This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

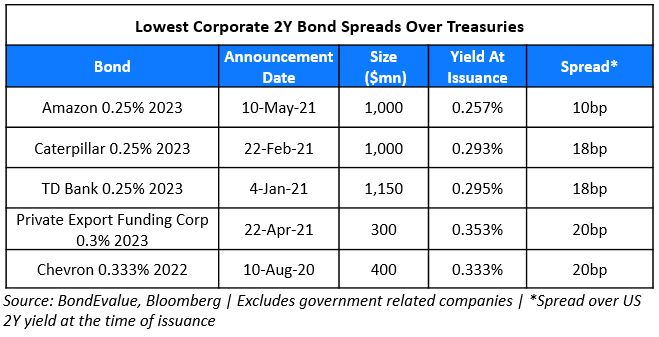

Amazon Sets Records for Lowest Yield/Spread with Jumbo $18.5bn Bond Deal

May 11, 2021

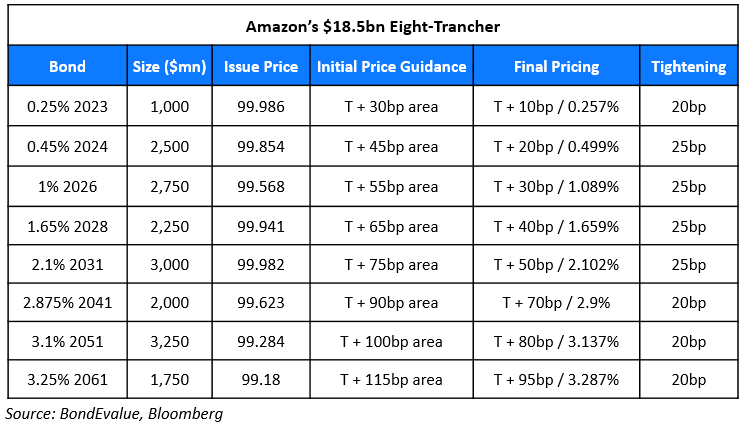

Amazon raised a record $18.5bn via an eight-part bond offering priced on Monday.

Go back to Latest bond Market News

Related Posts:

Amazon In Talks to Buy MGM Studios for $9bn

May 19, 2021

Amazon To Buy MGM For $8.45 Billion

May 27, 2021