This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Adani Group Buys Penna Cement for $1.2bn

June 14, 2024

Adani Group-owned Ambuja Cements has signed a binding agreement to buy out its smaller rival, Penna Cement Industries for INR 104.2bn ($1.2bn). The acquisition will be done using internal accruals, with the transaction expected to be completed within four months. This marks Adani Group’s return to capital spending, with an increased focus on the cements space, after its massive $10.5bn deal in 2022, to buy Ambuja and ACC from Swiss major, Holcim. The acquisition of Penna is expected to expand its presence in southern India, in addition to Penna’s existing limestone reserves that should help increase cement capacity.

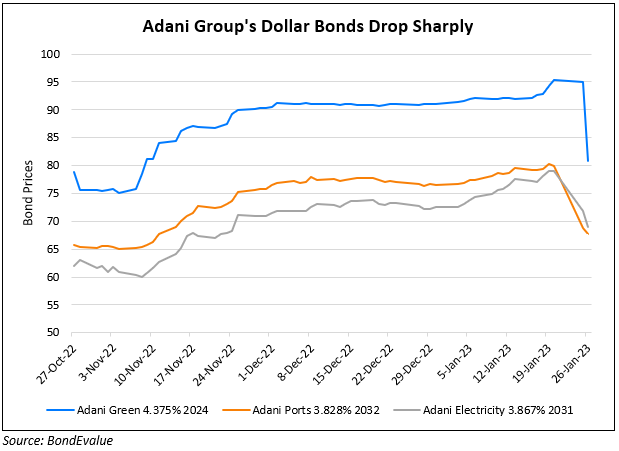

Adani Group companies’ dollar bonds remained stable with its 4.375% 2029s at 90.1, yielding 6.73%.

For more details, click here

Go back to Latest bond Market News

Related Posts: