This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Ageas Insurance Prices RT1 Bond

December 10, 2025

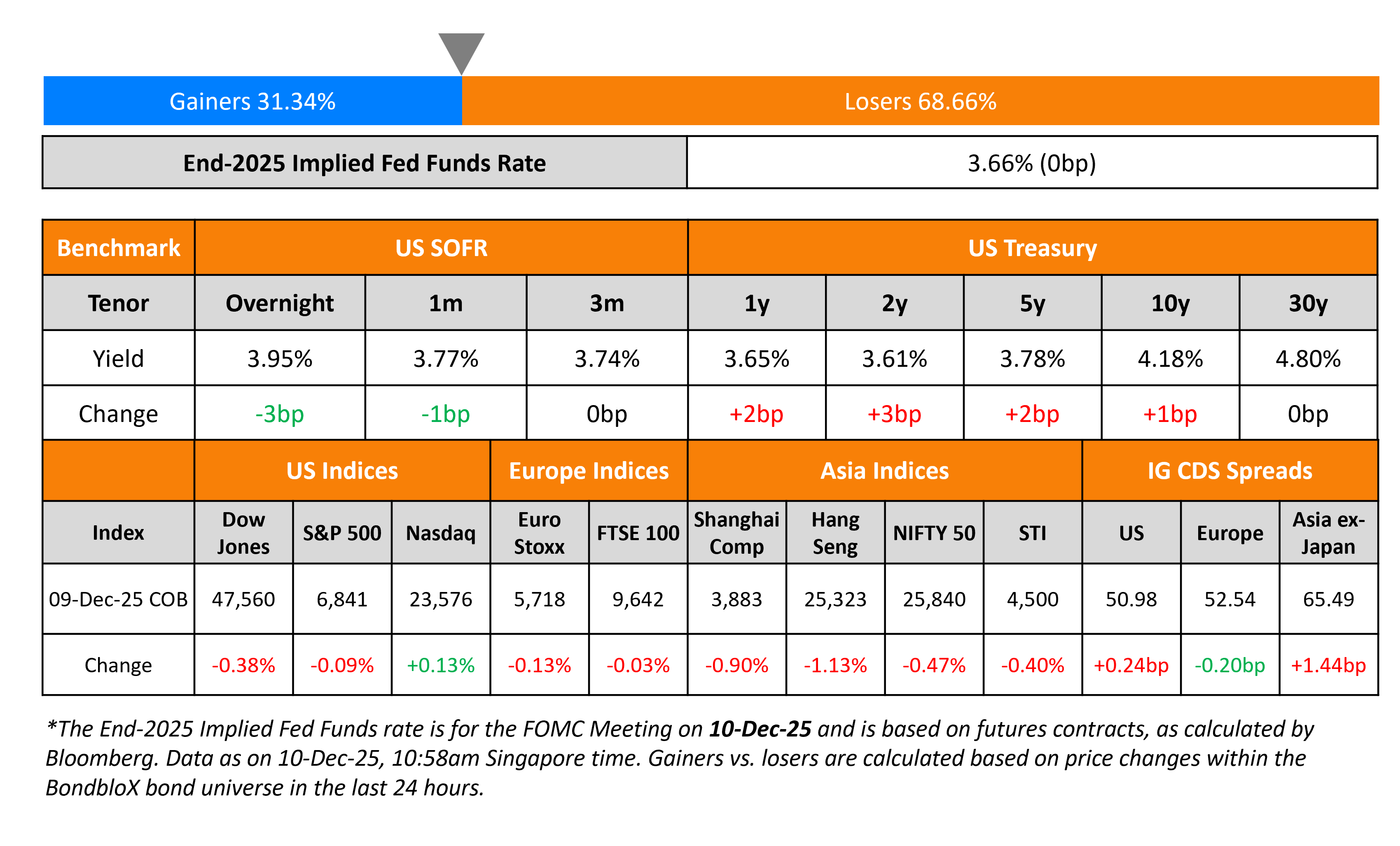

US Treasury yields ticked higher again by 2-3bp. The delayed US JOLTS job openings for September came-in at 7.67mn, beating expectations of 7.12mn and August’s 7.66mn reading. This was its highest print in five months. Separately, the National Economic Council Director, Kevin Hassett, said that there was “plenty of room” for the Fed to cut rates going by the data. Markets await the outcome of the FOMC’s meeting later today, alongside the dot plots and the press conference, with a 25bp cut already being priced-in.

Looking at US equity markets, the S&P ended 0.1% lower while the Nasdaq was 0.1% higher. US IG CDS spreads were 0.2bp wider and HY spreads widened by 2.5bp. European equity indices ended slightly lower. The iTraxx Main CDS spreads tightened by 0.2bp while the Crossover CDS spreads were 1.6bp tighter. Asian equity markets have opened weaker this morning. Asia ex-Japan CDS spreads were 1.4bp wider.

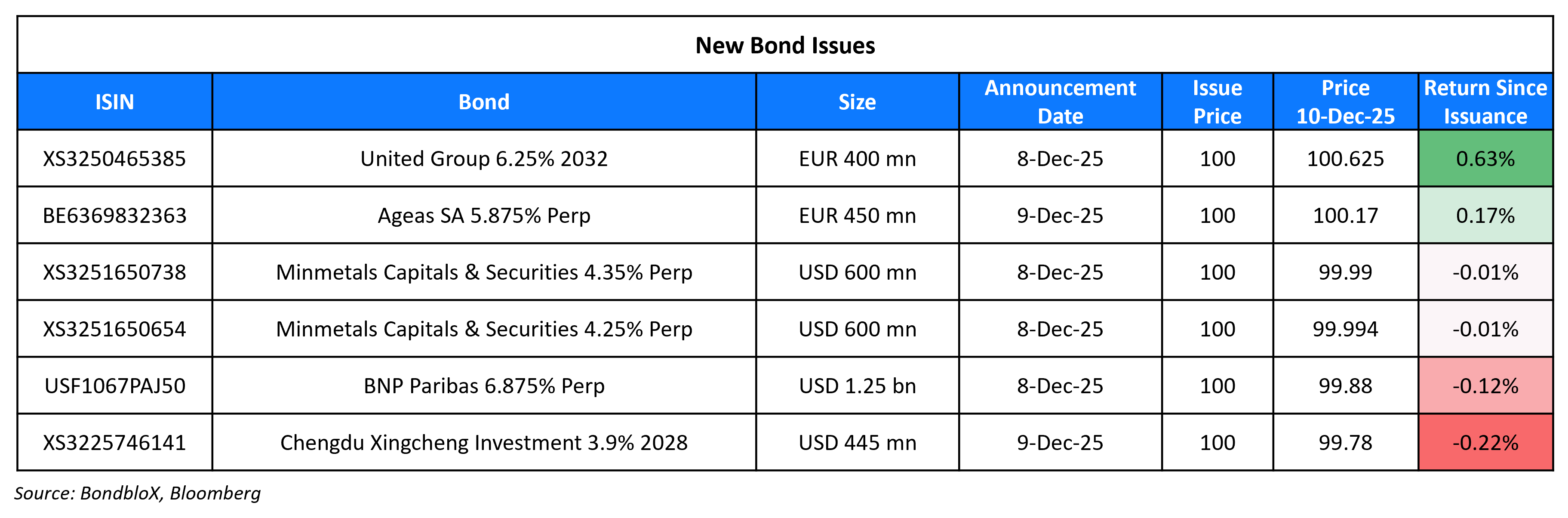

New Bond Issues

Ageas Insurance raised €450mn via a PerpNC9 RT1 bond at a yield 5.875%, 37.5bp inside initial guidance of 6.25% area. The junior subordinated note is rated BBB+/BBB+ (S&P/Fitch). If not called by 20 November 2034, the coupon will reset to the 5Y Mid-Swap plus 303.9bp. There is no step-up applicable. Proceeds will be used for general corporate purposes and to optimise the capital structure of the group.

Rating Changes

- Moody’s Ratings upgrades Camposol’s ratings to B2; maintains positive outlook

- Borr Drilling Ltd. Downgraded To ‘B’ On Higher Debt Burden; Outlook Stable; Senior Secured Notes Lowered To ‘B+’

- Moody’s Ratings downgrades Tullow’s CFR to Ca; negative outlook

- Bloomin’ Brands Inc. Downgraded To ‘B+’ On Higher Leverage From Margin Contraction; Outlook Revised To Stable

- Fitch Revises Outlook on FWD Group Holdings to Positive; Affirms Operating Subsidiaries’ IFS at ‘A’

- STMicroelectronics Outlook Revised To Negative On Weaker Cash Flow Generation; Rating Affirmed At ‘BBB+/A-2’

Term of the Day: Exchangeable Bonds

Exchangeable bonds are a type of hybrid security that allows the bondholder to swap the bond for shares of a different company (typically a subsidiary or related firm) instead of the issuer’s own stock. Issuers may benefit by offering lower interest rates for the hybrid fixed-income/equity-like payoff. While these bonds appear to be similar to a convertible bond, they instead target shares of another company, thereby, providing investors the upside potential in a third-party equity with capital protection from the bond’s floor value.

CMA CGM is planning to raise around €325mn via a 3Y exchangeable bond which it will be able to reimburse with its shares in Air France-KLM. CMA CGM will also have the possibility of repaying the bond in cash, or through a mix of cash and Air France-KLM shares.

Talking Heads

On Bond Traders Casting Doubt on Extended Fed Rate Cuts Past December

Lauren Goodwin, New York Life Investments

“We are modestly more hawkish than the market… A Fed hike is absolutely a risk” in 2026.

On Seeing Move Away From Dollar as Key Global Currency – ECB Governing Council member Fabio Panetta

The world “may gradually drift towards a more multi-polar configuration… That shift could bring greater diversification, or amplify volatility and contagion risk if coordination falters”… future evolution “will depend on.. weakening of some of the dollar’s traditional pillars, China’s rise and Europe’s progress toward deeper integration”

On Year-End Funding Strains Prompt Market Calls for Fed Purchases

Gennadiy Goldberg, TD Securities

“Powell could hint that they are watching the front-end more carefully and may suggest that they are getting close to the point where they’ll have to start adding reserves”

Jason Granet, BNY Mellon

“It’s about there being enough reserves in the system to satisfy all reserve needs… What we’re starting to see is there’s clearly distribution challenges.”

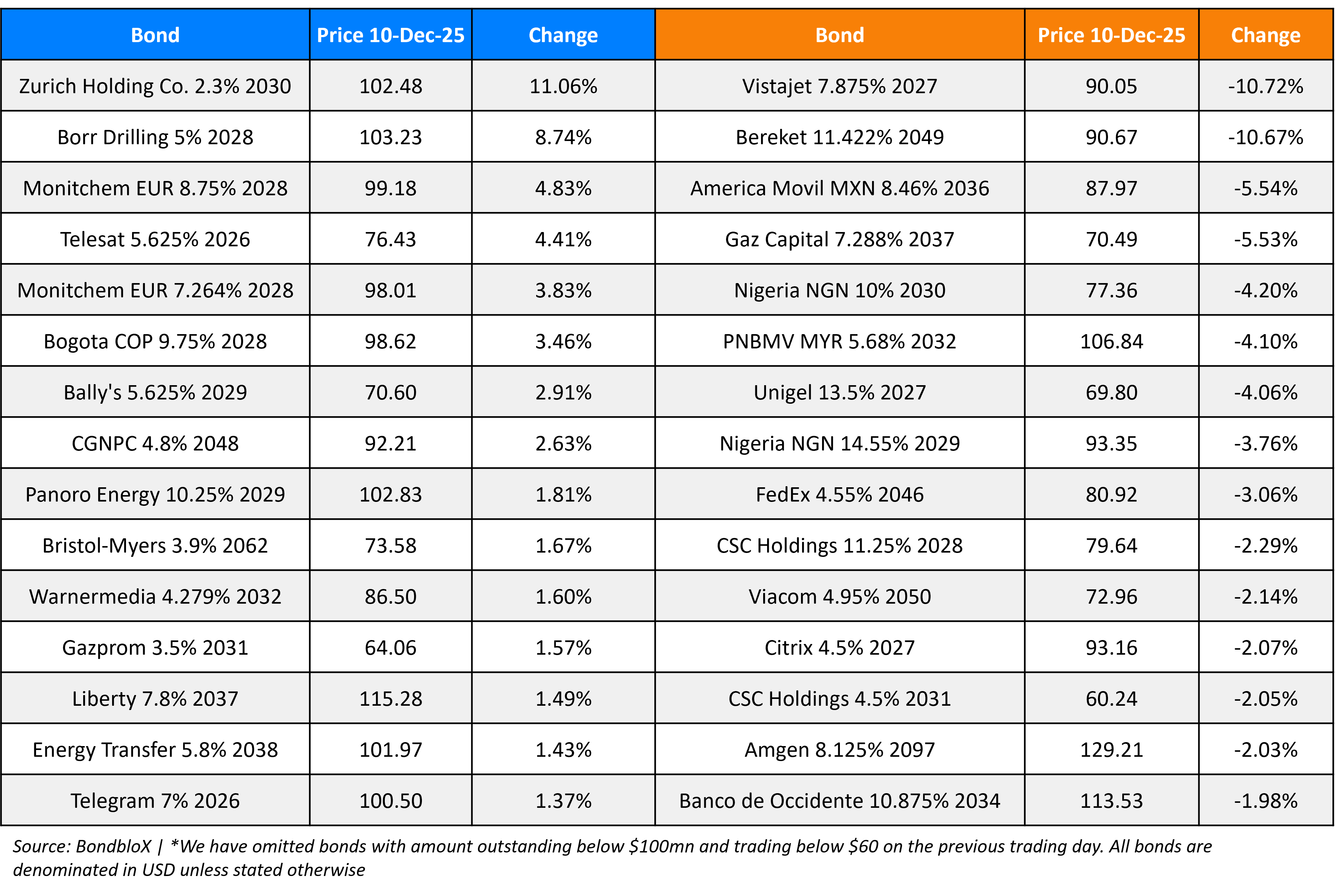

Top Gainers and Losers- 10-Dec-25*

Go back to Latest bond Market News

Related Posts: