This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

ADP Nonfarm 37K; ISM Services PMI 49.9, first contraction since Jul 2024; Afreximbank, Telesat Downgraded

June 5, 2025

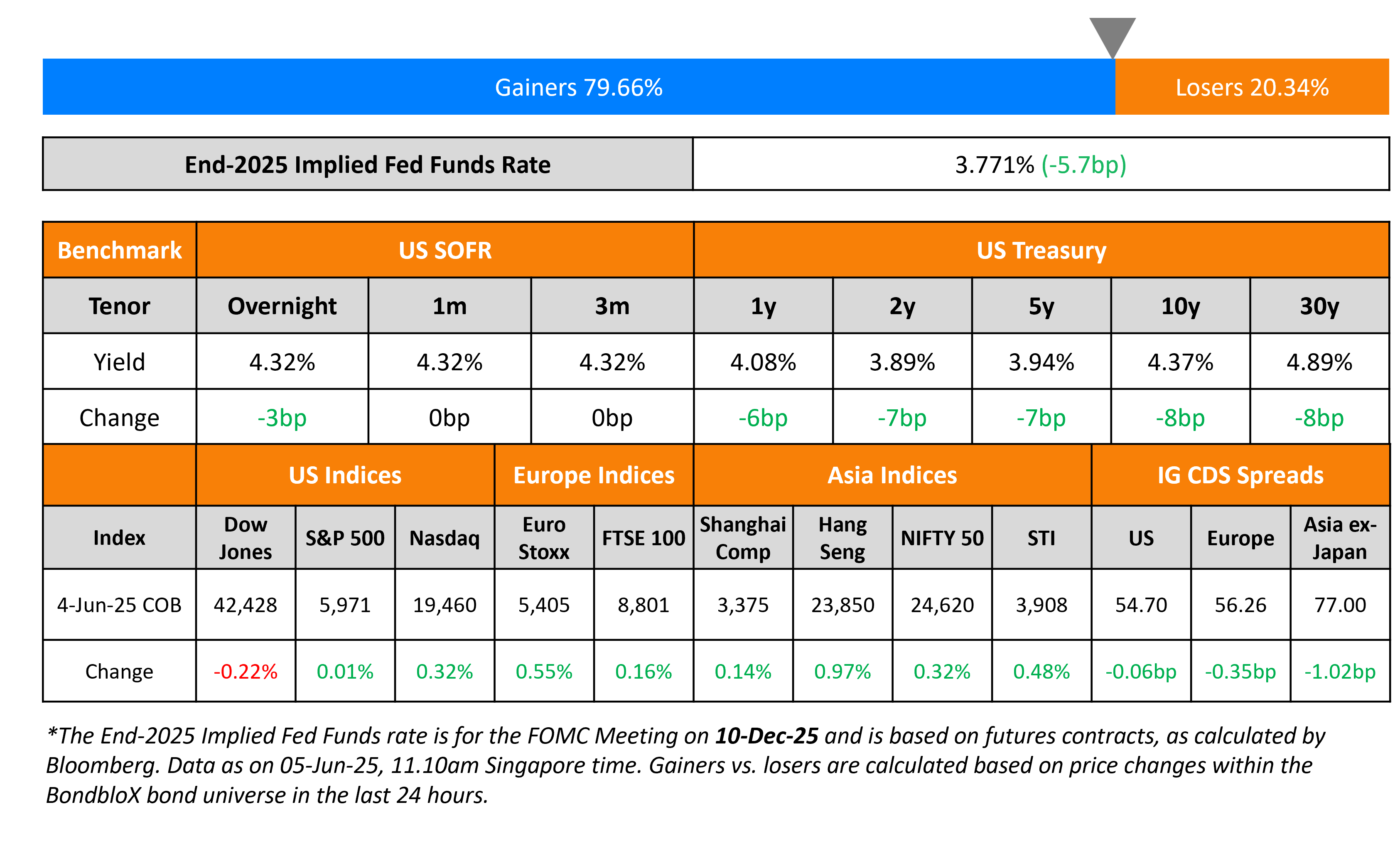

US Treasury yields fell by ~7bp across the curve. ADP Nonfarm Employment Change for May came-in at 37k vs. expectations of 111k, the lowest reading since February 2022. The ISM Services PMI for May came-in at 49.9 vs. expectations of 52, marking its first contractionary reading since July 2024. Minneapolis Fed President Neel Kashkari said that the Fed is well positioned to wait and see how tariff policies impact the economy before adjusting interest rates. US President Donald Trump said in a late-night social media post that Chinese leader Xi Jinping was very tough to make a deal with, raising concerns about the current tariff status between the two nations.

Looking at US equity markets, S&P closed flat whereas Nasdaq was higher by 0.32%. Looking at credit markets, US IG spreads remained flat whereas HY CDS spreads widened by 0.6bp. European equity markets ended higher. Looking at credit markets, the iTraxx Main and Crossover CDS spreads tightened by 0.4bp and 0.3bp respectively. Asian equity markets have opened somewhat higher today. Asia ex-Japan IG CDS spreads tightened by 1bp.

New Bond Issues

Brazil raised $2.75bn via a two-trancher. It raised $1.5bn via a 5Y bond at a yield of 5.68%, 44.5bp inside initial guidance of 6.125% area. It also raised $1.25bn via a tap of its 6.625% 2035s at a yield of 6.73%, 39.5bp inside initial guidance of 7.125% area. The notes are rated Ba1/BB/BB. Proceeds will be used to repay outstanding federal public debt. The new 5Y bond was priced at a new issue premium of 27bp over its existing 3.875% 2030s that yields 5.41%.

Macquarie Bank raised $1.75bn via a two-tranche deal. It raised $750mn via a 3Y bond at a yield of 4.331%, 25bp inside the initial guidance of T+75bp area. It also raised $1bn via a 3Y FRN at a yield of SOFR+74bp vs initial guidance of SOFR equivalent. These senior unsecured notes are rated Aa2/A+/A+. Proceeds will be used for general corporate purposes.

AIA raised S$800mn via a 10Y bond at a yield of 3.58%, 42bp inside the initial guidance of 4.00% area. The subordinated note is rated A1/A+/AA-. Proceeds will be used for general corporate purposes.

Cemex raised $1bn via a PerpNC5 bond at a yield of 7.20%, 42.5bp inside the initial guidance of 7.625% area. The subordinated note is rated BB/BB. If not called before 10 September 2030, the coupon will reset to the 5Y UST plus 25bp. If not called before 10 September 2050, the coupon will reset to the 5Y UST plus 100bp. Proceeds will be used for general corporate purposes.

Rating Changes

-

Telesat Canada Downgraded To ‘CCC-‘ From ‘CCC+’ On Revenue Erosion; Outlook Negative

-

New Fortress Energy Inc. Downgraded To ‘B-‘ On Weak Credit Measures; Outlook Negative

-

Fitch Revises Outlook on UPL Corp to Stable from Negative; Affirms at ‘BB’

-

Fitch Revises Outlook on Yuexiu Property to Stable, Affirms at ‘BBB-‘

Term of the Day: Change of control Event

Change of control is a covenant in bond offerings, mentioned in the bond’s prospectus where there typically is a change in ownership of the issuer. This can lead to strutural changes in the bond like a coupon step-up or in the form of a ‘change of control put’ where bondholders have the option to sell the bonds back to the issuer at a pre-defined price upon the occurrence of the change of control event.

Talking Heads

On US Economic Activity, Inflation – Fed’s Beige Book

“All districts reported elevated levels of economic and policy uncertainty”…Prices increased at a “moderate” pace… “widespread reports of contacts expecting costs and prices to rise at a faster rate going forward”

On Value in Japanese Bonds Despite Chaotic Yield Moves – Pimco

“While higher volatility is likely to continue, we believe that JGB valuations could be attractive for foreign investors seeking yield and diversification in global fixed income…The BOJ’s share of shorter-dated JGBs has made the long end an escape valve for any rise in the term premium…For foreign investors accustomed to the pre-pandemic era of low or negative yields on JGBs, the current environment is striking: 30-year JGBs hedged to the US dollar now yield over 7%.”

On the US Services Sector Contracting in May – James Knightley, ING

“Until there is clarity on the trading environment, it appears that the business sector will remain wary of putting money to work”

Top Gainers and Losers- 05-Jun-25*

Go back to Latest bond Market News

Related Posts: