 2.1x the issue size. These notes have an annual coupon of 4.175%. If not called by 24 June 2032, the coupon resets to the prevailing 5Y MS plus 180bp.

Hyundai Capital raised $3.5bn debt via a five-tranche deal:

The senior unsecured notes are rated A3/A-/A-, and the proceeds will be used for general corporate purposes.

Islamic Development Bank (IDB) raised $1.2bn via a 5Y sukuk at SOFR+57bp, in-line with the initial guidance of SOFR+58bp area. The senior unsecured sukuk is rated Aaa/AAA/AAA and received orders of $1.3bn, slightly more than the issue size.

Europe Investment Bank (EIB) raised $5bn via a 7Y bond at a yield of 4.283%, 3bp inside initial guidance of SOFR MS+53bp area. The senior unsecured bond is rated Aaa/AAA/AAA.

Enterprise Products Operating raised $2bn via a three-part offering. It raised:

- $500mn via a 3Y bond at a yield of 4.347%, 25bp inside initial guidance of T+70bp area

- $750mn via a long 5Y bond at a yield of 4.637%, 25bp inside initial guidance of T+90bp area

- $750mn via a long 10Y bond at a yield of 5.241%, 30bp inside initial guidance of T+115bp area

The senior unsecured bonds are rated A3/A-/A-. Proceeds will be used for general company purposes, including for growth capital investments and asset acquisitions, and for repayment of debt (including amounts outstanding under its commercial paper program).

Saudi National Bank raised $1.25bn via a 10NC5 Tier 2 bond at a yield of 6.01%, 35bp inside initial guidance of T+235bp area. The subordinated bond is rated BBB/BBB (S&P/Fitch). The bond is issued by SNB Funding Ltd, and guaranteed by Saudi National Bank. Proceeds will be used by the Guarantor for general corporate purposes and to further strengthen its capital base.

Rating Changes

-

Moody’s Ratings downgrades Dah Sing Bank’s deposit ratings to A3/P-2, outlook stable

-

Moody’s Ratings downgrades Shuifa’s issuer rating to Baa3 and change outlook to stable

-

Moody’s Ratings upgrades Johnson Controls’ senior unsecured ratings to Baa1, outlook stable

-

Moody’s Ratings downgrades Wizz Air to Ba2, outlook remains negative

Term of the Day: Supplementary leverage ratio (SLR)

The Supplementary leverage ratio (SLR) is a ratio used in the US to calculate the amount of tier 1 capital banks must hold relative to their total leverage exposure. Large US banks must hold capital of at least 3% of their assets and Global Systemically Important Banks (G-SIBs) must hold an extra 2% buffer, totaling 5%. In April 2020, the Fed loosened the SLR requirement to exclude holdings of Treasuries and reserves maintained with the Fed while calculating the ratio – this reduces the denominator (by increasing banks’ ability to take more deposits) and thereby allows more capital to be employed for lending purposes.

Talking Heads

On UK Banks Set for More Consolidation – Sheel Shah, JPMorgan

“Consolidation is the natural path given the trajectory of margins”…NatWest Group Plc and HSBC Holdings Plc best positioned for the trend, given their inorganic growth ambitions…household savings ratio to remain elevated given economic uncertainty…NatWest has shown interest in in Banco Santander SA’s UK business TSB

On US Stock Market’s Outperformance Over – BofA Survey

54% of asset managers expect international stocks to be the top asset class over the next five years, while 23% picked US stocks…responses reflect the popularity of the “Sell America” trade that’s taken hold as President Donald Trump hikes tariffs

On Weak US Retail Sales to Soften Economy – Michael Pearce, Oxford Economics

“Tariff announcements have had a clear impact on the timing of large-ticket purchases, notably autos…We expect a more marked slowdown to take hold in the second half of the year”

Top Gainers and Losers- 18-Jun-25*

Go back to Latest bond Market News

Related Posts: