This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

50 bps Rate Cut By End of 2019, Says Fed Funds Futures

June 3, 2019

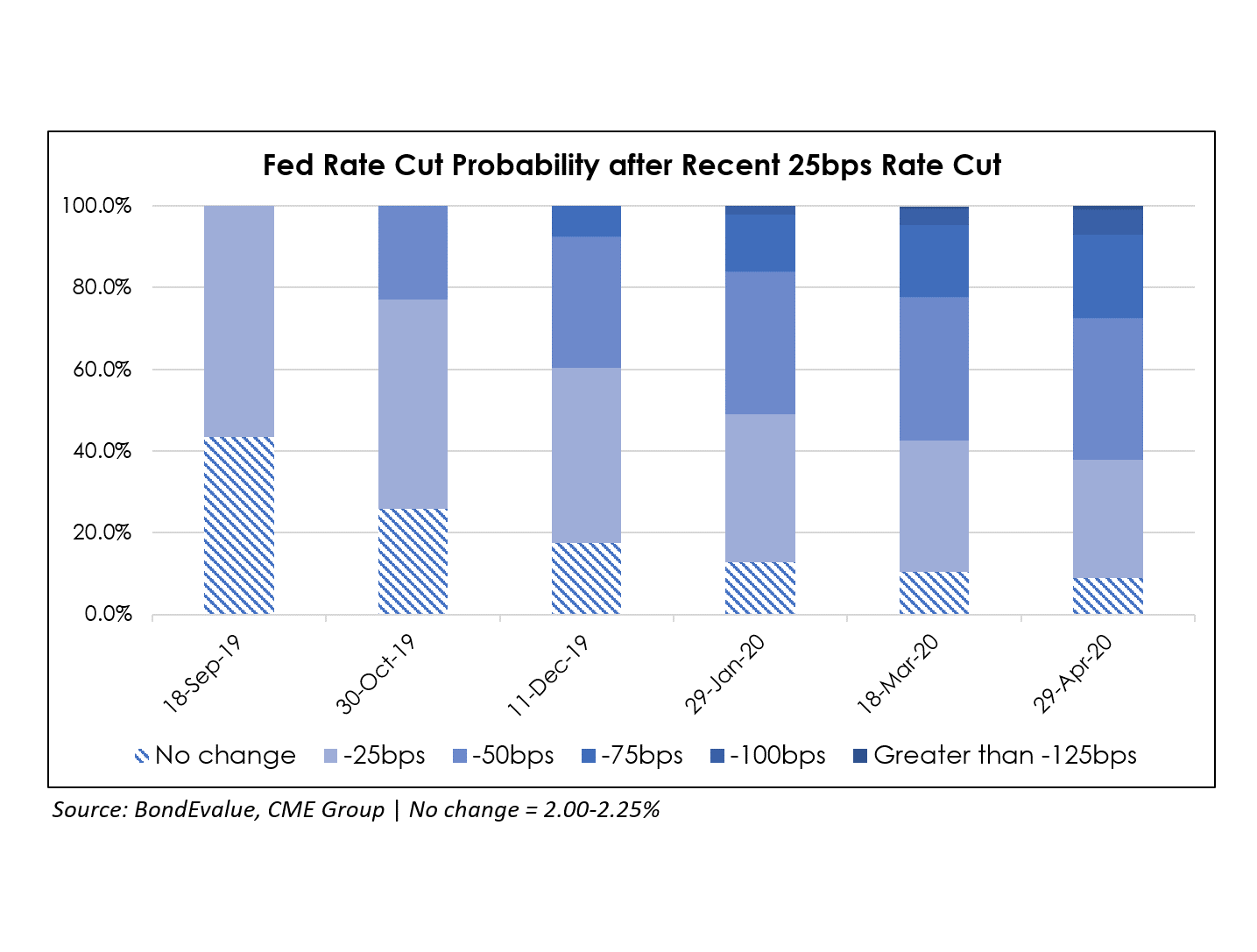

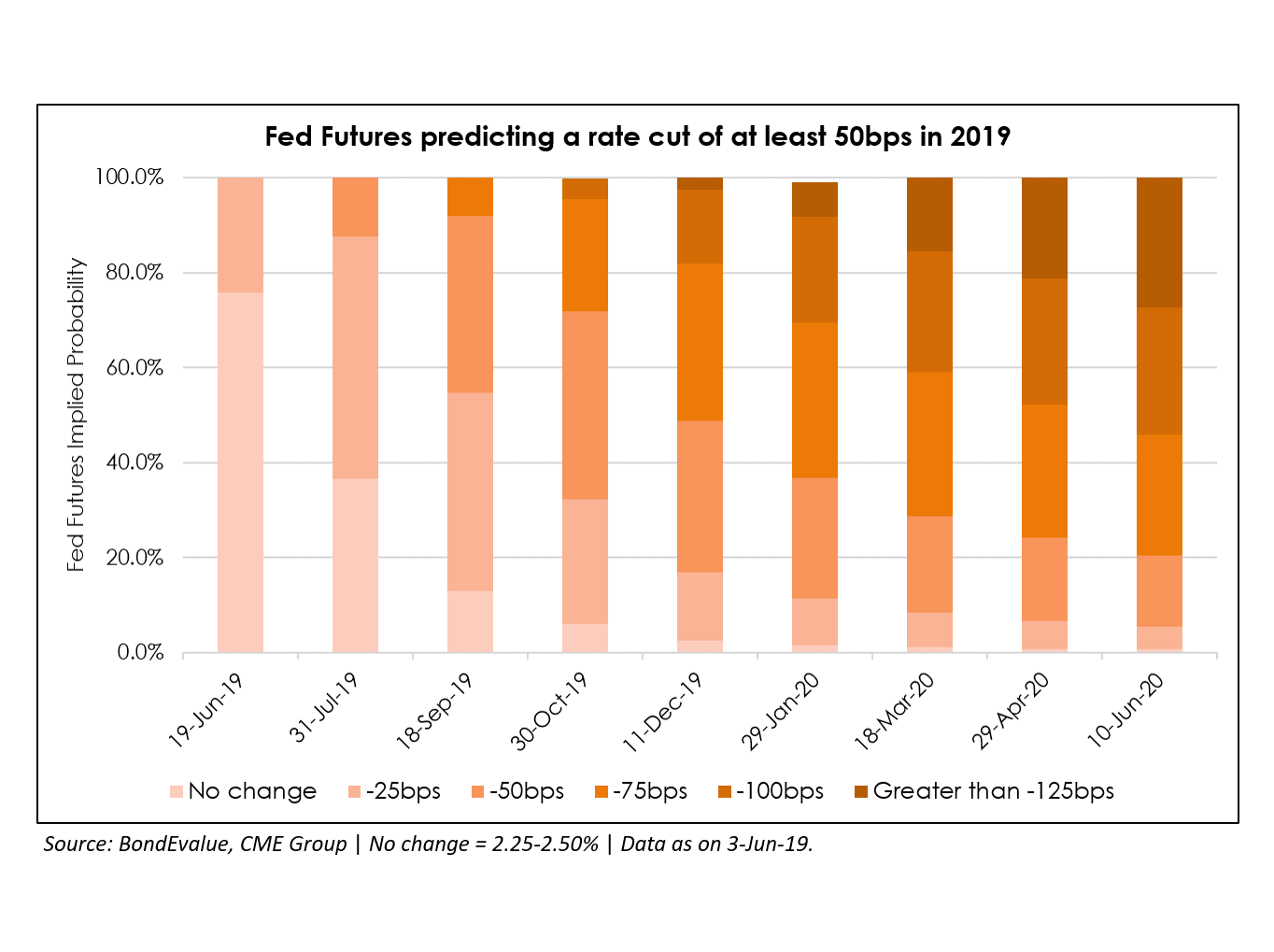

U.S. fed funds futures contracts extended their rally and are currently indicating more than half a percentage point of interest rate cuts this year by the Federal Reserve. Several U.S. primary dealers corroborate these numbers with their prediction of rate cuts in 2019. While the effective fed funds rate is 2.39%, the rate implied for 2019 year-end by the January 2020 futures contract dropped 15 bps on 31st May to 1.855%. This implies 2 rate decreases of 25 bps each, the standard incremental shift when the Central Bank takes rate actions, by the end of 2019.

This change in sentiment towards policy easing comes amid a worldwide rally in bonds after President Trump announced his plan to levy tariffs on imports from Mexico, adding further fuel to concerns about global trade tensions dragging down U.S. economic growth. He had announced that the U.S. would put 5% duties on all Mexican imports on June 10, rising in increments to 25% in October, unless Mexico halts “illegal migrants” heading to the U.S.

Go back to Latest bond Market News

Related Posts: