This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

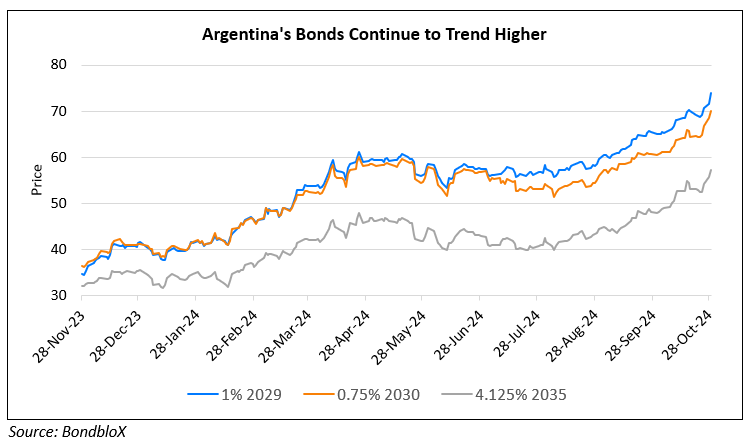

Argentina’s Bonds Continue to Trend Higher; Out of Distress Territory

October 29, 2024

Argentina’s Bonds continued to trend higher after it was reported last week that World Bank and Inter-American Development Bank (IDB) will be providing Argentina with $8.8bn in financing. The World Bank and IDB will provide $4.4bn over the coming months for social spending and the remaining amount for private sector projects in areas like mining, renewable energy, health and steel over the next few years. Argentina’s bonds have seen a quite a rally after President Javier Milei took the office in December last year. Prices for some of Argentina’s sovereign notes have soared to their highest levels since they were issued in a September 2020 restructuring, and markets are pricing in even higher odds of the country making good on its bond payments in January. According to Bloomberg, Argentina’s bonds have offered investors a return of 73.5% this year, the best in the developing world.

Go back to Latest bond Market News

Related Posts:

Argentina Bonds Trade Weaker Before Senate Debate

June 11, 2024

Argentina Planning Raising $1bn Through Santander

August 8, 2024

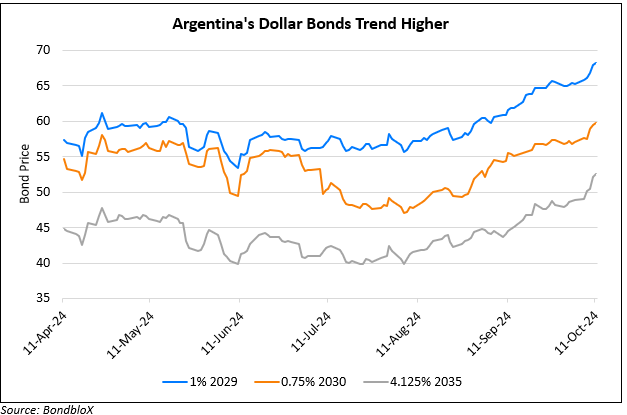

Argentina’s Dollar Bonds Extend Their Rally

October 11, 2024