This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

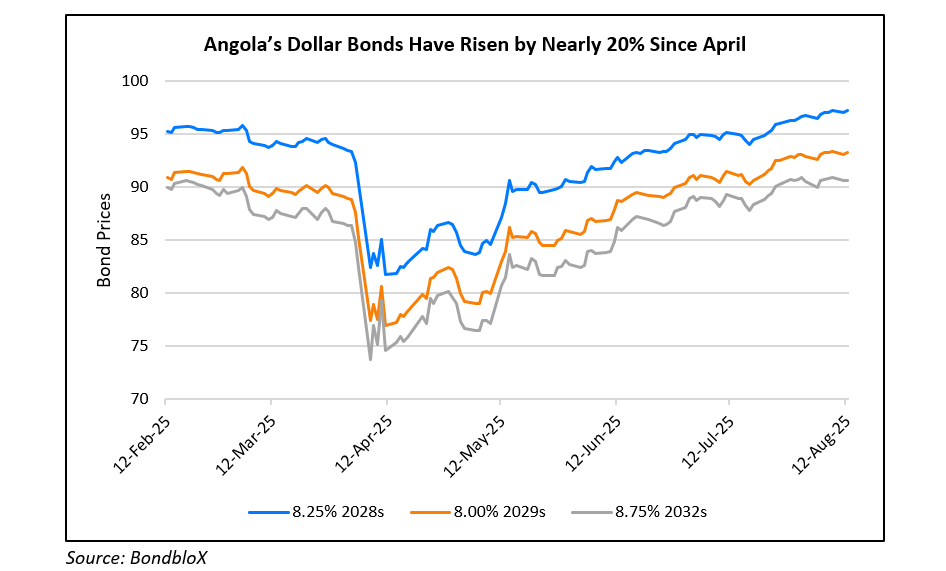

Angola Eyes Return to Eurobond Market as Debt Burden Eases

August 12, 2025

Angola is considering a return to the international eurobond market as borrowing costs for the oil-exporting nation continue to ease. Angola did a roadshow earlier this year, showcasing favourable conditions for a sale in April or May. However, it remains unlikely that a new issuance will come this year unless the financing costs decrease further, said an official. For the time being, Angola will continue relying on local markets, multilateral agencies, and private loans to extend maturities and cut costs.

Angola’s improved credit profile is underpinned by a stronger economic outlook, government efforts to diversify beyond oil, and lower inflation. The IMF estimates that Angola’s government debt fell to 62% of GDP in 2024, from 71% last year. Improved market conditions have also allowed Angola to recover $200mn in collateral previously posted to secure a loan from JPMorgan. It provides Angola with a much-needed breathing space as it approaches a $864mn payment on bonds maturing in November this year.

Angola’s dollar bonds have recovered from their recent lows in April, and its 8.00% 2029s have rallied by about 21% in the last 4 months. It is currently trading at 93.25, yielding 9.97%.

For more details, click here.

Go back to Latest bond Market News

Related Posts: