This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

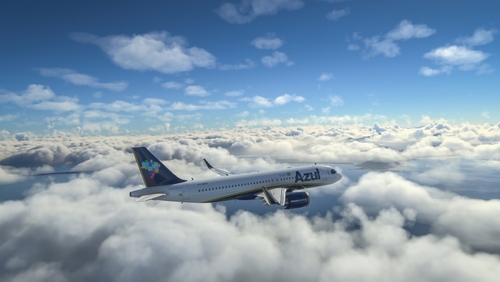

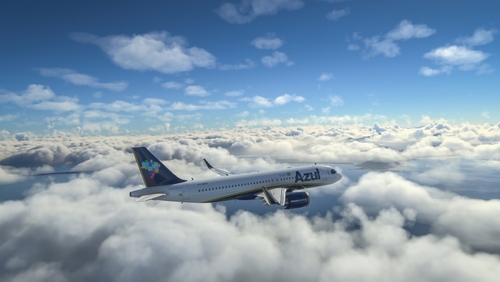

Azul Strikes a Financing Deal with Creditors

October 29, 2024

Azul struck a key financing agreement with its bondholders that will enable a key deal with lessors and parts suppliers, aimed at reducing debt and enhancing cash flow. The agreement allows creditors to provide up to $500mn in new senior secured debt, including $150mn this week and $250mn by year-end, with a potential additional $100mn at a later date. The agreement also eases some obligations the carrier has with lessors and parts suppliers in the next 18 months, which should improve Azul’s cash flow by more than $150mn. It will also allow potentially converting up to $800mn of existing Azul’s debt into shares if annual cash flow improvement targets are met. Analysts note this agreement was crucial for addressing pandemic-related liabilities and is aided by decreasing oil prices. Azul’s shares rose by 11% rise on back of the news.

Azul’s bonds traded stable with its 10.875% 2030s at 60.4 cents on the dollar.

For more details, click here

Go back to Latest bond Market News

Related Posts:

Azul plans to Buy 100% of LATAM Airlines

November 3, 2021

Gol-Azul Announce Codeshare Agreement

May 27, 2024

Azul Denies Chapter 11 Plans

August 30, 2024