This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

ANZ, Bupa Price Bonds; Senate Passes Funding Measure

November 12, 2025

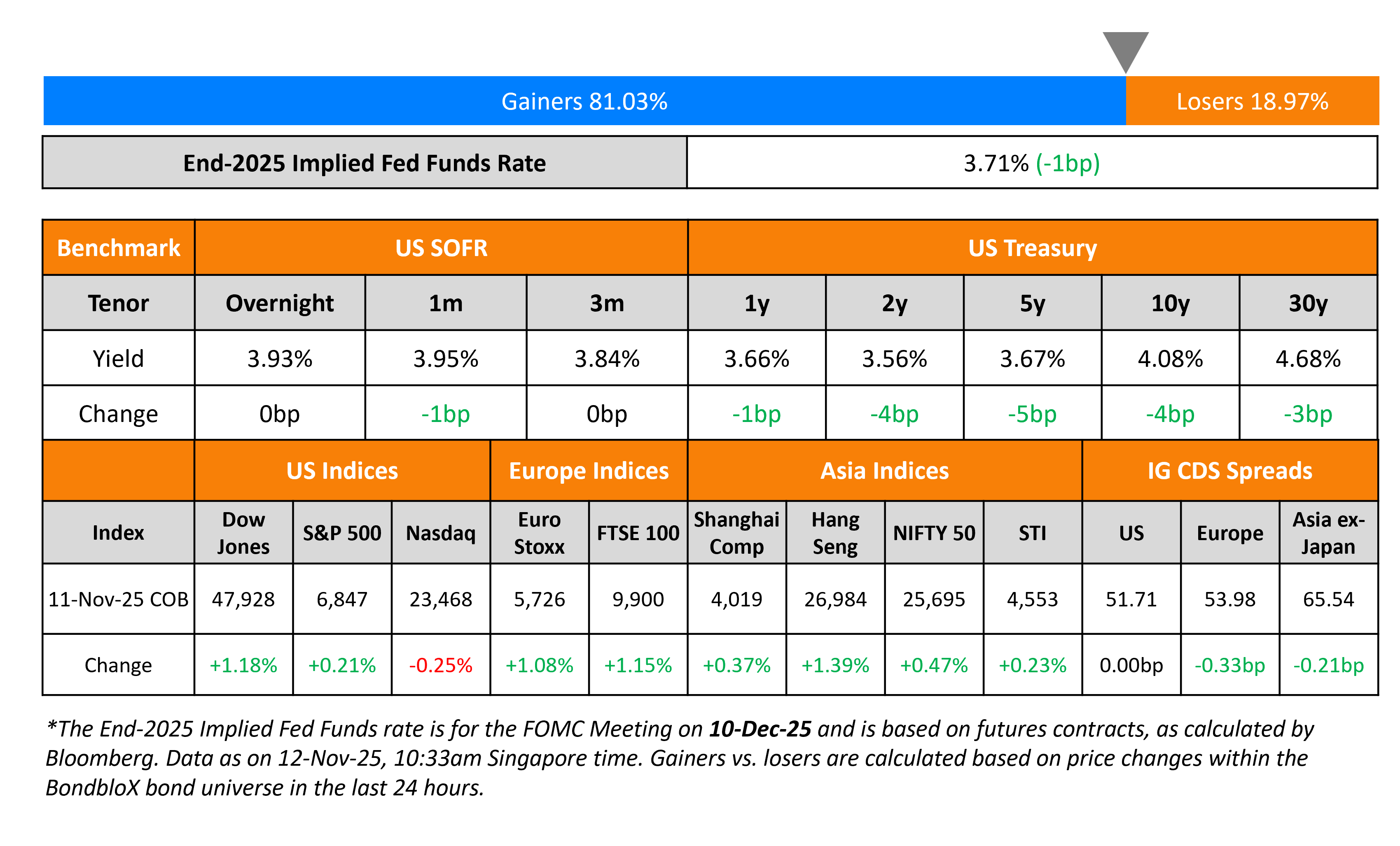

US Treasury yields eased by 4-5bp across the curve. The US Senate passed a temporary funding measure with a 60-40 vote, with the bill now set to require approval from the House of Representatives, followed by US President Donald Trump’s signature. A successful completion of this would see the government shutdown come to an end. Separately, an ADP report noted that US firms were shedding more than 11k jobs a week through late-October. This comes just after the prior week’s monthly ADP report which indicated that 42k jobs were added in October, thus showing how hiring trends are evolving on a week-to-week basis.

Looking at the equity markets, the S&P closed higher by 0.2% while the Nasdaq was lower by 0.3%. US IG and HY credit markets were closed on account of Veterans Day. European equity indices ended higher. The iTraxx Main CDS spreads were 0.3bp tighter and the Crossover CDS spreads were tighter by 1.1bp. Asian equity markets have opened broadly higher today. Asia ex-Japan CDS spreads tightened by 0.2bp.

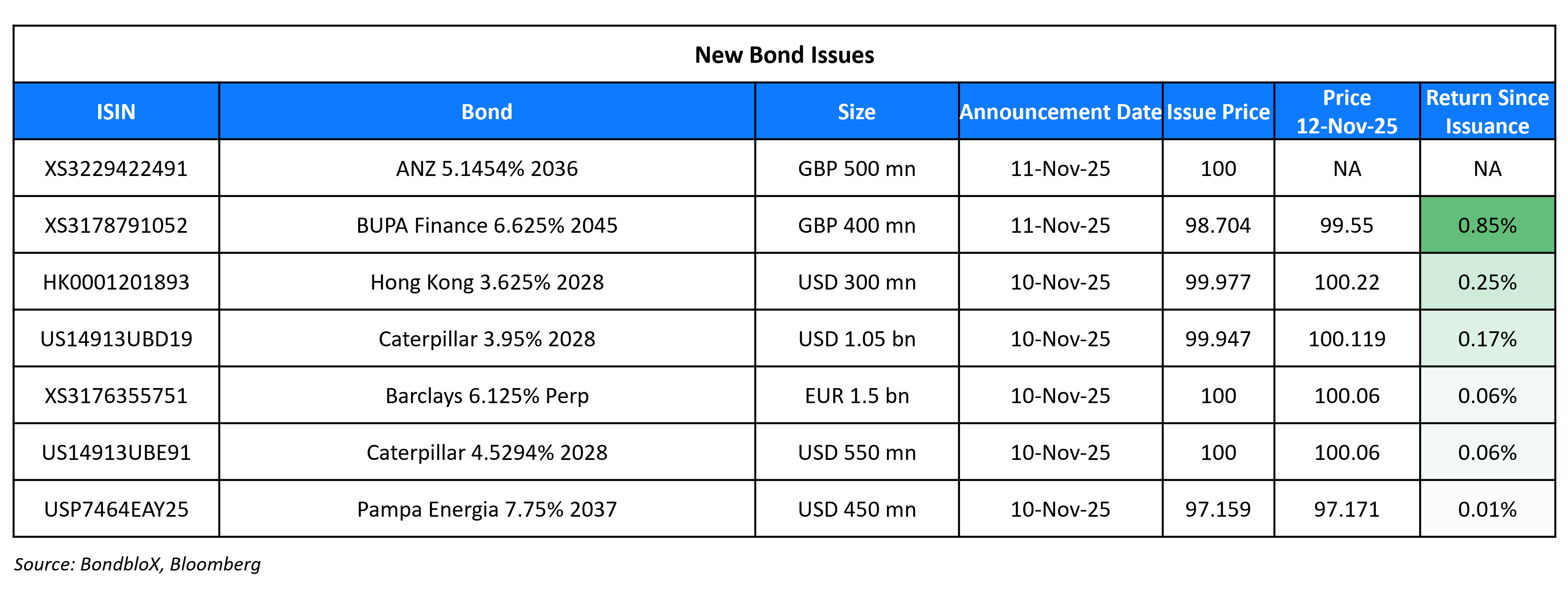

New Bond Issues

ANZ Bank raised £500mn via a 10.75NC5.75 Tier-2 bond at a yield of 5.147%, 18bp inside initial guidance of UKT+150bp area. The subordinated note is rated A3/A-/A- (Moody’s/S&P/Fitch). Proceeds will be used for general corporate purposes.

Bupa Finance raised £400mn via a 20Y Tier-2 bond at a yield of 6.744%, 15bp inside initial guidance of UKT+185bp area. The subordinated note is rated Baa1/BBB (Moody’s/Fitch). Proceeds will be used for general corporate purposes, including refinancing existing notes.

New Bonds Pipeline

-

China Resources Land USD 3Y/ CNH 5Y Green Notes

-

Bank of Sharjah $ 5Y bond

-

DIB $ SLB sukuk

-

Pluspetrol holds investor calls

-

National Bank of Oman $ PerpNC5.5 AT1

-

Resolution Life $ PerpNC7

-

Kuwait Finance House $ PerpNC5.5 AT1 Sukuk

-

MAF $ PerpNC5.25 investor calls

Rating Changes

- Fitch Upgrades Camposol’s L-T Local and Foreign Currency IDRs to ‘B+’

- Avation PLC Upgraded to ‘B’ On Refinancing; Removed From CreditWatch; Outlook Stable

- Moody’s Ratings downgrades Liquid Telecom to Caa2, outlook negative

- Israel Discount Bank Ltd. Outlook Revised To Stable From Negative Mirroring Action On Sovereign; ‘BBB+’ Rating Affirmed

- Moody’s Ratings changes Alsea’s outlook to positive; affirms Ba3 ratings

Term of the Day: Will Not Grow (WNG) Bonds

Bonds whose size is fixed and cannot be increased are called ‘Will Not Grow (WNG)’ or ‘No Grow’ bonds. Sometimes, issuers increase the final size of a deal to accommodate investor appetite. WNG bonds however have a fixed size and will not be increased. For example, green bonds often fall into this category as per the Climate Bonds Initiative (CBI). The CBI says that issuers need to show that there are enough green projects to match the amount that they intend to raise and for some, the number of suitable projects is limited. This according to them shows why green bonds tend to be smaller than vanilla bonds from the same issuer whereas for others there is more flexibility and the final size of the deal can be increased to accommodate investor appetite.

Talking Heads

On Stocks, Bonds Rising as US Data Spurs Rate-Cut Bets

Rajeev De Mello, Gama Asset

“As government functions resume, we expect a clearer read on the economic data, an important step for assessing the underlying strength of US activity”

Westpac Banking strategists

“The market will be guided by the general risk vibe and Fedspeak, but we suspect it will be unable to establish consistent directional impetus”

Louis Navellier, Navellier & Associates

“Overall, the trend remains positive.. New highs by year-end are definitely on the table”

On JPMorgan Backing December BOE Cut

Allan Monks, JPMorgan economist

“Still a risk that inflation could surprise in the next two releases and cast doubt on timing… moves would need to be significant enough to offset the September data and to dominate the latest labor market news”

On Dollar easing as traders eye December Fed cut

Sim Moh Siong, Bank of Singapore

“The alternative data, I think, overall points to a softer labour market picture… the broad set of data suggests that the labour market is cooling, but only gradually so”

Brian Martin, ANZ

“We remain of the view that the balance of risks to the labour market, inflation and consumption favour a 25-bp rate cut next month”

Top Gainers and Losers- 12-Nov-25*

Go back to Latest bond Market News

Related Posts: