This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Aramco, Colombia, SocGen, CLCT Price Bonds; Strong 10Y Treasury Auction With 2.65x Bid-to-Cover Ratio

September 11, 2025

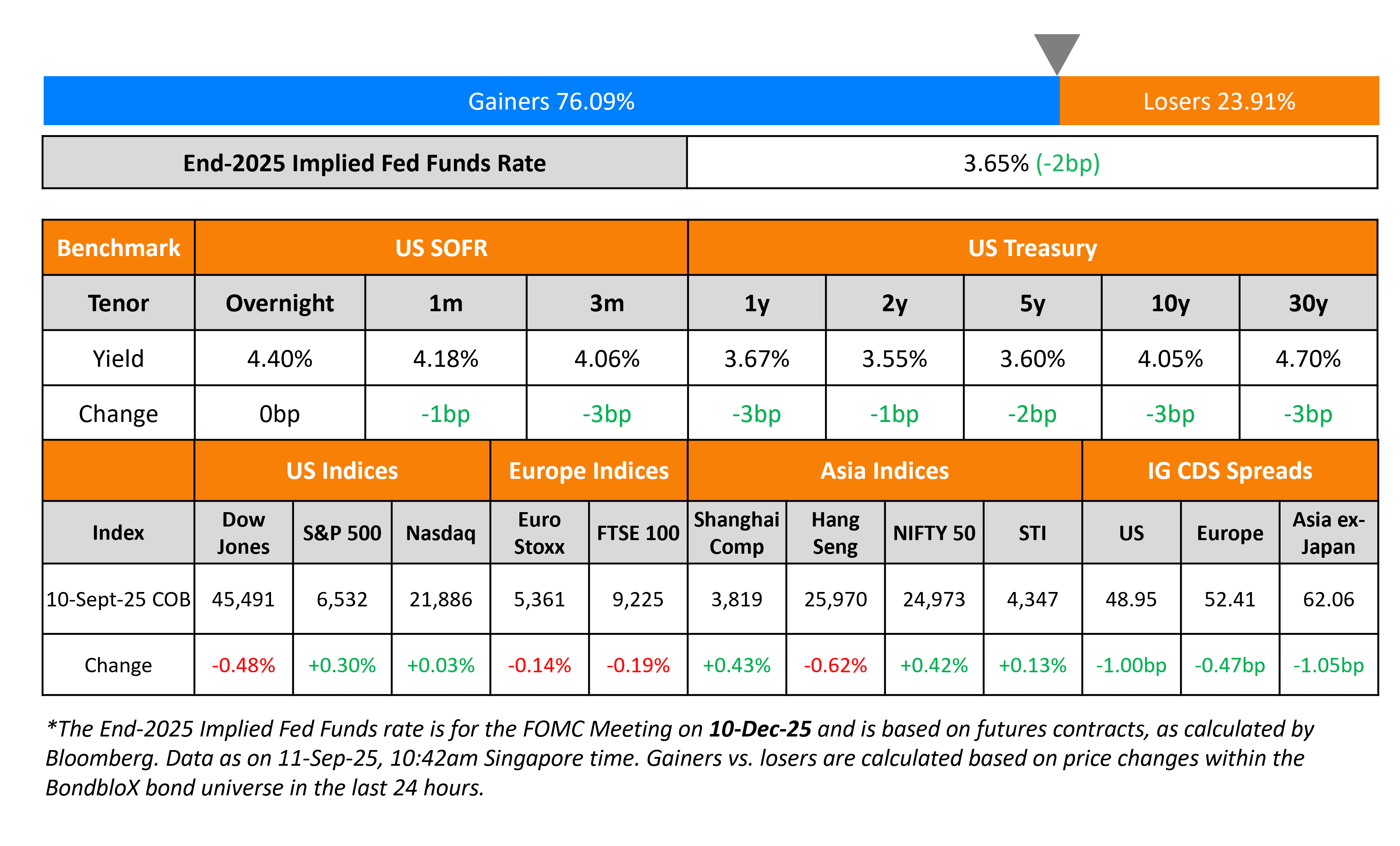

The US Treasury curve saw yields ease across the board by as much as 3bp. On the data front, US final demand PPI for August saw a 0.1% MoM fall, worse than expectations of a 0.3% rise. The YoY number grew by 2.6%, much weaker than expectations of a 3.3% rise. Separately, the US 10Y Treasury auction saw significant demand, with a bid-to-cover ratio of 2.65x, much higher than the prior auction’s 2.35x. Also, indirect take-up came-in at 83.1%, with primary dealers’ take-up being the lowest since 2003, indicating a strong auction. Markets await the CPI report later today.

Looking at US equity markets, the S&P ended higher by 0.3% while the Nasdaq closed flat. US IG and HY CDS spreads were tighter by 1bp and 1.9bp respectively. European equity markets ended lower. The iTraxx Main CDS spreads were 0.5bp tighter while the Crossover spreads were 3.5bp tighter. Asian equity markets have opened mixed today. Asia ex-Japan CDS spreads were 1.1bp tighter.

New Bond Issues

Saudi Aramco raised $3bn via a two-part sukuk deal. It raised $1.5bn via a 5Y sukuk at yield of 4.278%, 30bp inside initial guidance of T+105bp area. It also raised $1.5bn via a 10Y sukuk at a yield of 4.83%, 30bp inside initial guidance of T+115bp area. The senior unsecured notes are rated Aa3/A+ (Moody’s/Fitch), and received orders of over $20bn, 6.7x issue size. Proceeds will be used for general corporate purposes. The new 5Y note was priced at a new issue premium of ~5bp to its existing 4.75% 2030s that currently yield 4.23%. The new 10Y note was priced roughly inline with its existing 5.375% 2035s that currently yield 4.84%.

Colombia raised €4.1bn via a three-part deal. It raised:

- €1.45bn via a 3Y bond at a yield of 3.75%, 50bp inside initial guidance of 4.25% area.

- €1.45bn via a 7Y bond at a yield of 5.125%, 50bp inside initial guidance of 5.625% area.

- €1.20bn via a long 10Y bond at a yield of 5.75%, 50bp inside initial guidance of 6.25% area.

The senior unsecured notes are rated Baa3/BB/BB+. Proceeds will be used for liability management transactions and/or general budgetary purposes.

SocGen raised €500mn via a PerpNC7 AT1 bond at a yield of 6.125%, 50bp inside initial guidance of 6.625% area. The junior subordinated note is rated Ba2/BB/BB+. If not called by 17 September 2032, the coupon will reset to the 5Y Mid-Swap plus 377.9bp.

CapitaLand China Trust raised S$150mn via a PerpNC3 bond at a yield of 3.95%, 30bp inside initial guidance of 4.25% area. The subordinated note is unrated. If not called by 19 September 2028, the coupon will reset to the 3Y SORA-OIS plus 272bp. It has a dividend stopper but not a dividend pusher. There is no coupon step-up. Proceeds will be used for general corporate/working capital purposes, and investment or refinancing of existing borrowings of the group.

New Bond Pipeline

- Bank AlJazira $ PerpNC5.5 AT1 Sukuk

Rating Changes

- Moody’s Ratings downgrades Service Properties Trust’s CFR to Caa1, outlook revised to stable

- Fitch Revises Outlook on GMR Hyderabad International Airport to Positive; Affirms at ‘BB+’

- Fitch Revises Outlook on Bank Gospodarstwa Krajowego to Negative; Affirms at ‘A-‘

Term of the Day: Bridge Financing

Bridge financing is a temporary form of financing used to cover the borrower’s short-term costs until the moment when regular long-term financing is secured. This form of financing ‘bridges’ the gap between when the borrower’s funds are set to dry up and its next long-term funding option.

Tata Motors aims to raise €3.875bn ($4.5bn) via a bridge loan to fund its acquisition of Iveco Group’s commercial vehicle business

Talking Heads

On Fed Rate-Cut Bets Strengthening Lure of EMs – Navin Hingorani, Eastspring Investments

“Emerging markets are trading at a 65% discount to the US, so we’re seeing opportunities across different markets, across different sectors… real rates are still very high across emerging markets…As the US moves into a rate-cutting cycle, that will be very positive for emerging market”

On Bond-Market Beting on Deep Fed Cuts at Risk From Hot CPI Data

Ed Al-Hussainy, Columbia Threadneedle

“The front-end has priced for a weaker economy, not any focus on inflation…If the focus comes back to inflation, if the number is hot, the front-end will be a bit vulnerable.”

Cameron Crise, Bloomberg

“PPI offered less than no impediment to Fed easing, though the components that feed into PCE were less dovish than the unexpected drop in the headline and core indexes.”

Meghan Swiber, Bank of America

“It’s incredible that you have the market pricing such a high degree of cuts — such a very, very fast trajectory of cuts — alongside sticky inflation,”

On Credit Market Math Making Buyers Cash No Matter What Rates Do

Bryn Jones, Rathbones Group

“It’s quite tough for a fixed income fund manager to lose money…If I’m an asset allocator and I pumped the numbers in, wow, I can get 6% with a duration of three or four or five years”

Kshitij Sinha, Canada Life Asset Management

“The higher duration in government bonds, along with tightening spreads, has meant corporate bonds are having a big outperformance”

Top Gainers and Losers- 11-Sep-25*

Go back to Latest bond Market News

Related Posts: