This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Aramco Maintains Quarterly Dividend, as Questions Emerge Over Future Dividends

November 6, 2024

Saudi Aramco said that it expects to declare total dividends of $124.3bn in 2024, that would involve maintaining its $31bn quarterly dividend. Now, questions have arisen over whether the company will maintain or cut its $31bn quarterly dividend. Maintaining it would imply that Aramco might have to continue keep borrowing to maintain the payout while, cutting it would risk worsening the nation’s budget deficit. Aramco has now moved into a net debt position of $8.9bn from a net cash position of $27.4bn during the same period last year. The company reported net income of $27.6bn in the quarter ending September. Aramco’s gearing ratio rose to 1.9% at end-September from -6.3% at the end of last year. Over the same period, Aramco had a net debt position. Analysts at HSBC have noted that Aramco has more room to borrow, that can help maintain dividends near current levels.

Aramco’s dollar bonds were trading in the green. For instance its 5.25% 2034s were up 0.4 points to 100.1, yielding 5.2%

For more details, click here

Go back to Latest bond Market News

Related Posts:

Huarong Announces Progress on Sale of Non-Core Assets

October 1, 2021

Netflix Upgraded by S&P to BBB

October 26, 2021

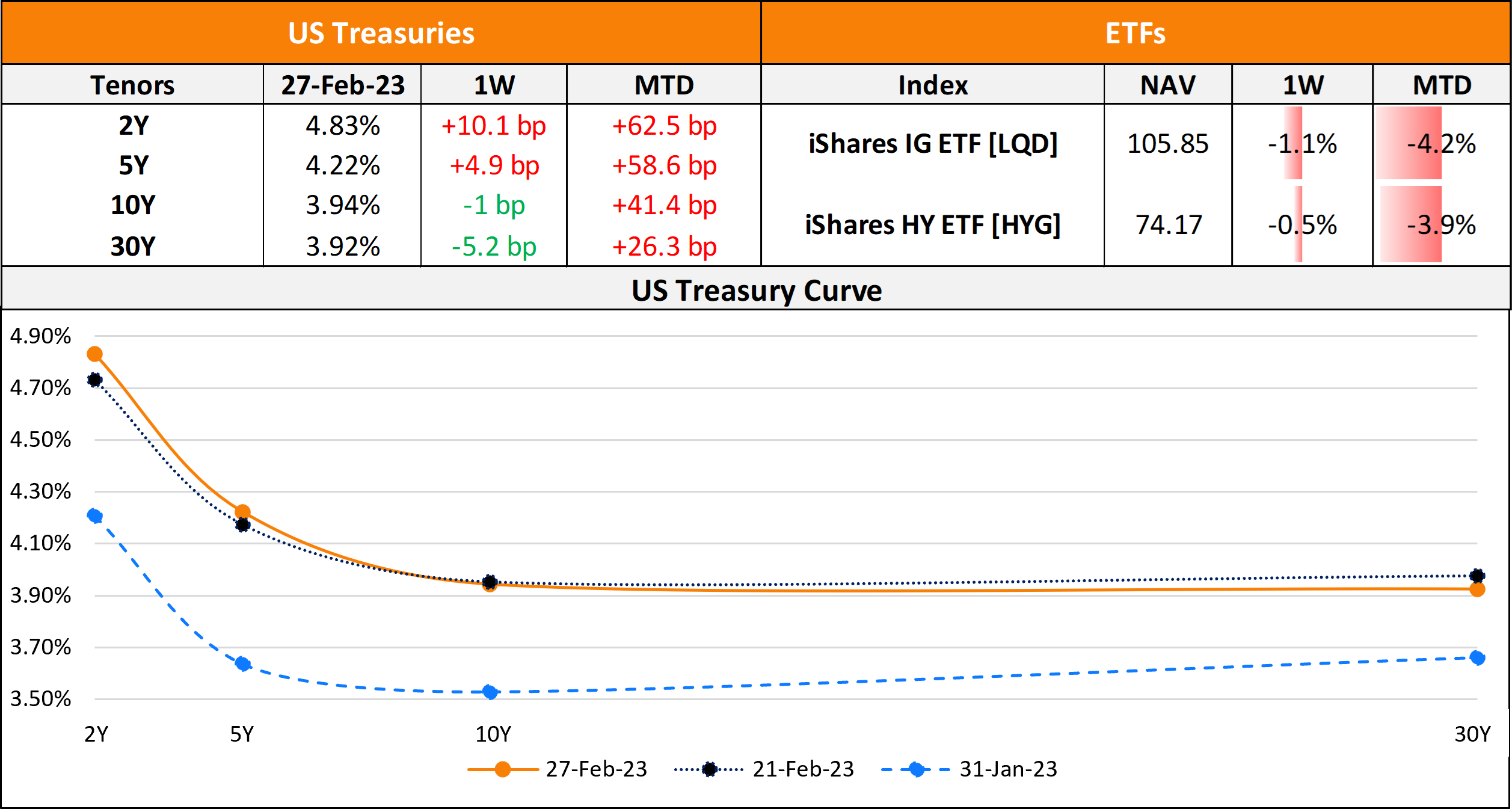

The Week That Was (February 20 – 27, 2023)

February 27, 2023