This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

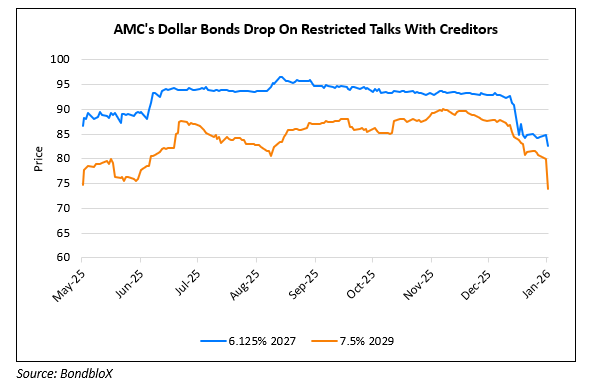

AMC Entertainment’s Dollar Bonds Drop on Restricted Talks with Creditors

January 27, 2026

AMC Entertainment Holdings’ (AMC) dollar bonds dropped sharply across the curve after it was reported that the company was holding confidential talks with a group of bondholders. According to sources, some creditors of the company’s 15% notes have entered restricted discussions with the company. The sell-off highlights investors’ unease over the company’s next moves to manage its debt load. The move comes after AMC completed a broad restructuring in 2024 that deferred certain debt repayments and shifted theaters and intellectual property away from some creditors. The deal was later challenged by lenders but ultimately settled, enabling the company to raise fresh capital. Since then, AMC has continued to manage its maturities through debt swaps and buybacks. AMC reported declines in attendance, revenue, and earnings in Q3, citing industry wide softness. However, its CEO Adam Aron downplayed the weakness, saying it was not indicative of a broader negative trend and forecasting a strong Q4 box office.

For more details, click here

Go back to Latest bond Market News

Related Posts: