This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Argentina Disagrees with IMF Proposal; Hikes Interest Rates

January 7, 2022

Argentina’s economy Minister Martin Guzman recently criticized IMF’s proposal to reduce the country’s fiscal deficit. The announcement raised concerns among investors since the country is looking to reach a deal to restructure $40bn in loans with the IMF. Argentina has a $2.8bn payment due to the IMF in March, setting a deadline to reach a deal, according to many analysts. Head of emerging markets research at Oppenheimer & Co. Fernando Losada, said “Markets reacted badly to the presentation because it became clear that deep differences remain in the key aspect of policy adjustment.”

Separately, Argentina’s central bank hiked its benchmark Leliq rate for the first time in over a year from 38% to 40%. Adriana Dupita, an economist with Bloomberg Economics said, “The rate hike is a step in the right direction, but too timid to matter… The central bank will need to raise the rate further if it intends to use monetary policy to tackle inflation — with or without a deal with the Fund.”

Argentina’s dollar bonds were down with its 2.5% 2041s down 0.38 to 34.844, yielding 10.33%

For the full story, click here

Go back to Latest bond Market News

Related Posts:

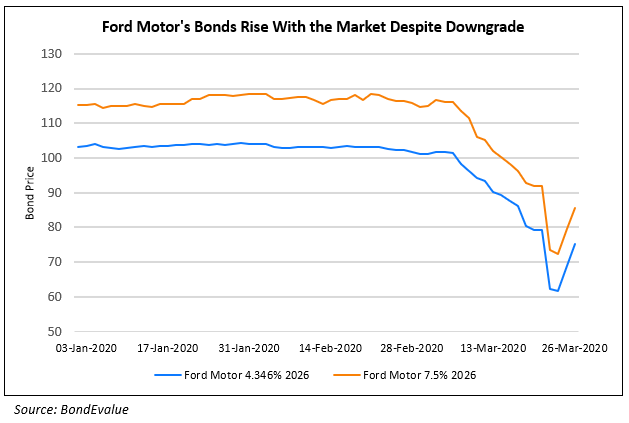

SoftBank Downgraded; Ford Becomes Junk

March 26, 2020

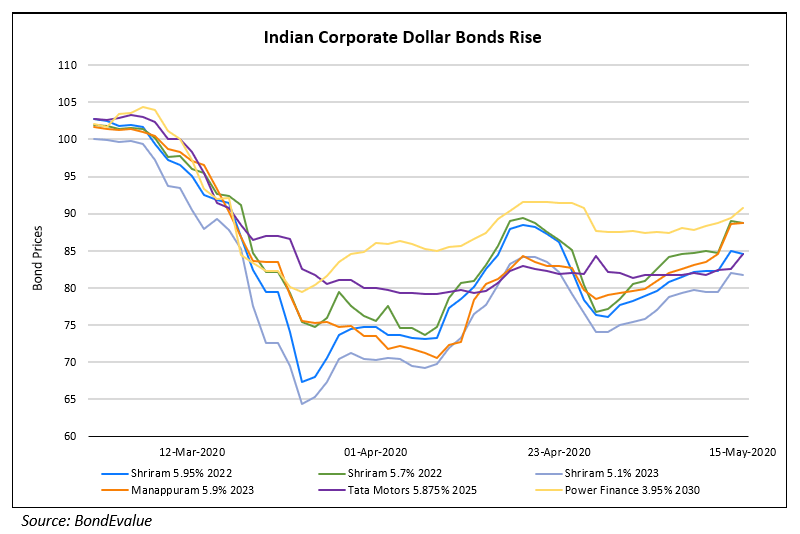

Are We Really Out of The Woods?

April 29, 2020