This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

ANZ, Lloyds, Suntec Price Bonds; US-China Talk Continues to Day 2

June 11, 2025

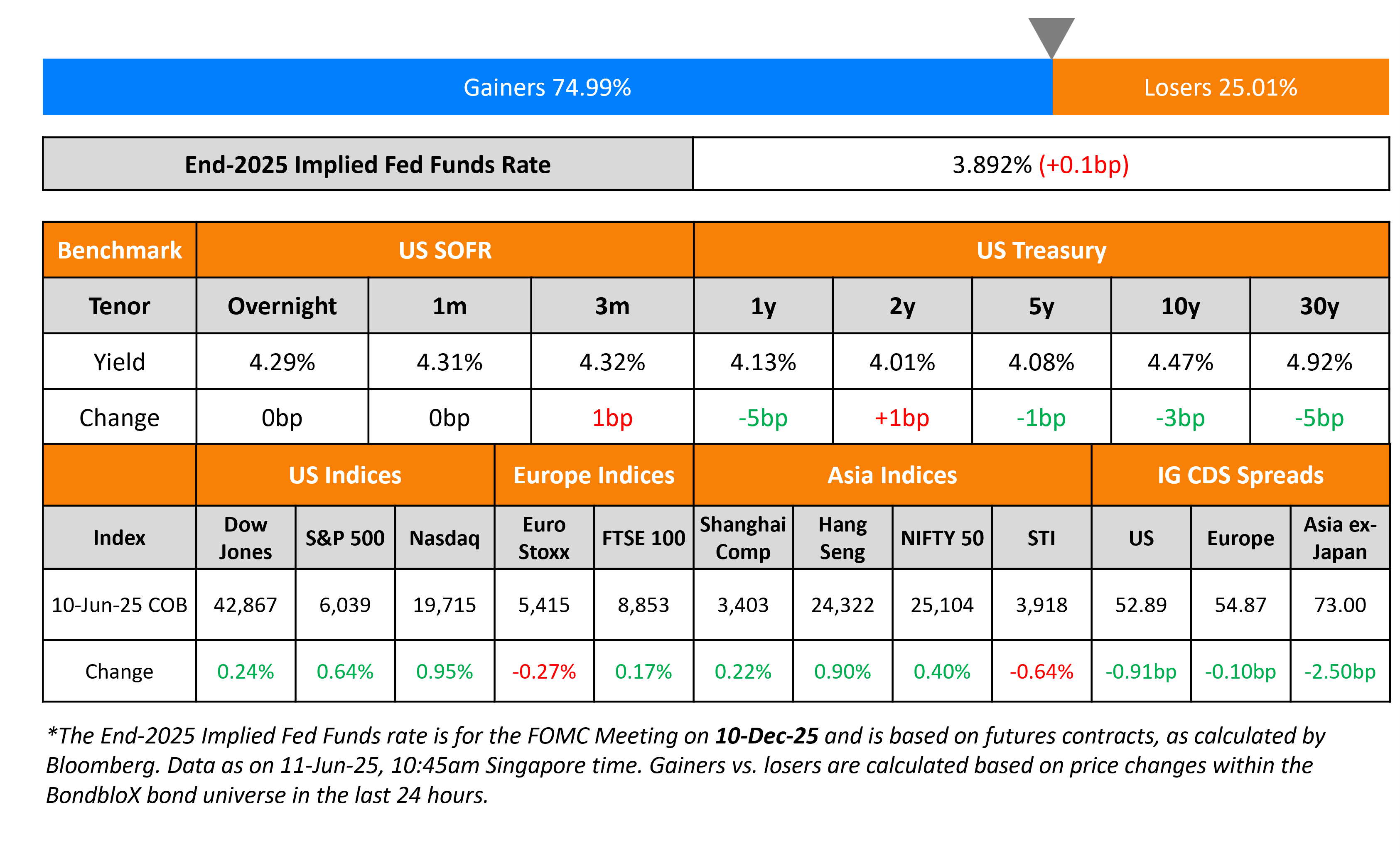

US Treasury yields eased slightly across the curve. US-China trade talks continued in London yesterday. Senior officials from both countries agreed on a provisional framework to revive the Geneva truce, including easing US export curbs on chips and China’s rare-earth export restrictions. Markets await the CPI data release later today – the headline and core readings are expected at 2.4% and 2.9% respectively.

Looking at US equity markets, S&P and Nasdaq jumped higher by 0.6% and 1% respectively. In credit markets, US IG and HY CDS tightened by 0.9bp and 4.1bp respectively. European equity markets closed mixed yesterday. The iTraxx Main and Crossover CDS spreads tightened by 0.1bp and 0.8bp respectively. Asian equity markets have opened higher today. Asia ex-Japan spreads tightened by 2.5bp.

New Bond Issues

.png)

ANZ raised $2.75bn via a three tranche deal. It raised:

- $500mn via a 3Y bond at a yield of 4.362%, 22bp inside initial guidance of T+60bp area. The new bond is priced ~17bp tighter to its existing 5.355% 2028s that currently yield 4.53%.

- $1bn via a 3Y FRN at SOFR+62bp, vs initial guidance of SOFR equivalent area

- $1.25bn via a 11NC10 Tier 2 bond at a yield of 5.816%, 30bp inside initial guidance of T+165bp area. If not called before 18 June 2035, the coupon will reset to the 10Y UST+135bp. In case of a non-viability event, there will be a mandatory conversion into ordinary shares of ANZ Group Holdings Limited with a fall back to write off.

The 3Y fixed rate and FRN notes are rated Aa2/AA-/AA-. The 11NC10 subordinated note is rated A3/A-/A-. Proceeds from all three bonds would be used for general corporate purposes.

Lloyds raised $3bn via a three tranche deal. It raised:

- $1.25bn via a 4NC3 bond at a yield of 4.818%, 32bp inside initial guidance of T+115bp area. The new bond is priced roughly in-line with its existing 5.871% 2029s (callable in March 2028), that currently yields 4.79%.

- $500mn via a 4NC3 FRN at SOFR+106bp, vs initial guidance of SOFR equivalent area

- $1.25bn via a 11NC10 Tier 2 bond at a yield of 6.068%, 30bp inside initial guidance of T+190bp area.

Both 4NC3 senior unsecured notes are rated A3/BBB+/A+. The 11NC10 subordinated note is rated Baa1/BBB-/A-. Proceeds will be used or general corporate purposes.

Suntec REIT raised S$250mn via a PerpNC5 AT1 bond at a yield of 4.48%, 32bp inside initial guidance of 4.80%. The subordinated note is unrated. If not called before 17 June 2030, the coupon will reset to the SGD 5Y OIS plus 265.6bp then and every 5 years thereafter. There is no coupon step-up. The notes have a dividend stopper but don’t have a dividend pusher. Private banks receive a 25 cent concession.

Rating Changes

- Fitch Upgrades China Great Wall to ‘BBB’; Outlook Stable

- Fitch Downgrades Sunnova’s IDR to ‘D’ on Bankruptcy Filing

- Provident Group Falcon Properties Bonds Downgraded Two Notches To ‘B+’, Placed On CreditWatch Negative

- Fitch Downgrades AP Core Holdings (Yahoo) to ‘B-‘; Outlook Stable

- Fitch Revises PulteGroup’s Outlook to Positive; Affirms IDR at ‘BBB+’

- Fitch Revises Lennar’s Outlook to Positive; Affirms IDR at ‘BBB+’

- Fitch Revises Outlook on Qingdao Conson to Stable; Affirms at ‘BBB+’

Term of the Day: Fallen Angel

A fallen angel is a company or sovereign whose credit rating has been cut from investment grade to junk due to deteriorating financial conditions of the company. The downgrade to junk may have a negative impact on its bond prices as asset managers that are mandated to hold only investment grade debt may be forced to sell off their holdings in the fallen angels.

Talking Heads

On Popular US Treasury Bet Risks Being Next Pain Trade – BNP

“Steepeners could be a pain trade in the current market set up…Every auction now feels like a risk event…A good auction is probably par for the course, but a weak auction really sets the cat among the pigeons…a lot of the scepticism and concern is in the price”

On Traders Wary of Bold Bets Dragging Credit Volatility Near Record Low

Alexandra Ralph, Nedgroup Investments

“There’s no fundamental reason for a big credit sell off…There’s no one sector that is under distress.”

Mark Dowding, RBC BlueBay

“…would not be surprised if volatility doesn’t pick up materially again over the course of the coming month”

Christian Hantel, Vontobel Asset Management

“There are concerns about a blow somewhere down the road if macro headlines impact corporates as well as investor risk appetite”

On Favoring 5- to 10-Year Bonds and Being Cautious on Private Credit – Pimco

“Divergent inflation, growth, and trade outlooks reinforce the need for broad, global diversification…Active investors can favor attractive medium-term bonds over longer maturities…US Treasuries remain the cleanest dirty shirt in the sovereign closet”

Top Gainers and Losers- 11-Jun-25*

Go back to Latest bond Market News

Related Posts: