This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

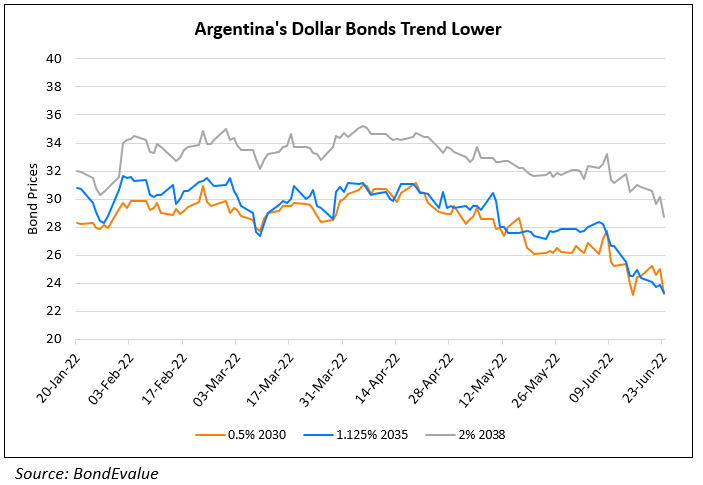

Argentina Reaches $7.5bn Staff-Level Agreement with IMF, Bonds Rise

July 31, 2023

Argentina’s dollar bonds ticked higher after the IMF announced that it had reached a staff-level agreement with the country to unlock about $7.5bn and complete the fifth and sixth reviews of Argentina’s $44bn loan program. The country has recently been troubled by a severe drought that impacted its exports and fiscal revenues. The reviews will allow additional funds to be disbursed to the country and support its economy. The agreement has relaxed some program requirements as the drought caused the country to miss some end-June financial targets. The agreement still awaits approval from the IMF Executive Board in the second half of next month. Meanwhile, Argentina still needs to avoid a default with the IMF. It has $2.6bn in maturities due today and another $800mn due tomorrow, with Argentine officials currently working towards obtaining funding to meet these obligations.

While Argentina’s bonds have rallied by up to 1.6 points, most are still currently trading at distressed levels. Its 0.75% 2030s have risen 1.6 points and are currently trading at 29.7 cents on the dollar.

For more information, click here

Go back to Latest bond Market News

Related Posts:

Argentina Closes $45bn Deal with IMF

March 4, 2022

Argentina Downgraded to CCC- by Fitch

October 27, 2022