This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

ADP Report Shows 32k Pvt Payrolls Drop; ISM Services Stronger Than Expected

December 4, 2025

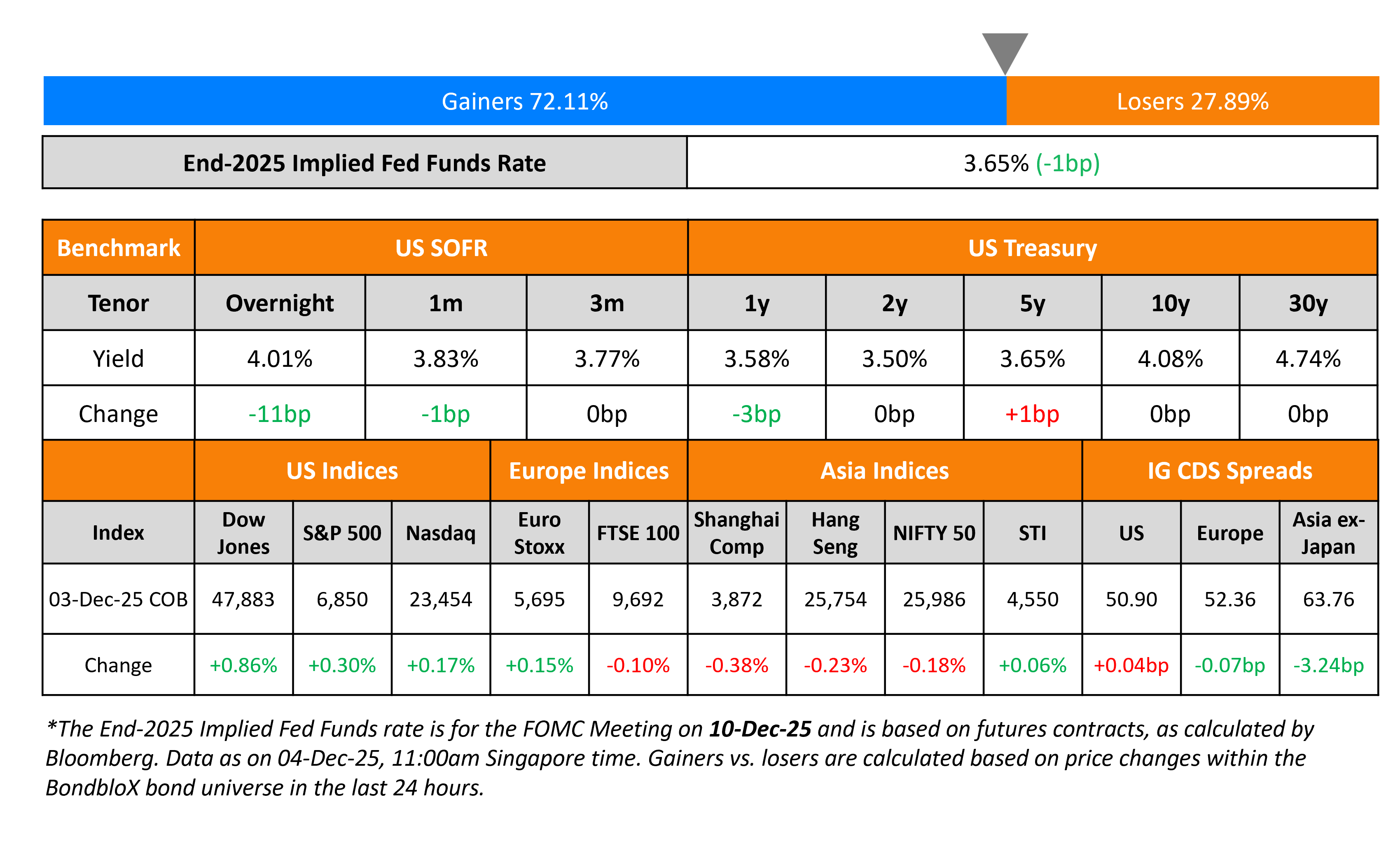

US Treasury yields were broadly stable across the curve on Wednesday. On the data front, the November ADP report showed that private payrolls fell by 32k, significantly worse than expectations of a pick-up of 10k. On the other hand, the November ISM Services Index inched higher to 52.6, better than expectations of 52.0 and the prior month’s 52.4 reading. Markets are currently pricing-in a near 100% probability of 25bp Fed rate cut next week.

Looking at US equity markets, the S&P and Nasdaq closed higher by 0.3% and 0.2% respectively. US IG CDS spreads were almost unchanged while HY spreads tightened by 1.1bp. European equity indices ended mixed. The iTraxx Main CDS spreads tightened 0.1bp while the Crossover CDS spreads were 0.3bp tighter. Asian equity markets have opened broadly higher this morning. Asia ex-Japan CDS spreads were 3.2bp tighter.

New Bond Issues

- Bank of China (HK branch) $ 3Y FRN at SOFR+100bp area

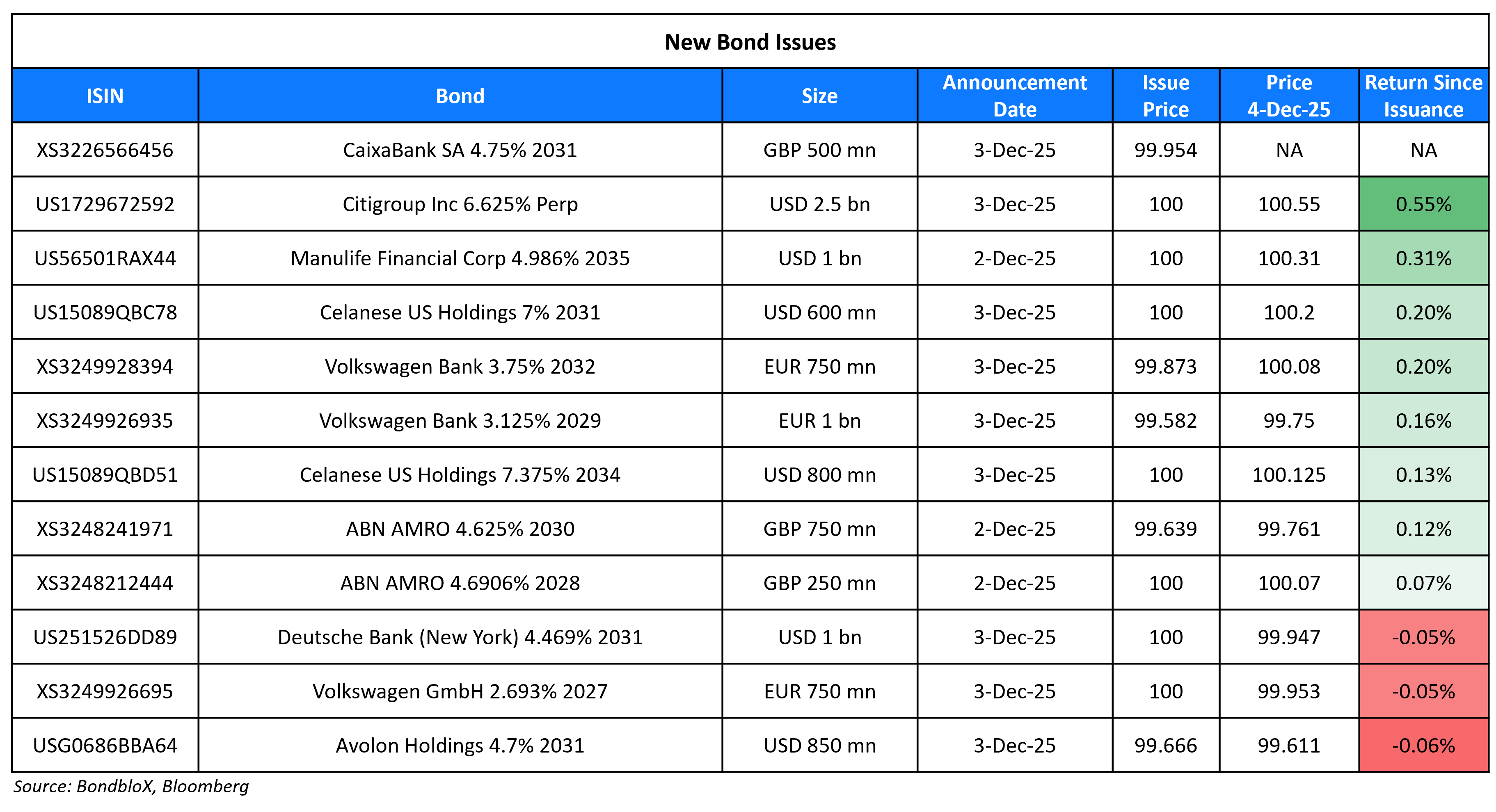

Deutsche Bank (New York) raised $1bn via a 6NC5 bond at a yield of 4.469%, 30bp inside initial guidance of T+115bp area. The senior preferred note is rated A1/A/A. Proceeds will be used for general corporate purposes.

CaixaBank raised £500mn via a short 6NC5 bond at a yield of 4.761%, 12bp inside initial guidance of UKT+110bp area. The senior non-preferred note is rated Baa1/BBB+/A-, and received orders of over £1.25bn, 2.5x issue size. Proceeds will be used for general corporate purposes.

Celanese US Holdings raised $1.4bn via a two-part deal. It raised $600mn via a 5NC2 bond at a yield of 7%, 12.5bp inside initial guidance of 7.125% area. It also raised $800mn via a 8NC3 bond at a yield of 7.375%, 12.5bp inside initial guidance of 7.500% area. The senior unsecured notes are rated Ba2/BB/BB+. Proceeds will be used to fund the tender offer for its 6.665% 2027s and 6.85% 2028s. The deal was upsized from $1bn to $1.4bn.

Volkswagen Bank raised €2.5bn via a three-trancher. It raised:

- €750mn via a 2Y FRN at 3m Euribor+65bp, 20bp inside initial guidance of 3m Euribor+85bp area.

- €1bn via a 4Y bond at a yield of 3.238%, 32bp inside initial guidance of MS+120bp area.

- €750mn via a 7Y bond at a yield of 3.771%, 32bp inside initial guidance of MS+150bp area.

The senior preferred green notes are rated A1/BBB+/A, and received orders of over €9.1bn, ~3.6x issue size. Net proceeds are to be used to finance and/or refinance eligible green projects relating to vehicles with zero-tailpipe emissions under its framework.

Citigroup raised $2.5bn via a PerpNC5 preference share at a yield of 6.625%, 50bp inside initial guidance of 7.125% area. The SEC-registered note is rated Ba1/BB+/BBB-. The depositary shares, represent a 1/25th interest in a share of Citi’s fixed-rate reset non-cumulative Series HH preferred stock. Proceeds will be used for general corporate purposes which may include the partial or full redemption of outstanding preferred stock and related depositary shares.

New Bonds Pipeline

- China Minmetals $ guaranteed Subordinated Perp

Rating Changes

- Moody’s Ratings upgrades Kinross Gold’s senior unsecured rating to Baa2; outlook stable

- Fitch Upgrades Eutelsat to ‘BB’; Outlook Stable

- Moody’s Ratings upgrades Kimco’s senior unsecured rating to A3; outlook stable

- Moody’s Ratings upgrades Zegona’s ratings to Ba2; outlook stable

- Moody’s Ratings upgrades Laos’ ratings to Caa2; outlook remains stable

- Toshiba Upgraded To ‘BB-‘ On Improving Earnings And Financial Conditions; Outlook Positive

- Fitch Downgrades Greenko Energy’s IDR and Note Ratings to ‘BB-‘; Outlook Stable

- Moody’s Ratings downgrades Ashland’s CFR to Ba2; outlook stable

- PLDT ‘BBB’ Ratings Affirmed On Governance Improvement And Tighter Capex Control; Outlook Stable

Term of the Day: Euribor

Euribor is an average unsecured inter-bank rate complied from a panel of 20 large European banks that lend money on an overnight basis to one another in Euros. Maturities on loans used to calculate Euribor often range from one week to one year. Euribor is generally considered as a reference rate for pricing bonds denominated in Euros.

Talking Heads

On Pemex debt a red flag for potential partners as Mexico seeks to boost oil output

Senior executive at a Mexican international oil company

“There’s always the doubt about whether Pemex can honor its commitments, given that paying suppliers remains an issue”

Rafael Espino, Amespac

“When supply contracts are not honored, Pemex’s production is compromised

On Debt Gap at 50-Year High in Emerging Countries – Indermit Gill, World Bank

“Policymakers everywhere should make the most of the breathing room that exists today to put their fiscal houses in order instead of rushing back into external debt markets”

On China Bond Yields May Fall Back Toward Record

Michael Cross, HSBC Asset Management

“If you’re looking at markets where we’d have some conviction that rates could fall further, China would be the candidate… recovery in China is unbalanced. As part of a package of easing over the next year, I can see scope for rates to fall further.”

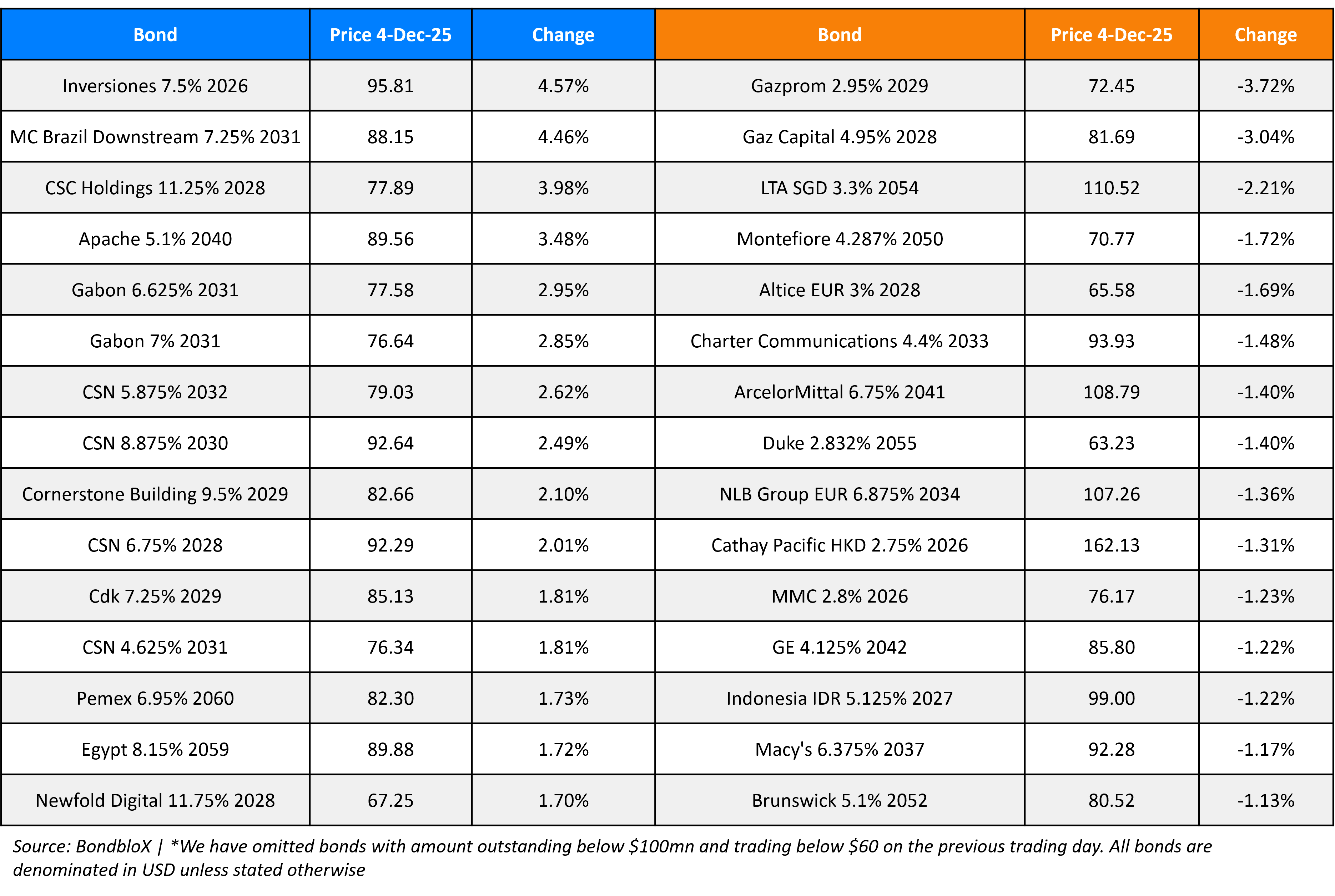

Top Gainers and Losers- 04-Dec-25*

Go back to Latest bond Market News

Related Posts: