This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Arabian Centres Downgraded to BB; Outlook Negative

July 22, 2025

Arabian Centres Company (Cenomi Centres) has been downgraded to BB from BB+ by Fitch with a negative outlook. The downgrade comes on the back of increased burden due to its development programmes and Cenomi’s portfolio being concentrated to limited assets. Fitch sites that Arabian Centres’ liquidity continues to weaken and that they are planning to refinance its SAR 3.3bn ($880mn) sukuk due in October 2026. Fitch expects the refinanced sukuk to be priced at 9.5%, which will substantially increase fixed charge coverage. Their revolving credit facility is full drawn and other lines are restricted to financing mall projects.

New malls would reduce business risk, however, the high capex has increased leverage. Net Debt-to-EBITDAR was at 8.1x in end-2024, and is expected to increase to 9x by end-2025. Although lease renewals and tenant retention remain strong, lease renewals would be super critical as 60% of the contracts end in the next two years. The negative outlook reflects tightening liquidity, with SAR 2.1bn ($560mn) in capex still to be funded by end-2025. Cenomi expects to bridge this via asset sales, undrawn project financing and existing cash reserves.

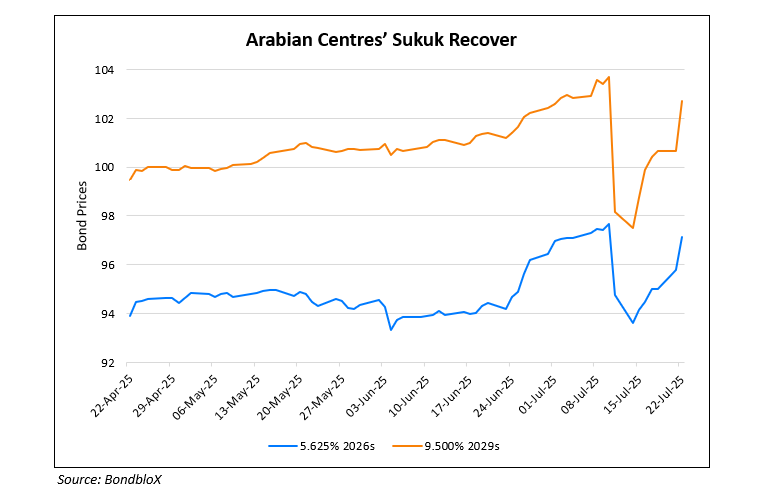

Arabian Centres’ dollar sukuk had trended lower earlier this month. However, they have recovered most of the move as seen in the chart aboce.

For more details, click here.

Go back to Latest bond Market News

Related Posts: