This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Amex, Pepsi, BofA Price Bonds; Banca Popolare di Sondrio, Hess Upgraded

July 22, 2025

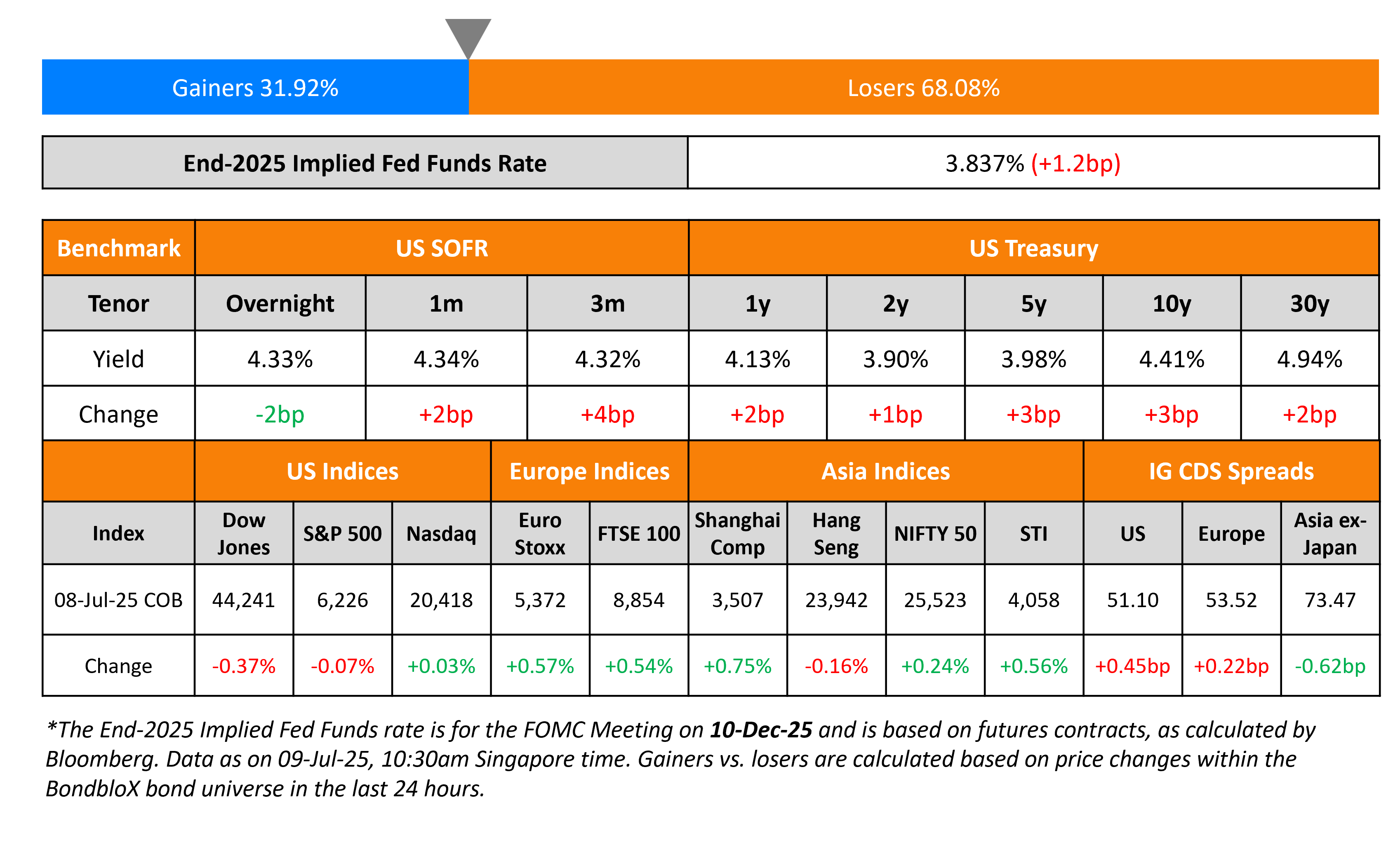

The US Treasury curve bull flattened with long-end yields moving lower by 5bp while short-end yields were steady. US Commerce Secretary Howard Lutnick said that he was confident that the US and the EU would secure a trade deal. There were no major data points from the region on Monday.

Looking at US equity markets, both the S&P and Nasdaq ended higher by 0.2% and 0.4% respectively. US IG and HY CDS spreads widened by 0.1bp and 0.8bp respectively. European equity markets ended mixed. The iTraxx Main and Crossover CDS spreads widened by 0.3bp each. Asian equity markets have opened mixed today. Asia ex-Japan CDS spreads were tighter by 1.4bp.

New Bond Issues

American Express raised $4bn via a three-tranche deal. It raised:

- $1.5bn via a 4NC3 bond at a yield of 4.351%, 25bp inside initial guidance of T+80bp area.

- $750mn via a 4NC3 FRN at SOFR+81bp, vs initial guidance of SOFR equivalent.

- $1.75bn via a 8NC7 bond at a yield of 4.918%, 30bp inside initial guidance of T+110bp area.

These senior unsecured notes are A2/A-/A rated. Proceeds will be used for general corporate purposes.

Bank of America (BofA) raised $2.5bn via a PerpNC5 preference share issuance at a yield of 6.25%, 37.5bp inside initial guidance of 6.625% area. The SEC registered notes are rated Baa2/BBB-/BBB+. The depositary shares represent a 1/25th interest in a share of BofA’s fixed-rate reset non-cumulative preferred stock. If not called by 26 July 2030, the coupon will reset to US 5Y Treasury yield plus 235.1bp. Proceeds will be used for general corporate purposes.

Pepsi raised ~$4.67bn via a multicurrency six-tranche deal:

The senior unsecured notes are rated A1/A+. Proceeds will be used for general corporate purposes, including the repayment of commercial paper.

New Bonds Pipeline

- Adecoagro hires for $ bond

- NAB hires for A$ 15NC10 Tier 2 MTN bond

Rating Changes

-

Hess Corp. Upgraded To ‘AA-‘ From ‘BBB-‘ Following Acquisition By Chevron Corp.; Outlook Stable

-

Fitch Revises Outlook on Continuum Green Energy to Stable; Affirms at ‘B+’

-

Fitch Affirms Perrigo’s IDR at ‘BB’; Outlook Revised to Stable

Term of the Day: Payment-In-Kind (PIK) Bonds

Payment-in-kind (PIK) is a type of bond for which, on each coupon payment date, the accrued coupon is capitalized and fully or partially paid in the form of additional bonds or added to the principal amount. PIK bonds are typically bonds with deferred coupons. These are riskier for investors due to more credit risk with respect to the PIK interest amount, payment of which can be deferred until maturity. Given this inherent higher risk, interest rates for PIK bonds are higher than for conventional bonds. Generally, issuers with liquidity stresses that are able to pay coupons in non-cash form issue these notes.

Talking Heads

On Treasuries Gaining for Fourth Day as Tariffs Add to Haven Demand

Kathleen Brooks, XTB Ltd

“Fears about tariff risks and the Aug. 1 deadline are adding to a risk-off tone to markets…This is leading to a small reallocation of money as it moves out of equities and into safer assets like Treasuries.”

Bloomberg Strategists

“Even before the final tariff salvo, two-year inflation swaps are at the highest level since early 2023, when the Federal Reserve was raising rates. That suggests long-term yields will remain under upward pressure despite Monday’s price action.”

On Calling for Review of Fed Non-Monetary Policy Operations – Scott Bessent, US Treasury Secretary

“The Fed’s autonomy is threatened by persistent mandate creep into areas beyond its core mission, provoking justifiable criticism that unnecessarily casts a cloud over the Fed’s valuable independence on monetary policy”

On Seeing 30-Year Yield Up by Half Point on Powell Exit – Deutsche Bank

“Powell’s dismissal would be meant to produce easier monetary policy and should lift inflation expectations and risk premia…The implied moves are big but plausible.”

Top Gainers and Losers- 22-Jul-25*

Go back to Latest bond Market News

Related Posts: