This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Abu Dhabi Launches $ Bond; Binghatti, Oracle, Bank Muscat and Others Price Bonds

September 25, 2025

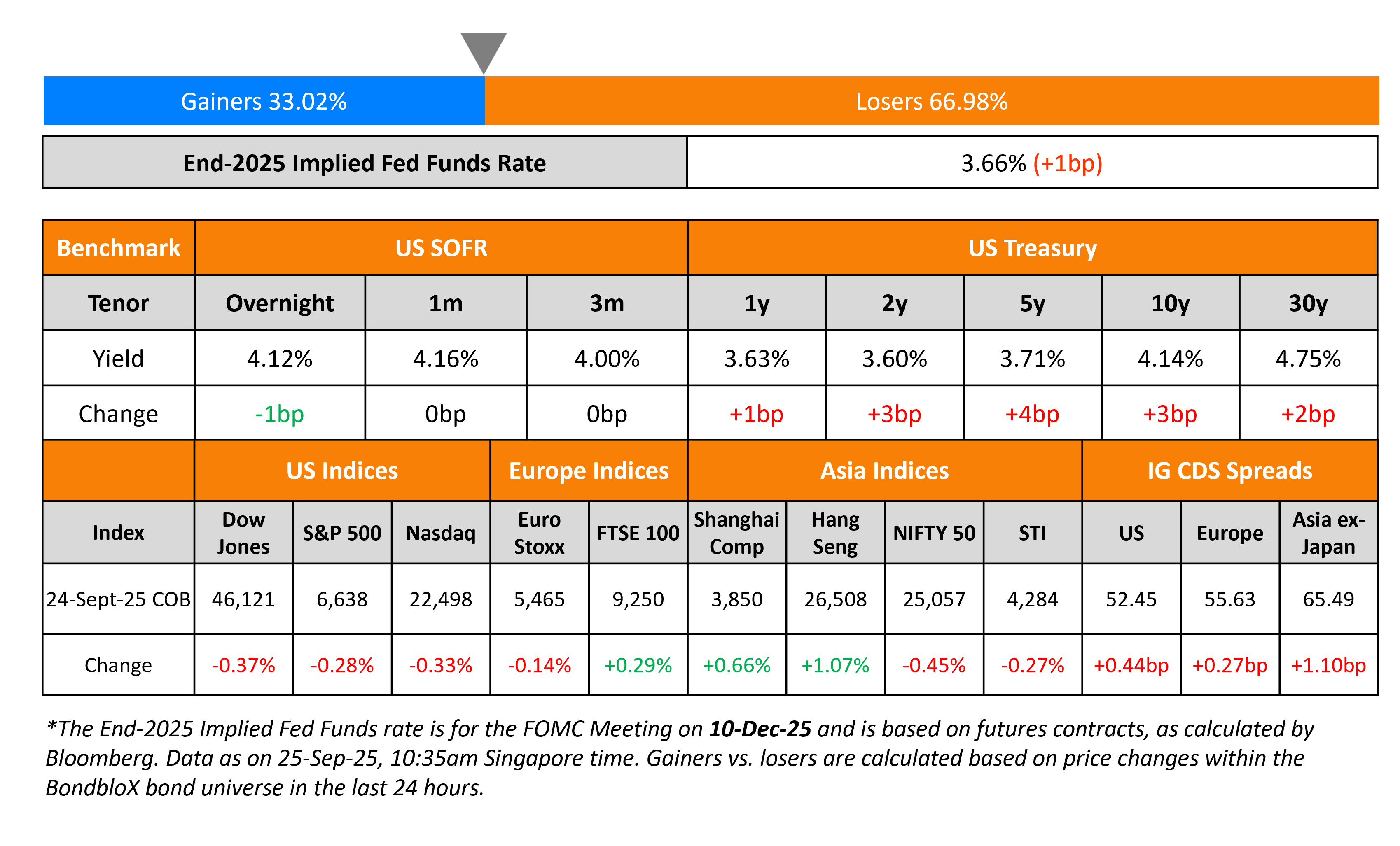

US Treasury yields were 3-4bp higher on Wednesday. The US Treasury’s 5Y auction witnessed soft demand, with a bid-to-cover ratio of 2.34x, weaker than the last six auctions’ average of 2.36x. Indirect take-up accounted for less than 60% of the size. Separately, San Francisco Fed President Mary Daly said that while further rate cuts might be required, the Fed would have to proceed with caution. She noted that the labour market had slowed down but was not weak. Besides, she added that the latest rate cut will likely ensure that the job market does not degrade further.

Looking at equity markets, both the S&P and Nasdaq ended 0.3% lower. US IG and HY CDS spreads were wider by 0.4bp and 0.8bp respectively. European equity markets ended mixed. The iTraxx Main and Crossover CDS spreads were both wider by 0.3bp each. Asian equity markets have opened broadly higher today. Asia ex-Japan CDS spreads were 1.1bp wider.

New Bond Issues

- Abu Dhabi $ 3Y/10Y T+40/55bp area

-

KB Capital $ 5Y T+115bp area

-

Mitsubishi Estate $ 5Y T+95bp area

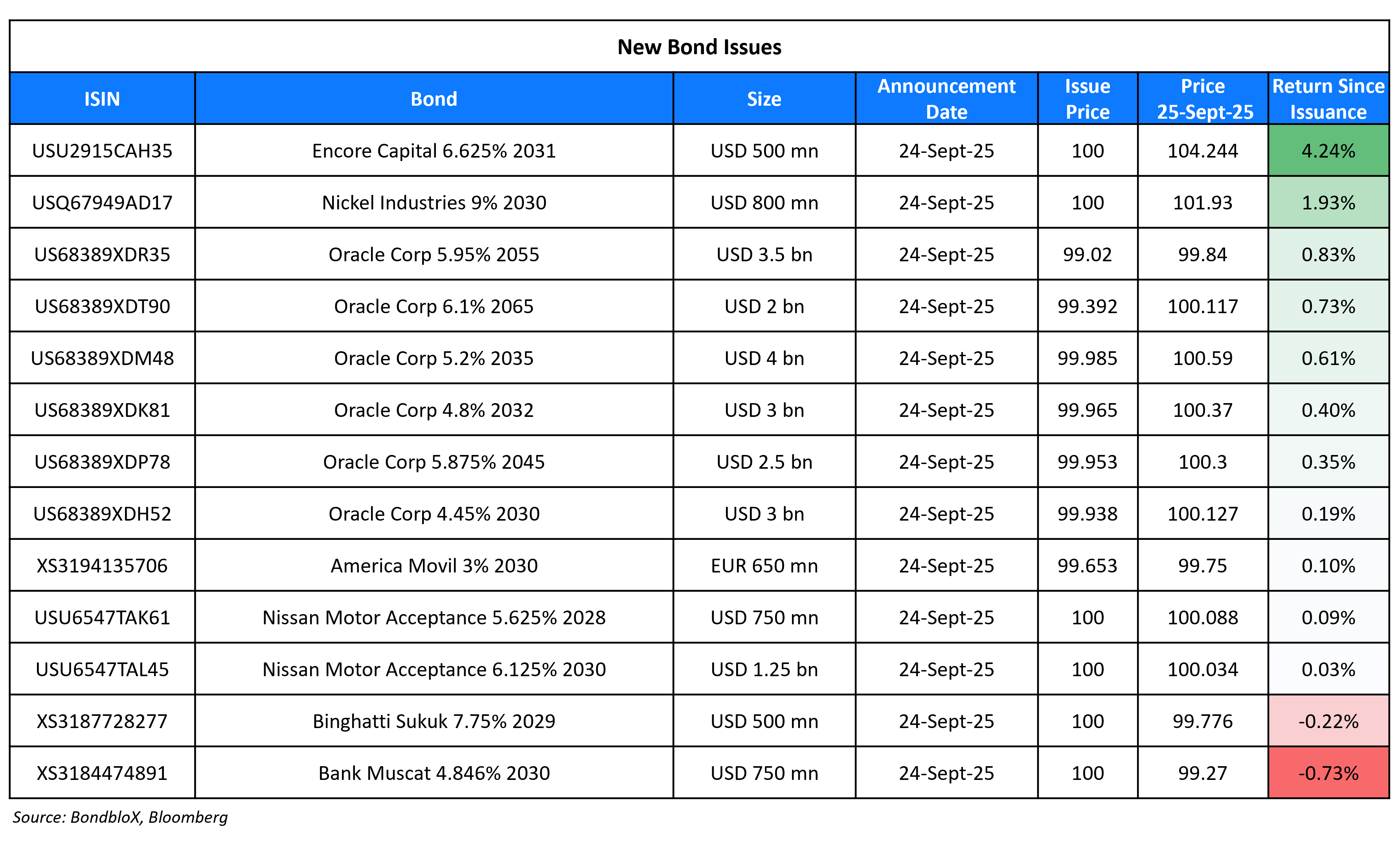

Binghatti raised $500mn via a long 3Y green sukuk at a yield of 7.75%, 37.5bp inside initial guidance of 8.125% area. The senior unsecured note is rated BB- by Fitch, and received orders of over $2bn, 4x issue size. Proceeds will be used to finance, refinance and/or invest, in whole or in part, certain eligible projects under its green framework.

Bank Muscat raised $750mn via a 5Y bond at a yield of 4.846%, 35bp inside initial guidance of T+150bp area. The senior unsecured note is rated Baa3/BBB-, and received orders of over $2.3bn, 3.1x issue size.

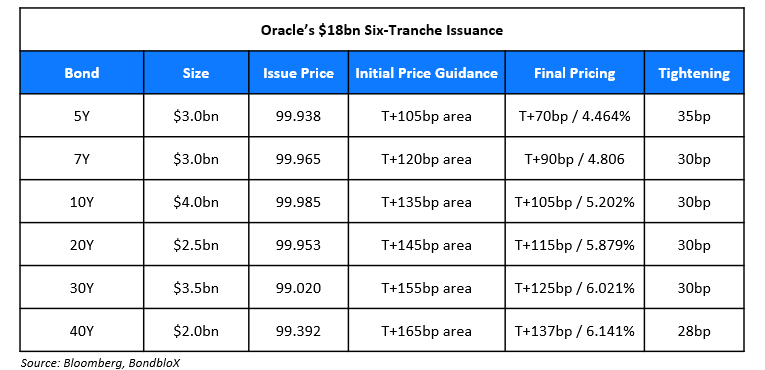

Oracle raised $18bn via a six-part deal, the second largest issuance this year (after Mars’ $26bn eight-trancher in March).

The senior unsecured notes are rated Baa2/BBB/BBB, and received peak orders of over $88bn, 4.9x issue size. Proceeds will be used for general corporate purposes including capex, repayment of debt, future investments or acquisitions and payment of cash dividends or repurchasing shares.

America Movil raised €650mn via a 5Y bond at a yield of 3.076%, 32bp inside initial guidance of MS+100bp area. The senior unsecured note is unrated, and received orders of over €3.3bn, 5.1x issue size. Proceeds will be used for refinancing existing debt.

Nickel Industries raised $800mn via a 5NC2 bond at a yield of 9.00%, 25bp inside initial guidance of 9.25% area. The senior unsecured note is rated B1/B+ (Moody’s/Fitch). Proceeds will be used to fund the refinancing of its $400mn 11.2% 2028s, and for general corporate purposes.

Nissan Motor Acceptance raised $2bn via a two-part deal. It raised $750mn via a 3Y bond at a yield of 5.625%, 37.5bp inside initial guidance of 6.00% area. It also raised $1.25bn via a 5Y bond at a yield of 6.125%, 37.5bp inside initial guidance of 6.50% area. The senior unsecured notes are rated Ba2/BB. Proceeds will be used for general corporate purposes. The new 3Y bond was priced at a new issue premium of 11.5bp over its existing 7.05% 2028s that currently yield 5.51%.

Encore Capital raised $500mn via a 5.5NC2 bond at a yield of 6.625%, 12.5bp inside initial guidance of 6.75% area. The senior secured note is rated Ba3/BB+ (Moody’s/Fitch).

New Bond Pipeline

- Mirae Asset Securities $ 3Y/5Y

Rating Changes

-

Moody’s Ratings upgrades Costa Rica’s ratings to Ba2; changes outlook to stable from positive

-

Fitch Downgrades Vistra Holdings to ‘B’, Outlook Stable

-

Fitch Revises Coventry Building Society’s Outlook to Stable; Affirms IDR at ‘A-‘

-

Fitch Revises Thailand’s Outlook to Negative; Affirms at ‘BBB+’

Term of the Day: Revolving Credit

Revolving credit is a form of borrowing where the credit line has a maximum limit but the borrower can access it in any quantum based on their funding needs. In a normal borrowing, once the loan has been repaid, the borrower must take a new loan to borrow more. In revolving debt, the borrower can re-access any funds that have been paid back too. Revolving debt generally comes with a higher interest rate and does not necessarily have a fixed coupon.

Talking Heads

On Company finance chiefs say mood is lifting, but tariffs set to push prices higher – Fed survey

“Compared to last quarter, firms are less uncertain about tariffs and are subsequently less worried about the most extreme outcomes manifesting… Firms have yet to see the types of extreme impacts from tariffs that they expected and have thus softened their forecasts for price and cost growth slightly”

On Blackstone, Apollo and Others Selling Bonds Backed by Private Credit at Fastest Pace Ever

Seth Painter, Antares Capital

“Private credit CLOs are surging because private credit is surging… Certain investors are seeking higher, levered returns and there’s no better funding structure to achieve that than a CLO”

Victoria Chant, Blackstone Credit & Insurance

“You’ve got more diverse portfolios, and you’re building diverse portfolios faster than before because of the proliferation of origination in private credit”

On ‘Frothy and Risky’ Rally in Profitless Tech Growing as Fed Eases

Ted Mortonson, Robert W. Baird & Co.

“A phase of speculative over-exuberance because the expected rate-cut cycle is leading to animal spirits being revived… rally looks extremely frothy and risky, and all the speculation from the Reddit and Robinhood crowds”

Anthony Saglimbene, Ameriprise Financial Services

“I don’t think the exuberance is unfounded, since growth has been decent, there’s more visibility on tech earnings than other industries”

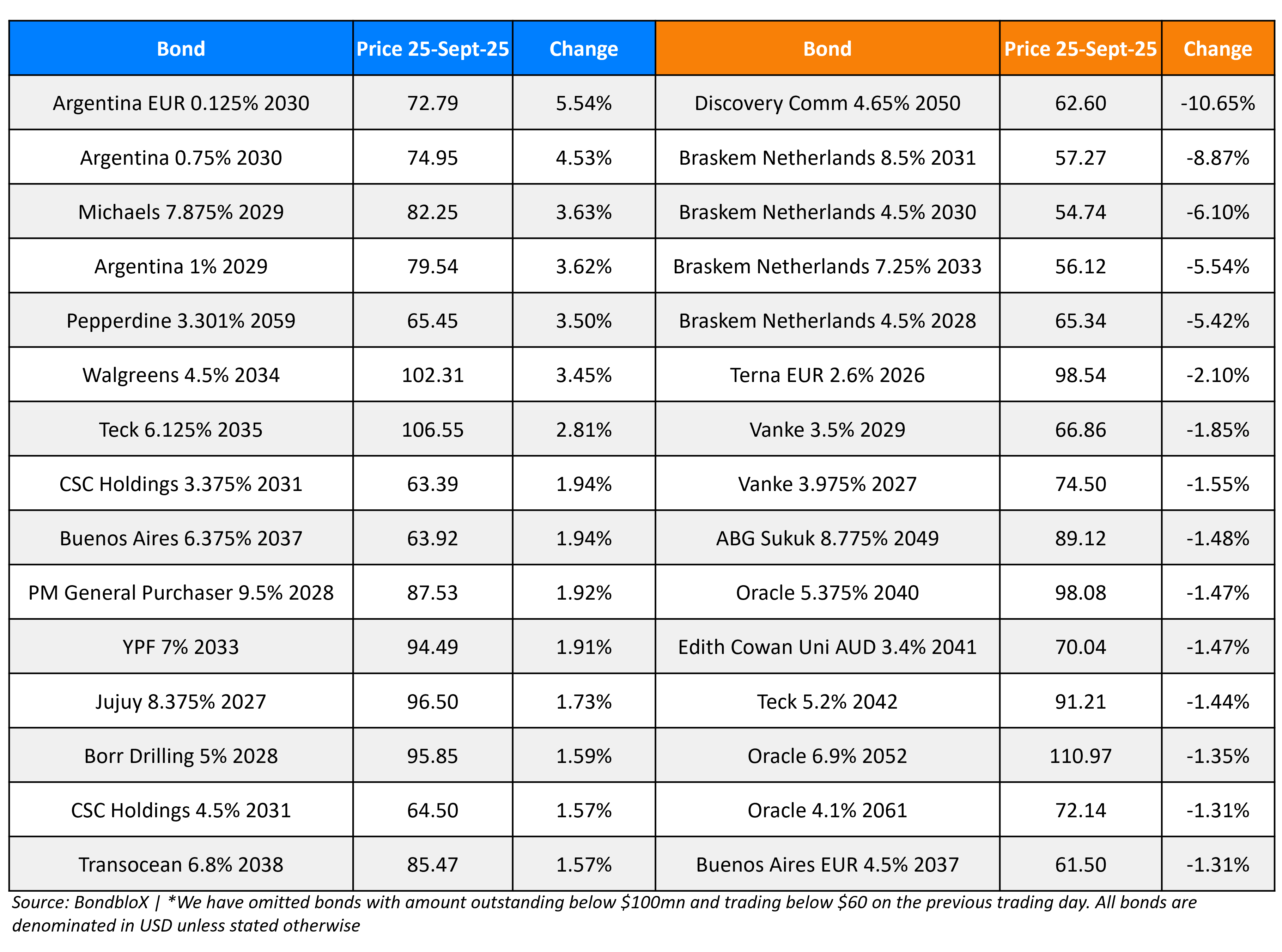

Top Gainers and Losers- 25-Sep-25*

Go back to Latest bond Market News

Related Posts: