This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Abu Dhabi, Generali, Volkswagen Bank, Aegea Price Bonds;

September 26, 2025

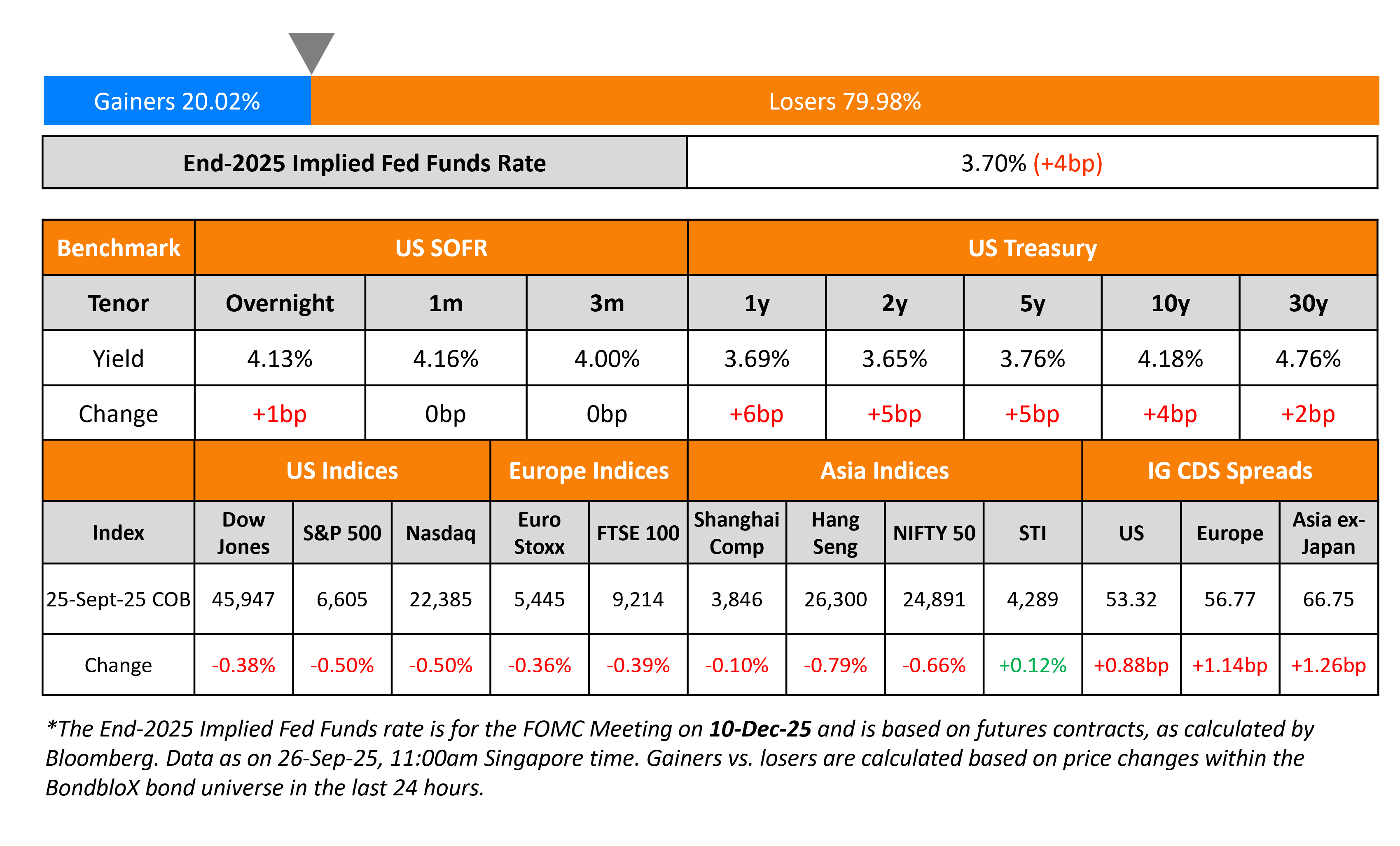

US Treasury yields continued to march higher by 4-5bp across the curve. On the data front, the final reading of US Q2 annualized GDP came-in at 3.8%, much better than expectations of a 3.3% growth. This was led by a sharp pick-up in personal consumption that grew 2.5% vs. the surveyed 1.7%. Separately, the preliminary reading of US Durable Goods Orders grew by 2.9% in August, a significant positve surprise vs. expectations of -0.3%. Similarly, Capital Goods Orders grew by 0.6% as compared to expectations of no growth.

More Fed speakers came out expressing their stance on the Fed’s policy. Fed governor Michelle Bowman said that more rate cuts may be justified give that the labor market was more “fragile” than expected while inflation was “within range”. Kansas City Fed President Jeffery Schmid said that the Fed’s 25bp rate cut last week was a “reasonable risk management strategy”. He added that the current “slightly restrictive” policy stance was the appropriate stance. Dallas Fed President Lorrie Logan said that the Fed may have to consider replacing the current benchmark rate from the Fed Funds Rate (FFR) to a different short-term interest rate. She mentioned that the FFR might be outdated, adding that the connections between the interbank and overnight money markets are fragile and could break suddenly. Meanwhile, Donald Trump’s newly appointed Fed governor Stephen Miran reiterated his call for aggressive rate cuts.

Looking at equity markets, both the S&P and Nasdaq ended 0.5% lower. US IG and HY CDS spreads were wider by 0.9bp and 3.5bp respectively. European equity markets ended lower. The iTraxx Main CDS spreads widened by 1.1bp and the Crossover CDS spreads were wider by 3.6bp each. Asian equity markets have opened lower today. Asia ex-Japan CDS spreads were 1.3bp wider.

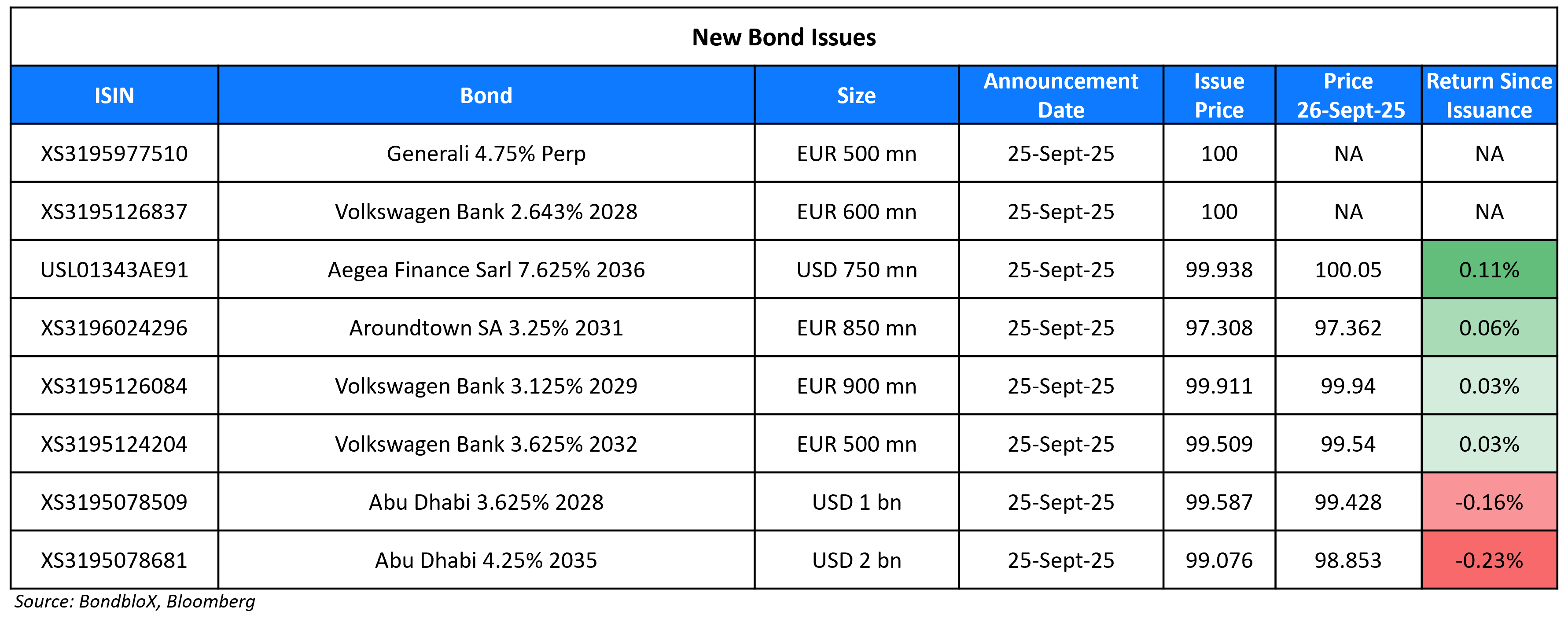

New Bond Issues

The Emirate of Abu Dhabi raised $3bn via a two-trancher. It raised $1bn via a 3Y bond at a yield of 3.772%, 30bp inside initial guidance of T+40bp. It also raised $2bn via a 10Y bond at a yield of 4.365%, 37bp inside initial guidance of T+55bp. The senior unsecured notes are rated AA/AA (S&P/Fitch). The new 3Y bond was priced roughly inline with its existing 1.625% 2028s that currently yield 3.75%.

Generali raised €500mn via a PerpNC6 RT1 bond at a yield of 4.75%, 62.5bp inside initial guidance of 5.375% area. The junior subordinated note is rated Baa3/BBB+ (Moody’s/Fitch). If not called by 2 October 2031, the coupon will reset to the EUR ICE 5Y Swap plus 231bp. There is no coupon step-up. A trigger event will occur if the regulator determines that (a) the sovency coverage ratio (SCR) is equal to or less than 75% (b) the minimum capital requirement (MCR) ratio is equal to or less than 100% (c) the SCR ratio is less than 100%, but higher than 75% for a three-month period from the date of non-compliance, on a solo or group basis. Proceeds will be used for general corporate purposes, including refinancing existing debt and to optimize the regulatory capital structure of the group.

Volkswagen Bank raised €2bn via a three-part offering. It raised:

- €600mn via a 3Y FRN at 3m Euribor+65bp, ~27.5bp inside initial guidance of 3m Euribor+90/95bp

- €900mn via a 4Y bond at a yield of 3.149%, 35bp inside initial guidance of MS+115bp. The bond was priced at a new issue premium of 5bp compared to its existing 4.25% 2029s that currently yield 3.10%

- €500mn via a 7Y bond at a yield of 3.706%, 40bp inside initial guidance of MS+155bp.

The senior preferred green notes are rated A1/BBB+/A. Proceeds will be used to finance and/or refinance eligible green projects relating to vehicles with zero emissions as defined by the Volkswagen Financial Services AG’s green framework.

Aegea Finance raised $750mn via a long 10NC5 bond at a yield of 7.625%, 37.5bp inside initial guidance of 8.00% area. The senior unsecured note is rated BB-/BB. Proceeds will be used to repay certain outstanding debt, including the $250mn capped tender offer of its 6.75% 2029s. The remainder, if any, will be used for general corporate purposes.

Aroundtown raised €850mn via a 5.25Y bond at a yield of 3.828%, 32bp inside initial guidance of MS+170bp area. The senior unsecured note is unrated. Proceeds will be used to refinance and/or repay its existing debt, including the purchase of notes through concurrent tender offers, and for general corporate purposes.

New Bond Pipeline

- Mirae Asset Securities $ 3Y/5Y

Rating Changes

- Fitch Upgrades UniCredit to ‘A-‘; Outlook Stable

- Fitch Upgrades Intesa Sanpaolo to ‘A-‘; Outlook Stable

- Fitch Upgrades CA Auto Bank and Drivalia to ‘A’ on Italy’s Sovereign Upgrade; Outlooks Stable

- Jamaica Long-Term Ratings Raised To ‘BB’ From ‘BB-‘ On Stronger Institutions; Outlook Is Positive

- Fitch Upgrades VTR Finance to ‘CCC+’

- Fitch Downgrades Ambipar’s IDRs to ‘C’

- Ambipar Participacoes e Empreendimentos S.A. Downgraded To ‘D’ From ‘BB-‘ On Announced Judicial Protection

Term of the Day: Collateralized Loan Obligations (CLO)

Collateralized Loan Obligations (CLO) are securities backed by a pool of underlying loans. The loans are packaged together by a process of securitization. The loans are bundled together in tranches in an order of risk – for example, the AAA rated tranche comes with the lowest default risk while a BB tranche has a higher default risk. Investors can choose the tranche they prefer based on risk appetite. Given that the underlying loans are floating rate loans, they are also considered a hedge against inflation.

Talking Heads

On Fed Likely to Cut Once More This Year – Citadel CEO, Ken Griffin

“I think they are going to cut one time more this year, two on the outside… Fed is nervous about the labor market because we did see this decline in number of jobs being created… hard to know precisely where are we at this minute when it comes to the labor market… I would let the Fed have as much perceived and real independence as possible, because the Fed often has to make choices that are pretty painful to make.”

On Goldman Warns of Stock Volatility, Finds Catalysts to Play

John Marshall, Goldman Sachs

“October volatility is more than just a coincidence… critical period for many investors and companies that manage performance to calendar year-end… pressures boost volumes and volatility as investors observe earnings reports, analyst days and managements’ guidance”

On Economic, Political Stakes Looming as US Shutdown Threat Increases

Andrew Hollenhorst, economist at Citi

“The most apparent effect, at least initially, for markets would be the delay of key data releases including the September jobs report”

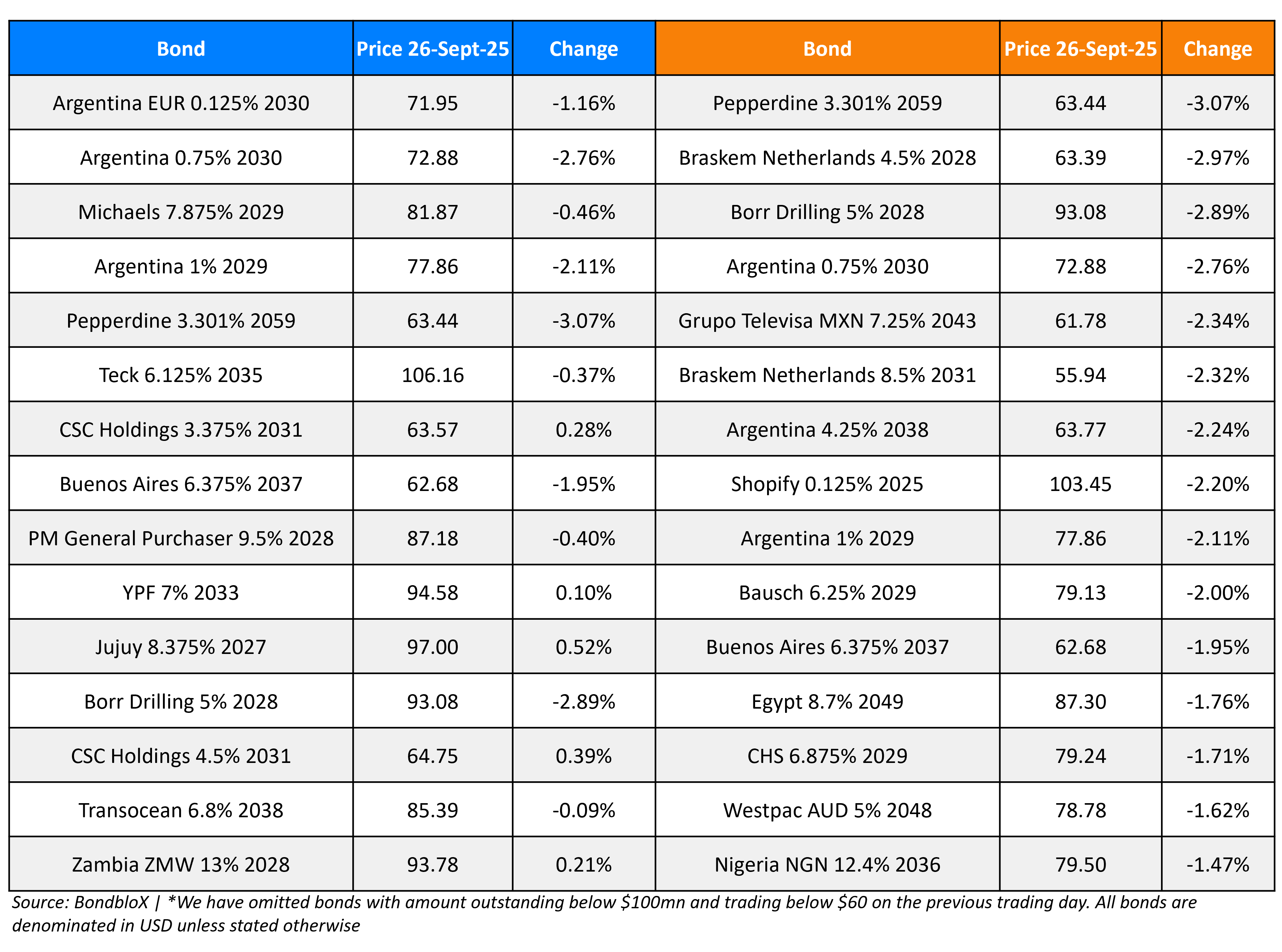

Top Gainers and Losers- 26-Sep-25*

Go back to Latest bond Market News

Related Posts: