This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Arabian Centres, DB, HSBC, CDL Price Bonds

November 25, 2025

US Treasury yields continued to ease, by 2-3bp with Fed Governor Chris Waller saying that a December rate cut would be appropriate due to a soft and weakening labor market, with inflation expected to ease. Similarly, non-voting member Mary Daly echoed the same sentiment, supporting a rate cut in December.

Looking at the equity markets, the S&P and Nasdaq closed higher by 1.6% and 2.7% respectively. US IG and HY CDS spreads were tighter by 1.4bp and 7.8bp respectively. European equity indices ended mixed. The iTraxx Main CDS and Crossover CDS spreads were 0.5bp and 3.1bp tighter respectively. Asian equity markets have opened mixed this morning. Asia ex-Japan CDS spreads were 1.9bp tighter.

New Bond Issues

- BDO Unibank $ 5Y T+110bp area

-

San Miguel $ PerpNC5.25 at 8.125% area

-

BNP A$ PerpNC5.5 at 7.25% area

-

West China Cement $ 3NC2 at 10.375% area

.png)

Deutsche Bank raised €1bn via a PerpNC10 AT1 bond at a yield of 6.75%, 37.5bp inside initial guidance of 7.125% area. The junior subordinated note is rated Ba2/BB, and received orders of over €7.5bn, 7.5x issue size. If not called by 30 April 2035, the coupon will reset to the 5Y Mid-Swap plus 403.6bp. A trigger event would occur if the consolidated CET1 ratio falls below 5.125%.

Arabian Centres raised $500mn via a 5NC2 sukuk at a yield of 9.125%, 25bp inside initial guidance of 9.375% area. The senior unsecured note is rated B+/BB (S&P/Fitch). Proceeds will be used for general corporate purposes, including the refinancing of its sukuk due 2026, and for the repayment of existing bank debt.

City Developments Ltd. (CDL) raised S$300mn via a 5Y bond at a yield of 2.4%, inline with final guidance. The senior unsecured note is unrated. Proceeds will be used to finance the general working capital requirements and corporate funding of CDL and its subsidiaries.

HSBC raised €1.25bn via an 8NC7 bond at a yield of 3.608%, 20bp inside initial guidance of MS+125bp area. The senior unsecured note is rated A3/A-/A+. Proceeds will be used for general corporate purposes.

SocGen raised €1bn via a long 6NC5 bond at a yield of 3.512%, ~24.5bp inside initial guidance of MS+130/135bp area. The senior non-preferred note is rated Baa2/BBB/A-.

Saudi National Bank raised S$425mn via a 10NC5 Tier-2 bond at a yield of 3.4%, 30bp inside initial guidance of 3.7% area. The senior unsecured note is rated BBB by S&P. Proceeds will be used for general corporate purposes, including strengthening its capital base.

Guangzhou Development District raised $500mn via a 2Y green bond at a yield of 4.4%, 50bp inside initial guidance of 4.9% area. The senior unsecured note is rated BBB+ by Fitch. Proceeds will be used to finance/refinance eligible green projects under its framework.

Rating Changes

- UNIQA Group’s Core Entities Upgraded To ‘A+’ On Strong Performance And Improved Diversification; Outlook Stable

- Moody’s Ratings Upgrades Block’s CFR to Ba1; outlook revised to stable

- Fitch Upgrades Pan Brothers to ‘B-(idn)’ on Completion of Restructuring; Outlook Stable

- Challenger Life Upgraded To ‘A+’ On Stronger Business Fundamentals; Outlook Stable

- FMC Corp. Downgraded To ‘BB+’ On Continued Weak Credit Metrics; Outlook Negative

- Fitch Downgrades Bellis Finco (ASDA) to ‘B’; Outlook Negative

- Moody’s Ratings changes outlook on Vistra Corp to positive from stable; ratings affirmed

Term of the Day: Tender Offer

A tender offer is an offer made by an issuer to bondholders to buyback their bonds. In return, the bondholders could get either cash or new bonds of equivalent value at a specified price. The issuer does this to retire some of its old debt and can use retained earnings to fund the purchases without affecting the liquidity position of the company. Tender offers have a deadline date before which holders must tender their bonds back.

Talking Heads

On wary of AI funding wave that could alter US high-grade debt market

Robert Cohen, DoubleLine

“The potential for this data center capacity spend to come to the investment-grade market means you could have a significant re-levering in a new sector, and it could become a material risk to the high-grade market… You’ve got a large new sector that’s clearly unproven, and that would change the risk profile of investment-grade credit quite substantially “

“Respondents cite ‘tariff impacts’ as the greatest downside risk to the U.S. economic outlook, considering both probability of occurrence and potential impact”

On Treasuries Rising as December Rate-Cut Bets Pile Up

John Canavan, Oxford Economics

“The improved tone in the front-end of the curve over the past few sessions” helped ensure the two-year auction went smoothly

Andrew Brenner, Natalliance Securities

Investors “are taking solace in the fact that the senior members of the Fed still want to ease in December even though the employment number won’t be out until after the Fed meeting”

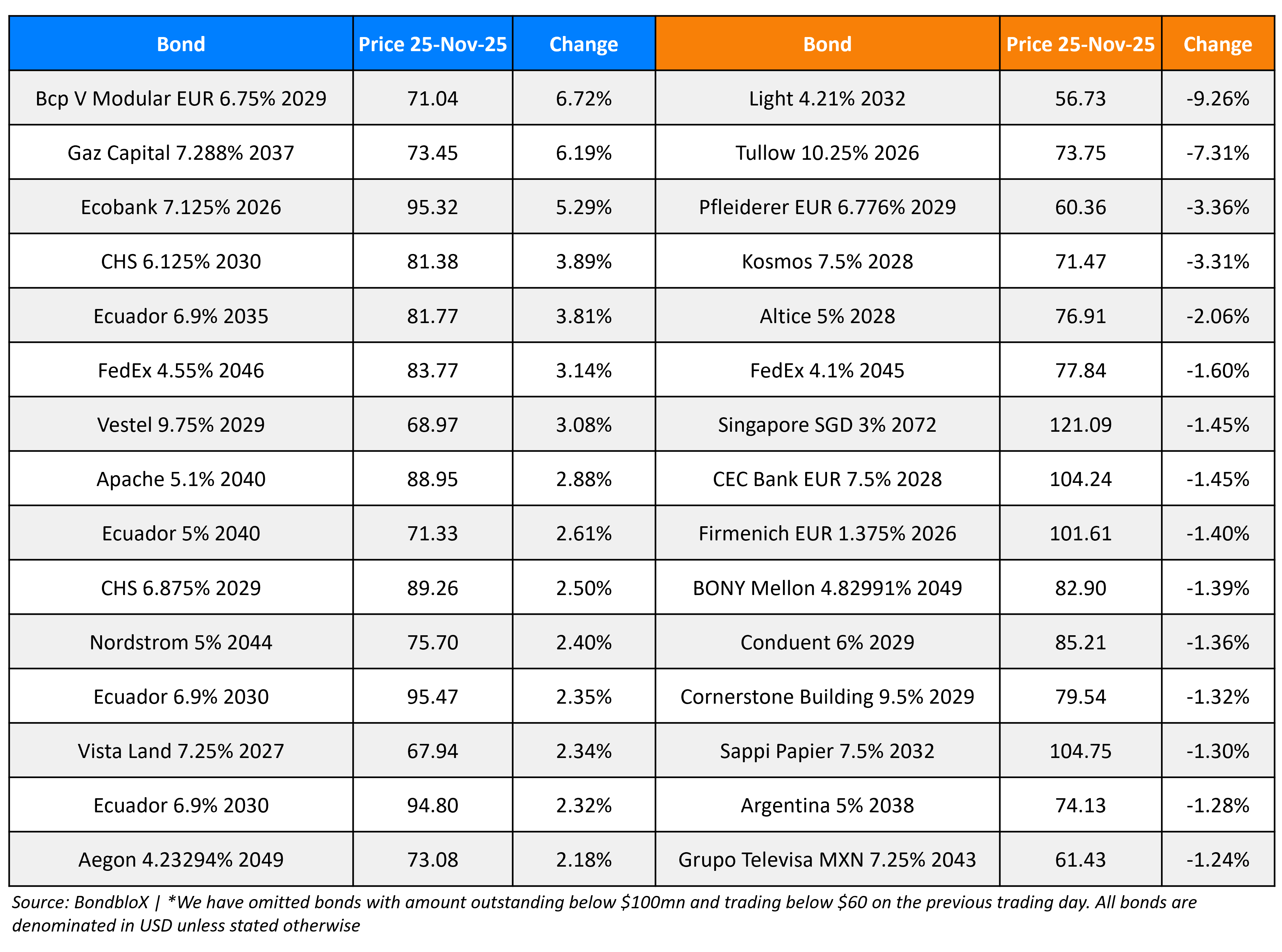

Top Gainers and Losers- 25-Nov-25*

Go back to Latest bond Market News

Related Posts: