This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

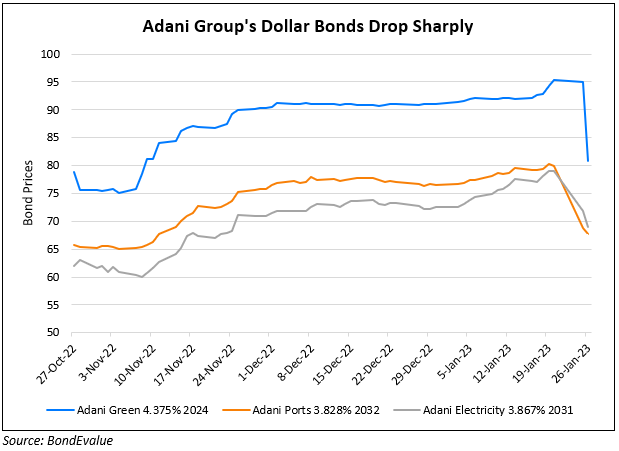

Adani Founders Said to Plan Injecting $1bn in Adani Green

December 22, 2023

Adani Green is looking to raise funds to meet its expansion plans and refinancing needs, with founder Gautam Adani and his family planning to inject $1bn into the company, as per sources. They noted that the company was looking at issuing preference shares to its founders. It is said that the company is considering funding proposals on December 26 and evaluating options like selling shares or convertible bonds. Adani Green currently has two dollar bonds outstanding that mature next year. Earlier in December, it was reported that the company had plans to raise $410mn via a new bond issuance to refinance its 6.25% bonds due December 2024, a day after it said that it would redeem its 4.375% 2024s.

Its 6.25% 2024s are currently trading at 98.88, yielding 7.49% and its 4.375% 2024s are at 97, yielding 8.89%

For more details, click here

Go back to Latest bond Market News

Related Posts: