This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

ASB Bank, China Energy Engineering Launch $ Bonds

October 21, 2025

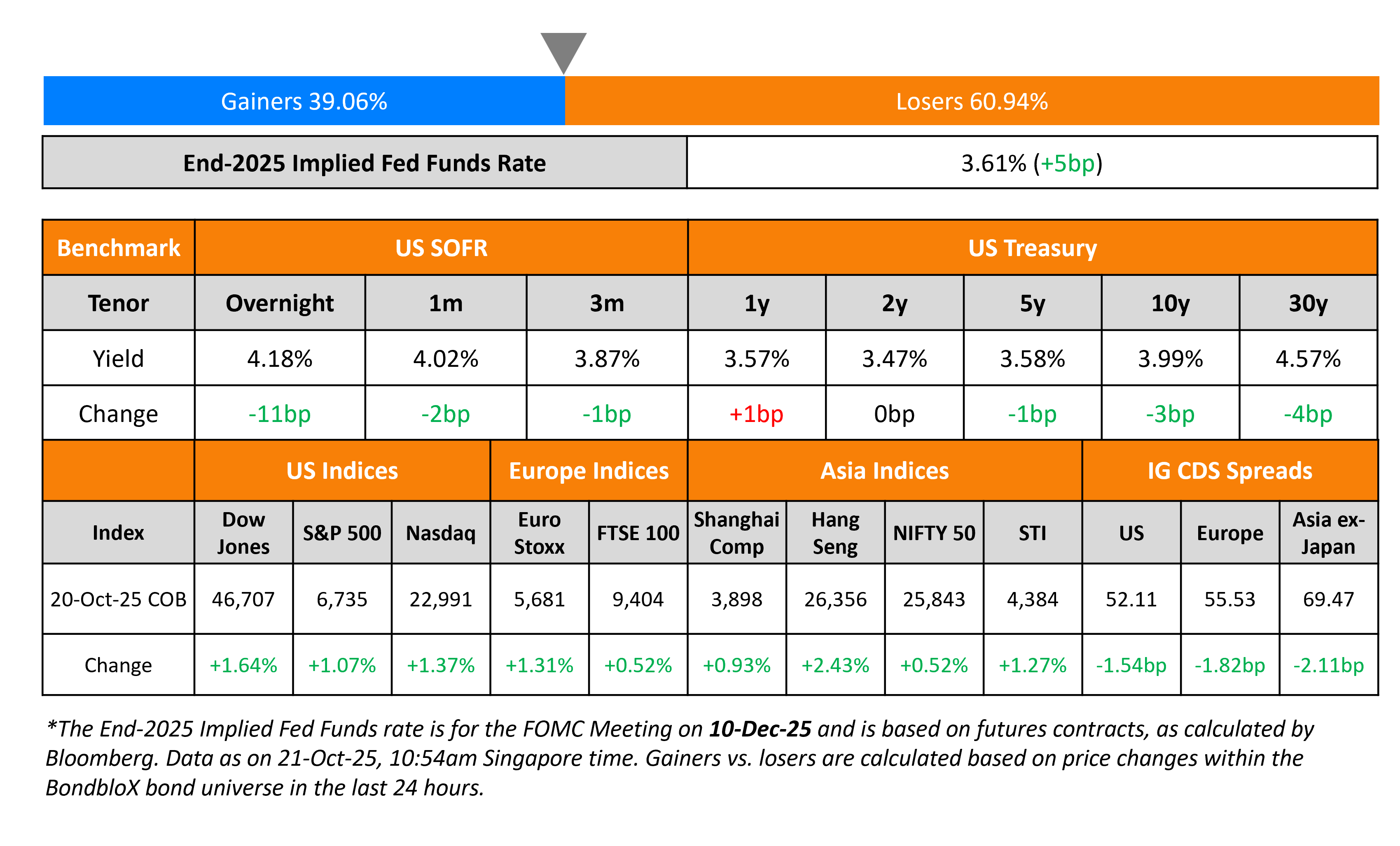

US Treasury yields were stable on Monday with no major catalysts as the government shutdown continues. US Treasury Secretary Scott Bessent said that relations with China had “deescalated” and that the US-China talks will resume this week. Separately, the earnings season for popular technology names like Tesla and Netflix amongst others are due this week.

Looking at equity markets, both the S&P and Nasdaq ended higher by 1.1% and 1.4% respectively. The US IG and HY CDS spreads tightened by 1.5bp and 5bp respectively. European equity indices ended higher too. The iTraxx Main CDS spreads were 1.8bp tighter while the Crossover spreads were 4.9bp tighter. Asian equity markets have opened higher this morning. Asia ex-Japan CDS spreads were 2.1bp tighter. China’s Q3 GDP growth slowed to 4.8% QoQ vs. 5.2% in Q2, albeit better than expectations for a 4.7% print.

New Bond Issues

-

ASB Bank $ 5Y/5Y FRN at T+90/SOFR eq. area

-

China Energy Engineering $ PerpNC5 at 4.75% area

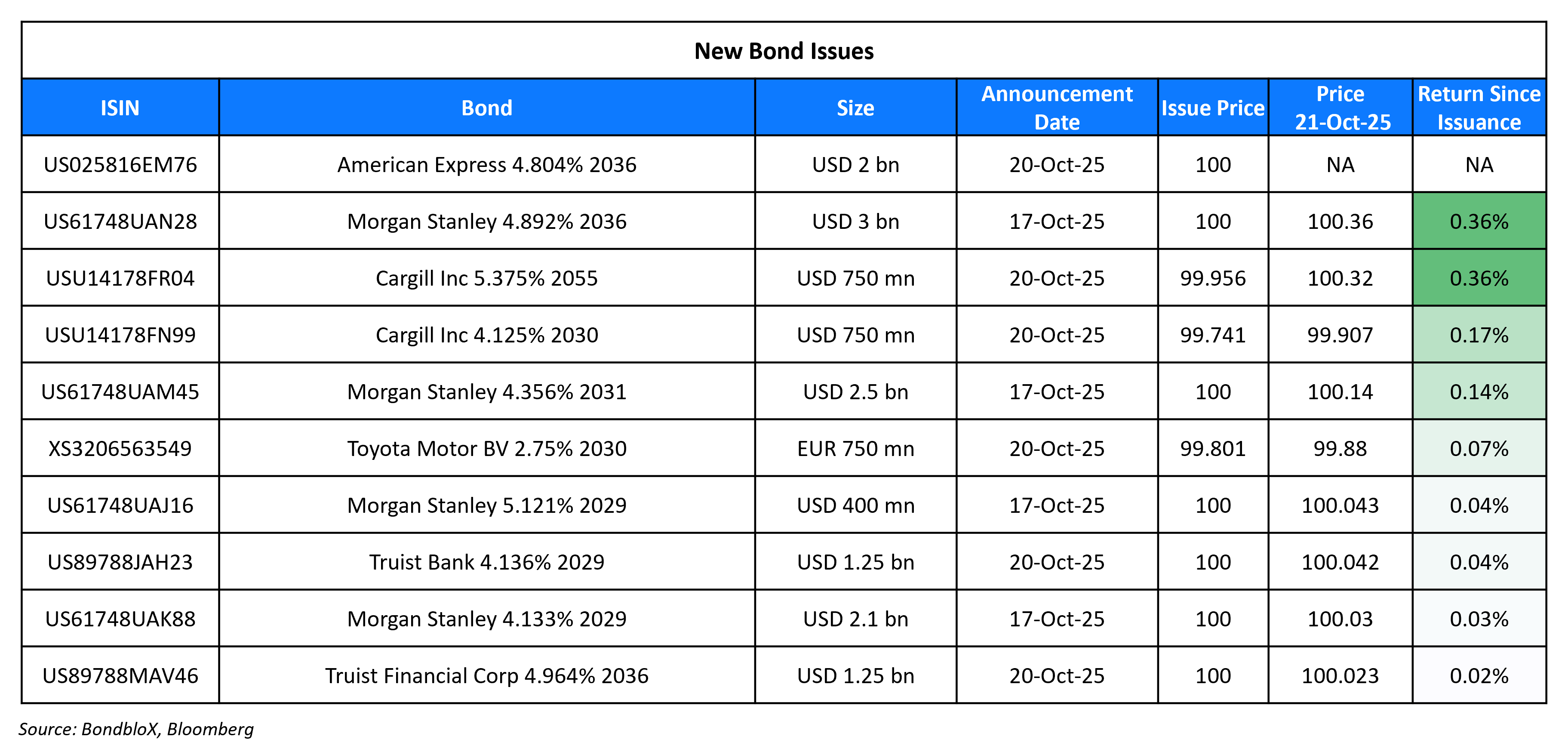

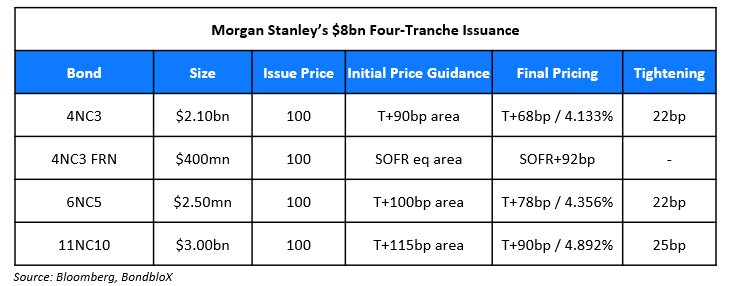

Morgan Stanley raised $8bn via a four-trancher:

The senior unsecured notes are rated A1/A-/A+. Proceeds will be used for general corporate purposes. Their 6NC5 FRN issuance was dropped at guidance stage.

American Express raised $2bn via a 11NC10 bond at a yield of 4.804%, 28bp inside initial guidance of T+110bp area. The senior unsecured notes are rated A2/A-/A (Moody’s/S&P/Fitch). The proceeds will be used for general corporate purposes.

Truist Bank raised $2.5bn in two tranches. It raised $1.25bn via a 4NC3 bond at a yield of 4.136%, 23bp inside initial guidance of T+90bp area. It also raised $1.25bn via a 11NC10 bond at a yield of 4.964%, 27bp inside initial guidance of T+125bp area. The 4NC3 bond is a domestic, senior bank note rated A3/A/A (Moody’s/S&P/Fitch). The 11NC10 is a senior unsecured note rated Baa1/A-/A- (Moody’s/S&P/Fitch). The proceeds will be used for general corporate purposes.

Cargill raised $1.5bn via two tranches. It raised $750mn via a 5Y bond at a yield of 4.183%, 25bp inside initial guidance of T+85bp area. It also raised $750mn via a 30Y bond at a yield of 5.378%, 25bp inside initial guidance of T+105bp area. The senior unsecured notes are rated A2/A (Moody’s/S&P). Proceeds will be used for general corporate purposes.

Toyota raised €750mn via a 4.25Y bond at a yield of 2.802%, 27bp inside initial guidance of MS+95bp area. The senior unsecured notes are rated A1/A+ (Moody’s/S&P). The proceeds will be used for general corporate purposes. The issuer may also use part of the proceeds for the purpose of posting collateral with third party hedge providers rather than for the purpose of lending onward to other Toyota companies.

New Bonds Pipeline

-

China Three Gorges $ notes

-

H&M €500mn WNG 8Y investor calls

-

Turk Telekom $ 5Y sukuk investor calls

Rating Changes

- France Ratings Lowered To ‘A+/A-1’ From ‘AA-/A-1+’ On Heightened Risks To Budgetary Consolidation; Outlook Stable

- Madagascar Ratings Placed On Watch Negative On Heightened Political Instability

- Sinochem International ‘BBB+’ Rating Affirmed With Stable Outlook; SACP Revised Down To ‘b+’ On Earnings Strain

- Fitch Downgrades Polygon to ‘B-‘; Outlook Negative

- Moody’s Ratings downgrades China Vanke’s ratings to Caa2/Caa3; outlook remains negative

- Moody’s Ratings downgrades Botswana’s ratings to Baa1 from A3, maintains negative outlook

Term of the Day: Debt-for-Education Swap

A debt for education swap is a transaction where a country’s external debt is reduced in exchange for its commitment to invest the money saved from debt servicing into its education sector. Here, a creditor or a third party helps cancel or reduce a portion of a sovereign’s debt. In return, the sovereign agrees to allocate equivalent funds to specific educational projects, such as building schools, training teachers, or equipping institutions.

Talking Heads

On Credit Markets Wobbling as Loan Losses Revive Bank Fears

Citigroup

“A flurry of negative headlines in recent weeks has undermined the resilience of credit markets. The increasing credit events should however mark a return to more fundamentally driven markets”

Mark Clegg, Allspring Global Investments

“The battle of who has the cockroaches will not be settled soon”

Dan Carter, Fort Washington Investment Advisors

“You’re not being paid to take risk and this could be a bit more of an issue than what’s priced”

“I’m not getting nervous when inflation deviates by 10, 20, 30 basis points from the target… We often hear the argument that we should look through if energy prices are pushing inflation up. I hear the argument less on the downside. We should be symmetric here

On Fed Policy Benchmark’s Rise Fuels Funding Concerns, QT Debate

Gennadiy Goldberg, TD Securities

“It’s going to be difficult for the Fed to dismiss these nascent pressures in front-end markets, making a termination of QT at the October FOMC meeting even more likely”

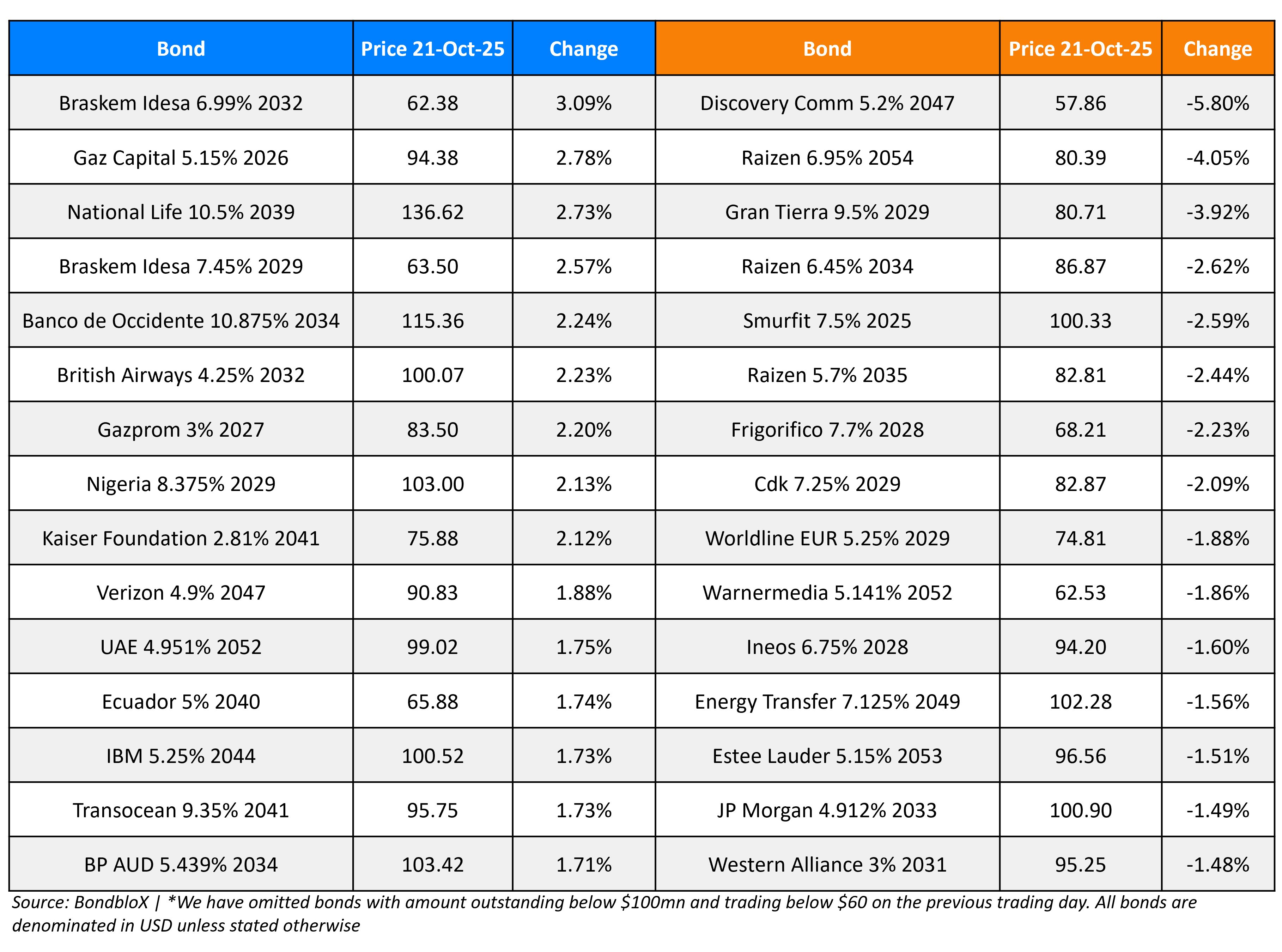

Top Gainers and Losers- 21-Oct-25*

Go back to Latest bond Market News

Related Posts: