This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Astrea, Panasonic, JBIC Launch Bonds

July 9, 2024

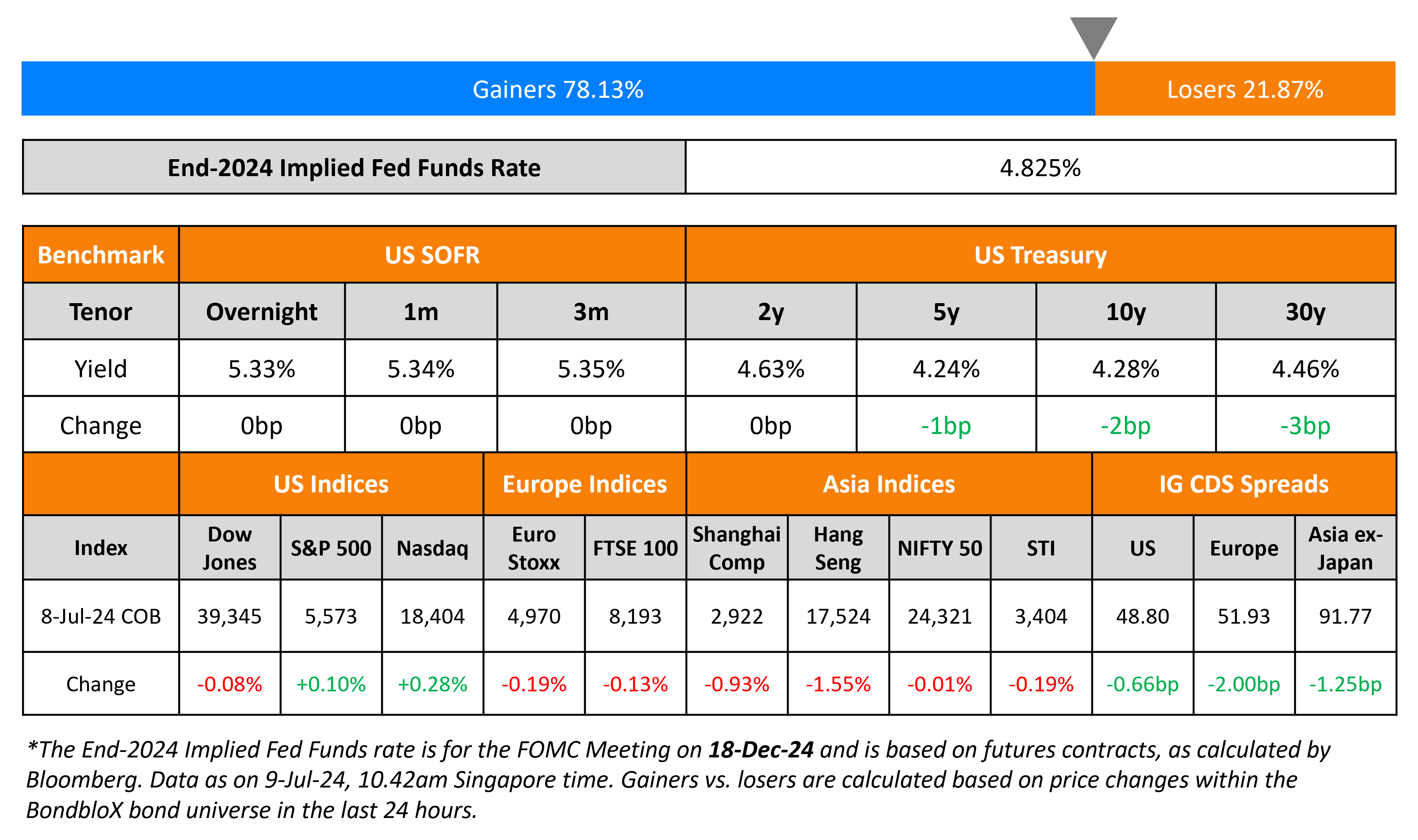

US Treasury yields were stable on Monday with no major economic data releases. Markets now shift focus to Fed Chairman Jerome Powell’s Congressional testimony over the next two days for any clues on the Fed’s thinking regarding interest rate policy. This will be followed by the consumer price inflation prints on Thursday. Looking at equity markets, S&P and Nasdaq were up 0.1% and 0.3%, respectively. US IG spreads were 0.7bp tighter and while HY CDS spreads tightened by 3.9bp.

European equity indices ended lower. In credit markets, the iTraxx Main and Crossover spreads were tighter by 2bp and 7.4bp respectively. Asian equity indices have opened mixed this morning. Asia ex-Japan CDS spreads were 1.3bp tighter.

New Bond Issues

- Astrea 8 S$ 15Y at 4.7/6.7% area

- JBIC $ 3Y at SOFR MS+46bp area

- Panasonic Holdings $ 10Y at T+125bp area

Santander raised $3.75bn via a three-trancher. It raised:

- $1.5bn via a 4NC3 bond at a yield of 5.365%, 30bp inside initial guidance of T+95bp area. The new bonds were priced 9.5bp tighter to its senior non-preferred 5.552% 2028s (callable in March 2027) that yield 5.45%.

- $750mn via a 4NC3 FRN at SOFR+112bp vs. initial guidance of SOFR equivalent area.

- $1.5bn via a 7Y bond at a yield of 5.439%, 30bp inside initial guidance of T+125bp area

The senior preferred notes are rated A2/A+/A.

ANZ raised $2bn via a two-part deal. It raised $750mn via a 3Y bond at a yield of 4.9%, 25bp inside initial guidance of T+75bp area. It also raised $1.25bn via a 3Y FRN at SOFR+68bp vs. initial guidance of SOFR equivalent area. The senior unsecured notes are rated Aa2/AA-/AA-. Proceeds will be used for general corporate purposes.

Broadcom raised $5bn via a three-trancher. It raised:

- $1.25bn via a 3Y bond at a yield of 5.056%, 30bp inside initial guidance of T+95bp area

- $2.25bn via a 5Y bond at a yield of 5.08%, 27.5bp inside initial guidance of T+112.5bp area

- $1.5bn via a long 7Y bond at a yield of 5.178%, 30bp inside initial guidance of T+125bp area

The senior unsecured bonds are rated Baa3/BBB/BBB-. Net proceeds will be used to prepay a portion of the term A-2 loans under its term loan credit agreement and for general corporate purposes.

New Bonds Pipeline

- Piramal Capital plans debut $ Bond Sale

- Sharjah hires for € 6.5Y bond

- NongHyup Bank hires for $ 3Y/5Y bond

- Telecom Argentina hires for $ bond

- Resolution Life hires for $ 7Y T2 bond

Rating Changes

- Moody’s Ratings upgrades Piraeus Bank S.A.’s long- and short-term deposit ratings to Baa3/P-3 from Ba1/NP, outlook on the long-term deposit ratings remains positive

- Fitch Upgrades LBBW’s IDR to ‘A+’/Stable; Affirms VR at ‘bbb+’

- Fitch Upgrades NORD/LB’s IDR to ‘A+’/Stable; Affirms Viability Rating at ‘bb+’

- Fitch Upgrades BayernLB’s IDR to ‘A+’/Stable; Affirms Viability Rating at ‘bbb+’

- Moody’s Ratings downgrades Kenya’s ratings to Caa1; maintains negative outlook

Term of the Day

Viability Rating

Viability Ratings (VRs) are ratings assigned by Fitch to be internationally comparable and show their view of the intrinsic creditworthiness of an issuer. VRs are a key component of a bank’s Issuer Default Rating (IDR), as per Fitch. VRs are assigned primarily to banking companies with certain factors that could be indicative of a bank likelihood of failing or becoming non-viable. These factors include defaulting on senior obligations, entering a resolution regime/bankruptcy/administration receivership etc., triggering non-viability clauses embedded in the instrument, execution of a distressed debt exchange as defined by Fitch’s criteria and receiving extraordinary support such that a default or other event of non-viability is avoided.

Talking Heads

On 10% Stock Market Correction Is ‘Highly Likely’ – Morgan Stanley’s Mike Wilson

“I think the chance of a 10% correction is highly likely sometime between now and the election… (Q3) “going to be choppy… likelihood of upside from now until year end is very low, much lower than normal… If they were to come in 10%, then we’d probably get interested again”

On Warning of Inflation, and Signaling Vote for Rates Hold – BOE’s Jonathan Haskel

“The continued tight and impaired labor market means that inflation will remain above target for quite some time… rather hold rates until there is more certainty that underlying inflationary pressures have subsided sustainably.”

On BOJ Sounding Out Market Players Before Finalizing Bond-Buying Cuts

Naomi Muguruma, Mitsubishi UFJ Morgan Stanley Securities

“What it wants to show is a stance of proceeding cautiously by hosting the gatherings”

Yuuki Fukumoto, NLI Research Institute

“For the BOJ, the key point is to hear and gather information on how much more bond-buying the market can take to assuage its concerns”

Top Gainers & Losers- 09-July-24*

Go back to Latest bond Market News

Related Posts:.png)