This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

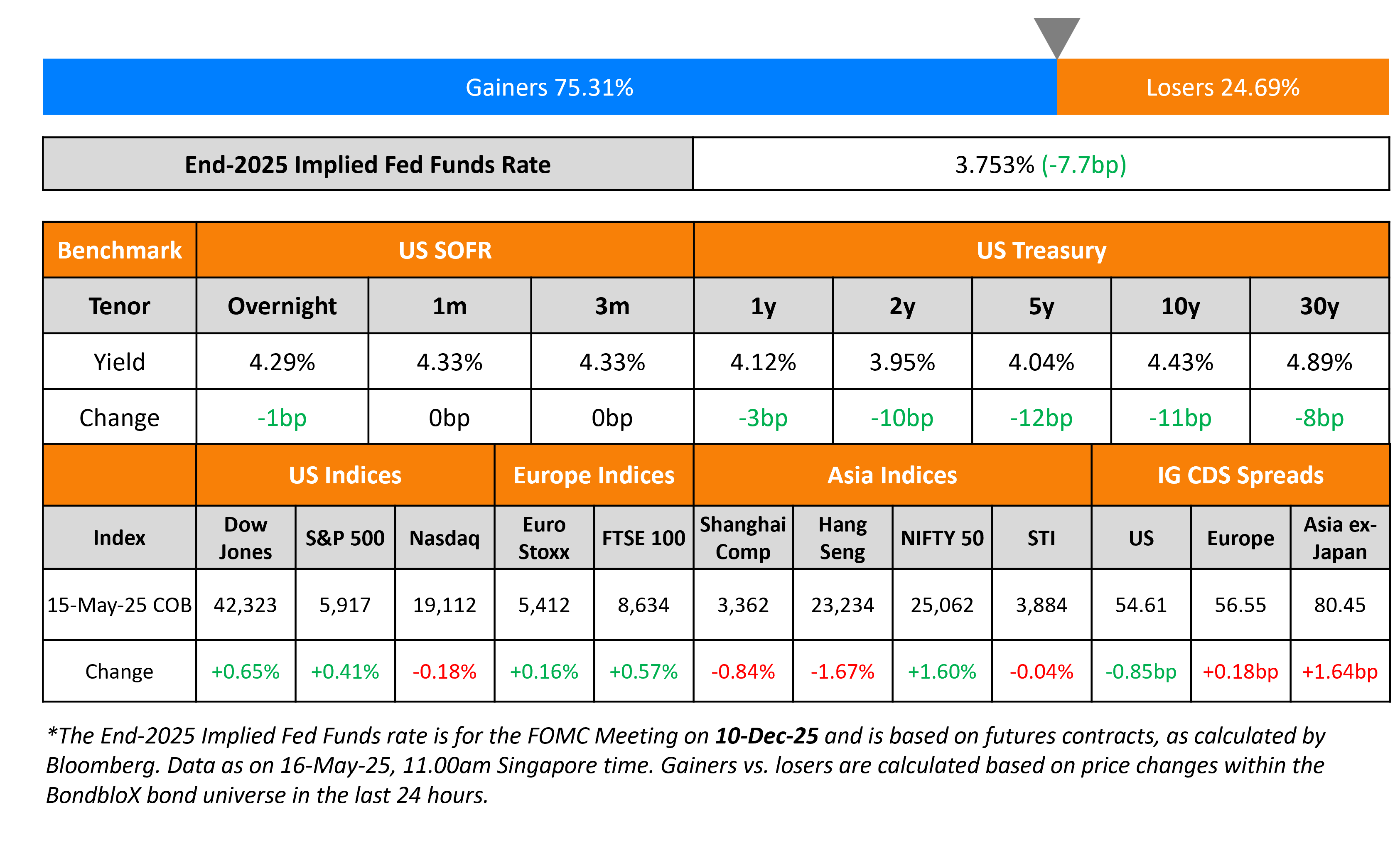

US Treasury Yields Ease; Kohl, FAB Price $ Bonds

May 16, 2025

US Treasury yields eased by nearly 12bp across the curve. US Retail Sales in April saw a growth of 0.1%, better than expectations of 0.0%. The prior month’s reading was revised higher from 1.4% to 1.7%. Core retail sales was softer at 0.2% vs. expectations of 0.3%. However, the prior month’s print was revised higher to 0.8% from 0.5%. Separately, US President Donald Trump said that the Indian government offered them a deal where to charge no tariffs.

Looking at equity markets, the S&P ended 0.4% higher while Nasdaq was lower by 0.2%. Looking at credit markets, US IG spreads were tighter by 0.9bp while HY CDS spreads tightened by 3.2bp. European equity markets ended higher. The iTraxx Main CDS spreads widened by 0.2bp and Crossover CDS spreads widened by 1bp. Asian equity markets have opened lower across the board today. Asia ex-Japan IG CDS spreads were wider by 1.6bp.

New Bond Issues

|

|

Prudential Funding raised S$600mn via an 10Y bond at a yield of 3.8%, 35bp inside initial guidance of 6.75% area. The senior unsecured note is rated A3/BBB+. Proceeds will be used for general corporate purposes. HSBC raised £750mn via an 8NC7 bond at a yield of 5.813%, 15bp inside initial guidance of UKT+160bp area. The senior unsecured note is rated A3/A-/A+, and received orders of over £1.7bn, 2.3x issue size. Air France-KLM raised €500mn via an PerpNC5.25 hybrid bond at a yield of 5.875%, ~56.25bp inside initial guidance of 6.375-6.5% area. The subordinated note is rated B+/BB. If not called by 21 August 2030, the coupon will reset to the 5Y MS plus 358bp. The coupon will step-up by 25bp from 21 Aug 2035 if not called by then, and a further 75bp from 21 Aug 2045 if not called before this date. Also, if S&P rates the issuer at Investment Grade (IG) on any date following the issue date, then the second step-up date shall immediately be changed to 21 August 2050. Moreover, a 500bp step-up will be applied following a change of control event if not called. Net proceeds will be used for general corporate purposes and for potential refinancing of existing perpetual hybrid debt within the group. Kohl’s raised $360mn via a 5NC2 bond at a yield of 10.25%, ~12.5bp inside initial guidance of 10.25-10.50% area. The senior unsecured note is rated Ba3/BB+/BB+. Proceeds will be used for repayment of Asset Backed Lending (ABL) related debt borrowings (with subsequent ABL borrowings used to redeem 2025 notes). First Abu Dhabi Bank raised $750mn via a 5Y Formosa FRN at SOFR+97bp, 3bp inside initial guidance of SOFR+100bp area. The senior unsecured note is rated Aa3. Proceeds will be used for general corporate purposes. |

New Bonds Pipeline

Rating Changes

|

Term of the DayHybrid BondsHybrid bonds are called “hybrids” because they combine characteristics of both bonds and equities. These instruments may be issued by both banks and non-financial corporates. A common example of hybrid bonds would be perpetual bonds, which are fixed income securities without a maturity date (similar to equities) that pay a fixed coupon to holders (similar to bonds). Perpetuals typically have a call option, which allows the bond issuer to redeem the bonds at a fixed date. It is important to note that the option to redeem lies with the bond issuer, not the holder. Talking HeadsOn US Bonds Rallying as Economic Data Backs Bets on Two 2025 Fed Cuts Zachary Griffiths, Creditsights “Bad news is good news for the bond market” Jamie Dimon, JPMorgan “It creates risk of inflation to me. It creates risk of higher long-term rates” On Vanguard, RBC BlueBay Scoop Up Battered 30-Year Japanese Bonds Ales Koutny, Vanguard “It’s hard to see how 3% makes sense here… still plan to keep adding JGBs in the long end if the 30-year yield comes back towards 3%” Mark Dowding, BlueBay “Once that volatility does come down, I think the spread will slowly creep back (10-30 yields)” On Gold Advancing as Economic Data Supports Fed Rate Cut Bets Christopher Wong, OCBC While some support should come in around $3,050-$3,150 an ounce, “gold may risk a deeper pullback towards $2,950 levels” Top Gainers and Losers- 16-May-25* |

|

Go back to Latest bond Market News

Related Posts: