This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

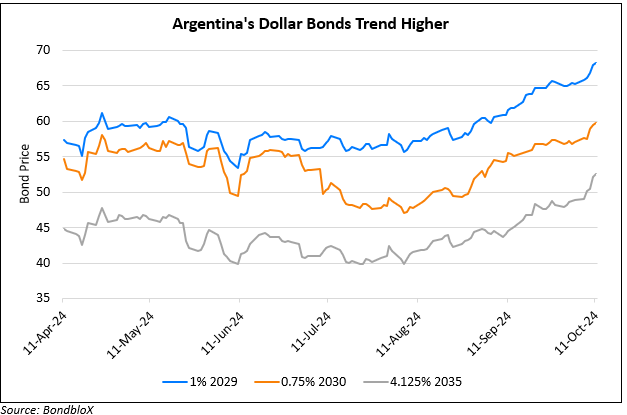

Argentina’s Dollar Bonds Trend Higher as IMF Talks Near

December 4, 2024

Argentina’s Economy Minister, Luis Caputo, stated that a successful negotiation with the IMF would likely lead to new funding, which would help bolster the central bank’s reserves. This, in turn, would support the government’s plan to ease capital and currency controls, which are expected to be lifted in 2025. No exact timeline has been provided yet. Caputo also mentioned that as inflation continues to decrease, Argentina will slow its crawling currency peg. While Argentina’s economy is projected to contract by 2.8% in 2024, Caputo expressed optimism for strong future growth. Argentina is currently facing challenges, including ongoing currency control issues that have stalled progress on securing more IMF funds. The ‘Stabilisation Plan’ of President Javier Milei’s government, launched just days after he took office on 10 December 2023, is said to have now entered its decisive phase, with the IMF expected to play a key role.

Argentina’s 3.5% 2041s are up ~3 points this week and currently trade at 60.8, yielding 11.4%.

Go back to Latest bond Market News

Related Posts:

Argentina Bonds Trade Weaker Before Senate Debate

June 11, 2024

Argentina Planning Raising $1bn Through Santander

August 8, 2024

Argentina’s Dollar Bonds Extend Their Rally

October 11, 2024