This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Aramco, CLCT Launch Bonds; Türkiye, Al Rajhi, Omniyat Price $ Notes

September 10, 2025

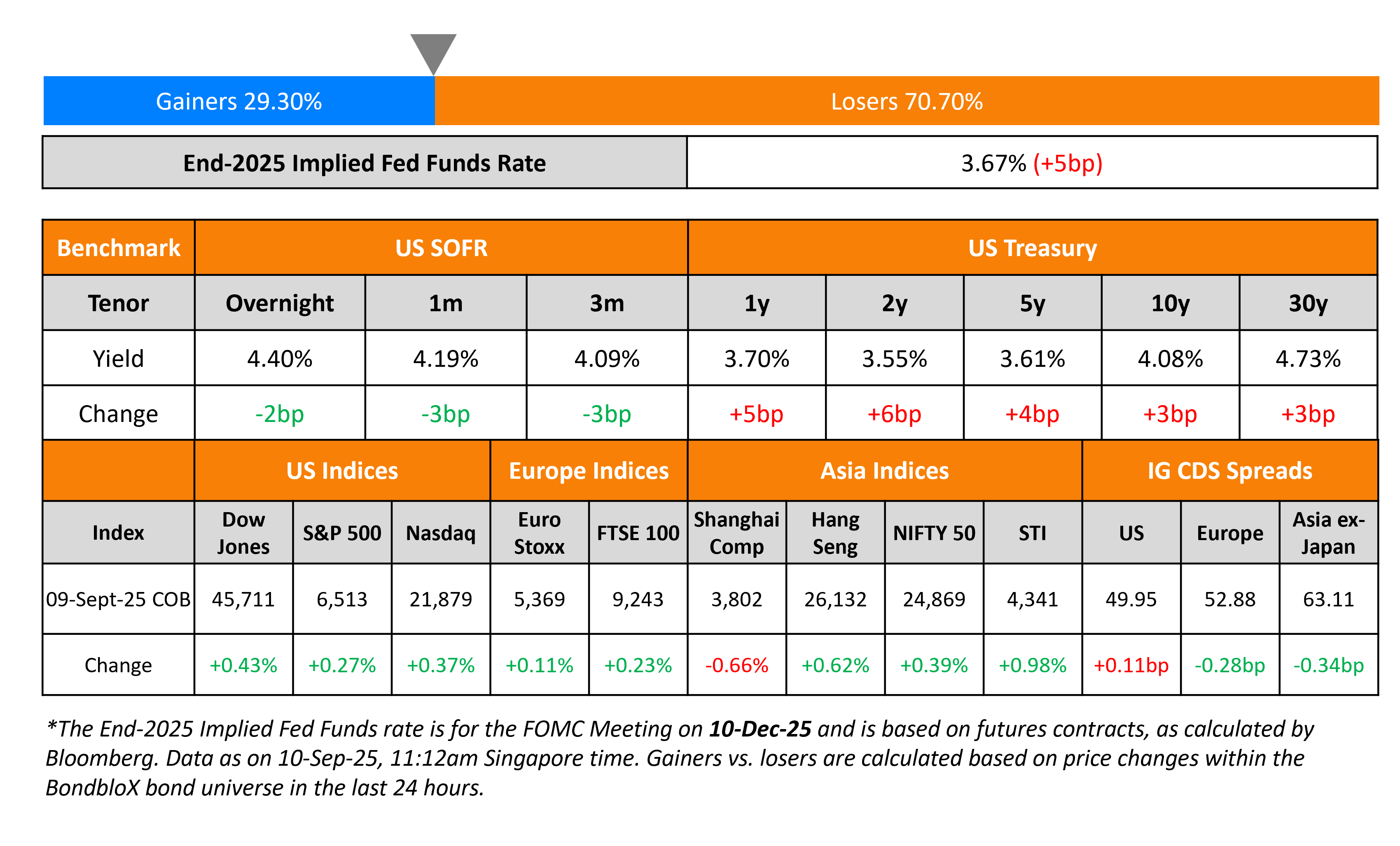

The US Treasury curve bear flattened with the 2Y yield rising by 6bp while the 10Y rose by 3bp. The preliminary estimate of the nonfarm payrolls for year ended March 2025 was revised downwards by a record 911k jobs. Thus job growth for this period came-in at 847k vs. the earlier assumption of 1.76mn.

Looking at US equity markets, the S&P and Nasdaq ended higher by 0.3-0.4%. US IG and HY CDS spreads were wider by 0.1bp and 0.2bp respectively. European equity markets ended higher too. The iTraxx Main CDS spreads were 0.3bp tighter while the Crossover spreads were 0.3bp wider. Asian equity markets have opened in the green today. Asia ex-Japan CDS spreads were 0.3bp tighter.

New Bond Issues

- CapitaLand China Trust S$ PerpNC3 at 4.25% area

- Saudi Aramco $ 5Y/10Y sukuk at T+105/115bp area

- KHFC $ 5Y at T+70bp area

Türkiye raised $2bn via a 10Y bond at a yield of 7.0%, 30bp inside initial guidance of 7.3% area. The senior unsecured note is unrated. Proceeds will be used for general budgetary purposes. The new bond is priced at a new issue premium of 14bp over its 6.5% 2035s that currently yield 6.86%.

Al Rajhi raised $1bn via a 10.5NC5.5 Tier-2 social sukuk at a yield of 5.651%, 35bp inside initial guidance of T+235bp area. The subordinated note is rated Baa2/BBB. Proceeds will be used to finance and/or refinance, in whole or in part, for eligible projects under its sustainable finance framework.

Omniyat raised $400mn via a long 3Y sukuk at a yield of 7.25%, 37.5bp inside initial guidance of 7.625% area. The senior unsecured note is unrated, and received orders of over $800mn, 2x issue size. Proceeds will be used for general corporate purposes. The new sukuk is priced at a new issue premium of 23bp over its 8.375% 2028s that currently yield 7.02%.

Doha Bank raised $500mn via a long 5Y bond at a yield of 4.621%, 35bp inside initial guidance of T+140bp area. The senior unsecured bond is rated A (Fitch). Proceeds will be used for general corporate purposes.

NatWest raised £500mn via a PerpNC10 AT1 bond at a yield of 7.625%, 62.5bp inside initial guidance of 8.25% area. The subordinated note is rated Baa3/BBB. If not called by 30 September 2035, the coupon will reset to the 5Y Gilt yield plus 297.1bp. A trigger event will occur if the CET1 ratio of the regulatory group is less than 7% at any point in time.

Vodafone raised €1.4bn via a two-part deal. It raised €700mn via a 30NC6.6 bond at yield of 4.25%, 50bp inside initial guidance of 4.75% area. It also raised €700mn via a 30NC9.6 bond at a yield of 4.75%, 50bp inside initial guidance of 5.25% area. The senior unsecured bonds are rated Baa3/BB+/BB+. Net proceeds will be used for general corporate purposes, including funding the repurchase of its notes.

Ford Motor Credit raised €1.2bn via a two-trancher. It raised €600mn via a 4Y bond at a yield of 3.815%, 35bp inside initial guidance of MS+200bp area. It also raised €600mn via a 7Y bond at a yield of 4.745%, 35bp inside initial guidance of MS+240bp area. The senior unsecured notes are rated Ba1/BBB-/BBB-. Proceeds will be used for general corporate purposes.

Rating Changes

-

Moody’s Ratings downgrades Phillips 66 to Baa1, outlook stable

-

Fitch Downgrades TDB to ‘BB’; Outlook Stable

-

Derichebourg S.A. Downgraded To ‘BB’ From ‘BB+’ On Lower-Than-Expected EBITDA And Higher Leverage; Outlook Stable

-

Kronos Acquisition Holdings Inc. Ratings Lowered To ‘CCC’ On Tightening Liquidity; Outlook Negative

Term of the Day: Social Bonds

Social bonds are issued by companies to specifically fund projects with social benefits (new/existing), which should be mentioned in the prospectus. ICMA’s social bond principles set out a standard covering four elements as follows:

– Use of proceeds (range of 6 categories but not limited to them)

– Process of evaluation and selection of social projects

– Management of proceeds

– Reporting

Examples of projects for social bonds include affordable housing, socioeconomic empowerment, essential service access and projects of their like.

Talking Heads

On BOJ Needs to Hike Rate to Fix Yen, Inflation – Kono Taro, Liberal Democratic Party

“We need to fix the yen rate. In order to do that, BoJ needs to increase the interest rate…If the BoJ delays a rate increase, I think it would mean inflation will continue and everything we import would be higher”

On Maximum Underweight Dollar Before Fed – Alessio de Longis, Invesco

“While the US dollar still enjoys higher yields than its developed market peers, this anticipated erosion of the US yield advantage has historically put downward pressure on the greenback…This provides a potential catalyst for outperformance in non-US equities.”

On Global Bonds Re-Entering Bull Market as Fed Easing Bets Extend

Jim Reid, Deutsche Bank AG

“The dominant theme in the markets over the past 24 hours has been the continued global bond rally…This has helped ease pressure on the latest French political crisis.”

Ben Hayward, TwentyFour Asset Management

“Higher yields improve potential returns, but they can also give portfolios some protection against volatility, so it is no surprise to see investors increasing allocations to fixed income across sectors”

Top Gainers and Losers- 10-Sep-25*

Go back to Latest bond Market News

Related Posts: