This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Aoyuan Reports 1H Earnings

August 23, 2021

China Aoyuan Group Limited reported an increase of 15% YoY in its revenue for 1H2021 to CNY 32.51bn ($5.01bn). The developer posted a net profit of CNY 2.84bn ($437.6mn) in line with the previous year. The net profit margin stood at 8.7% vs. 10.1% last year. The property developer also reported an increase of 33% YoY in its contracted sales to CNY 67.58bn ($10.41bn) during the period. During 1H2021, the company issued $738mn of offshore notes and CNY 1.82bn ($280.4mn) onshore bonds. It also secured 3Y offshore syndicated loans of ~HKD 2.1bn ($269.6mn) while redeeming all its offshore notes due in 2021. Its total credit facilities amounted to ~CNY 242.6bn ($37.38bn), of which CNY 128.3bn ($19.77bn) were unutilized. The company also reported a cash balance of ~CNY 68.3bn ($10.52bn) and a cash collection rate of 87%. As per the company, “Aoyuan had over 70 urban redevelopment projects at different phases. They are expected to provide additional saleable resources of approximately CNY 754.3bn ($116.2bn), of which CNY 748.7bn ($115.3bn) are located in the Greater Bay Area, accounting for 99%. In the first half of 2021, Aoyuan converted saleable resources from urban redevelopment of approximately CNY 13.5 ($2.08bn). In 2021-2024, saleable resources of approximately CNY 242bn ($37.28bn) are expected to be converted from urban redevelopment projects.”

Aoyuan’s 7.35% 2023s were up 0.25 to trade at 97.13 cents on the dollar while its 5.88% 2027s were down 1 point to trade at 77.5 cents on the dollar on the secondary markets.

For the full story, click here

Go back to Latest bond Market News

Related Posts:

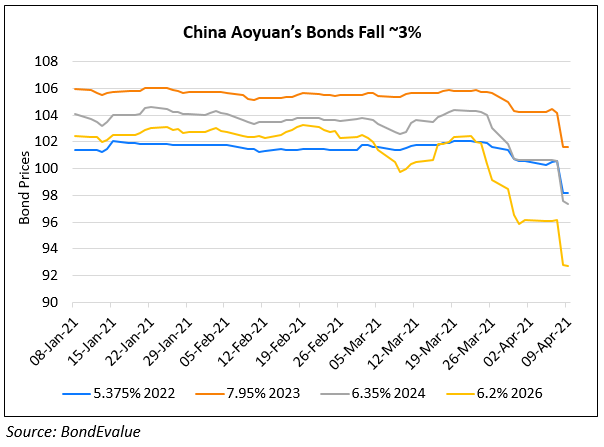

China Aoyuan’s Dollar Bonds Trend Lower

April 9, 2021

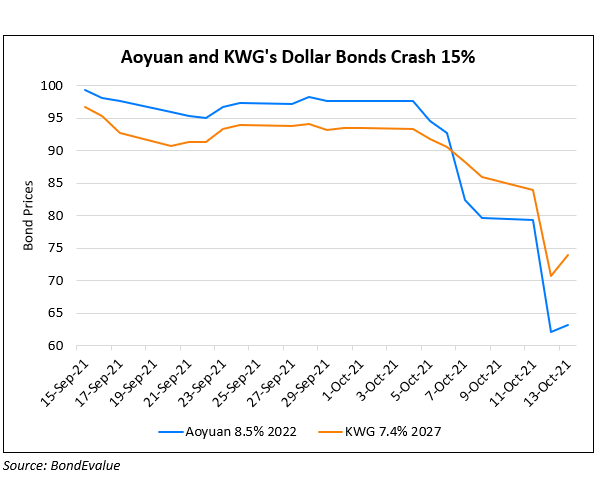

Aoyuan, KWG Dollar Bonds Plummet

October 13, 2021