This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

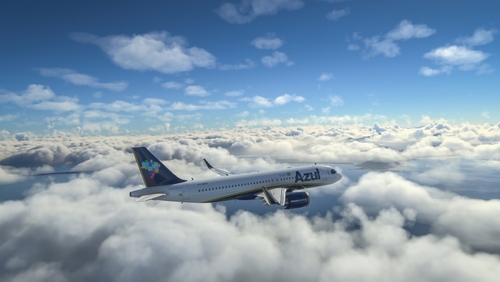

Azul Aiming to Exit Chapter 11 by Early 2026

June 2, 2025

Brazilian airline Azul aims to exit Chapter 11 bankruptcy proceedings by early next year, according to its institutional and corporate vice-president, Fabio Campos. While Azul had previously discussed a potential merger with local airline Gol, the company is now prioritizing its financial restructuring, he added. The memorandum of understanding (MoU) with Gol remains valid but is not currently a focus. Azul recently secured court’s approval to access $250mn of its $1.6bn debtor-in-possession financing, ensuring uninterrupted operations. The company does not plan mass layoffs, and sales and operations remain unaffected. Prior to its Chapter 11 filing, Azul made agreements with major financial stakeholders, including bondholders, aircraft lessor AerCap, and airline partners United and American Airlines. Negotiations with other lessors are still ongoing. The company had filed for Chapter 11 bankruptcy earlier last week.

Azul’s bonds traded stable with its 11.93% 2028s at 101.7, yielding 10.28%.

For more details, click here.

Go back to Latest bond Market News

Related Posts: