This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

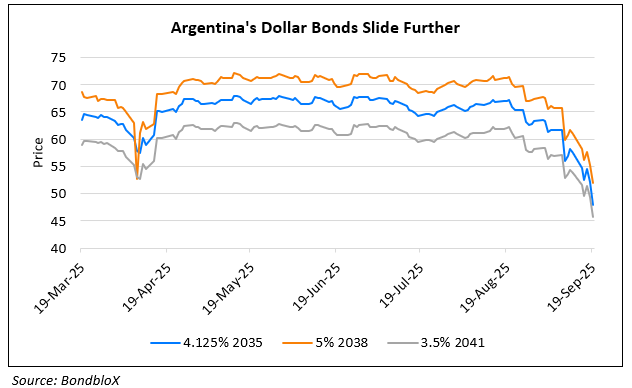

Argentina’s Dollar Bonds Dip Further on Missed GDP, Weakening Currency, Political Uncertainty

September 19, 2025

Argentina’s dollar bonds fell sharply by 4-5 points across the curve. The country’s economy contracted 0.1% in the second quarter, defying economists’ expectations for modest growth. GDP output rose 6.3% YoY, below the forecast of 6.5%. This decline was driven by weaker exports, sluggish retail consumption, and reduced capital investment, while imports fell and government spending offered only a mild offset. The Q2 drop in economic activity aligns with a consumer spending setback in recent months as inflation-adjusted wages fell into negative territory earlier in the year. Unemployment continues to hover at its highest level in nearly four years. The disappointing figures come at a politically sensitive time for President Javier Milei, who faces midterm elections on October 26. His coalition’s prospects have already been dented by a heavy defeat in Buenos Aires province. Bloomberg Economics notes that political and market uncertainty has undermined confidence in Milei’s economic program, creating a feedback loop that weighs on economic activity. Argentine assets suffered steep global losses, with the S&P Merval Index plunging 4.9%. Besides, Argentina’s central bank has been selling dollars to defend the peso and maintain it within the IMF-negotiated band.

For more details, click here.

Go back to Latest bond Market News

Related Posts:

Credit rating boost for Ireland & Portugal: EU inches towards recovery

September 20, 2017

China Refutes S&P Downgrade Action

September 26, 2017

Mongolia’s Credit Ratings Upgraded to B3 by Moody’s

January 19, 2018