This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

May 14, 2024

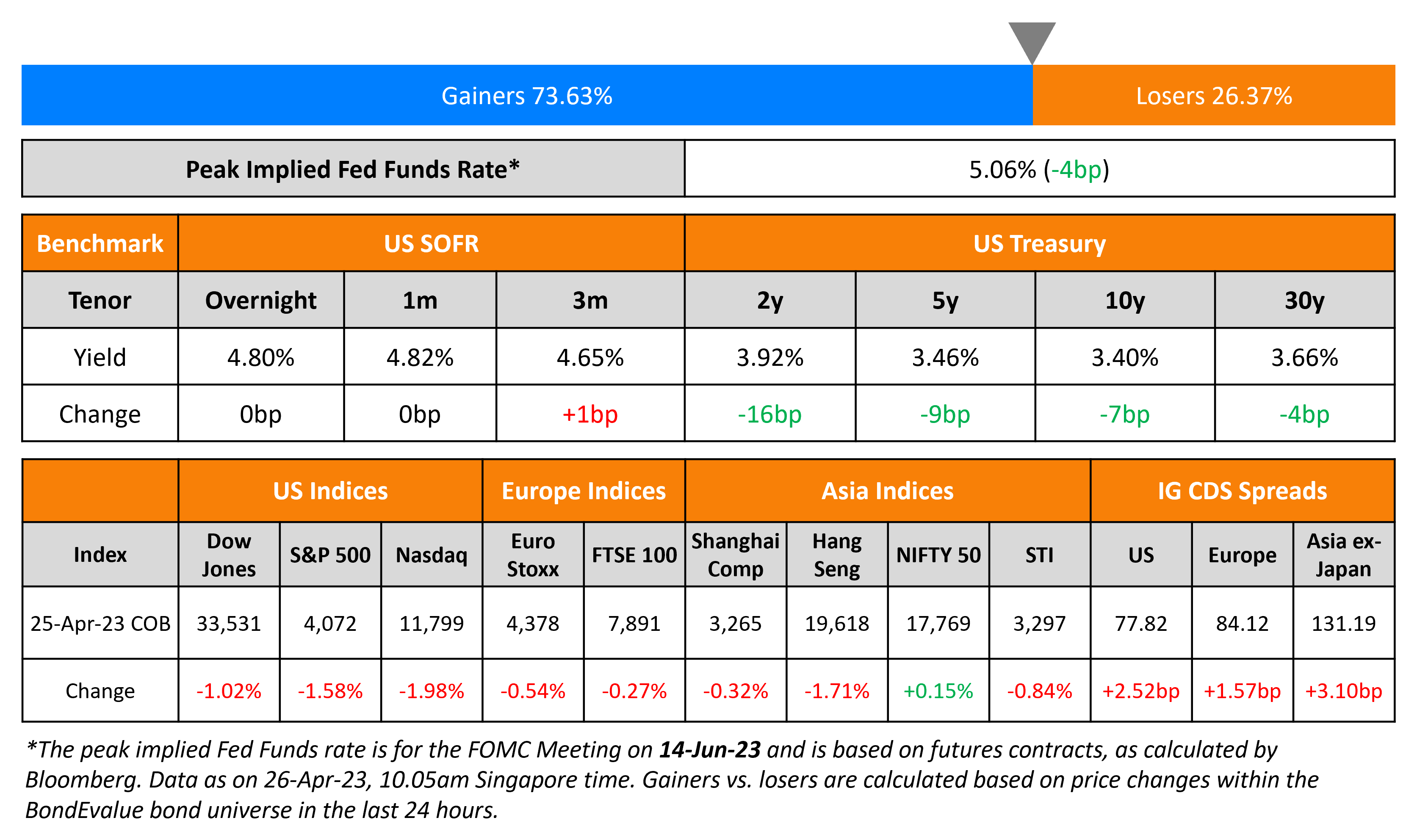

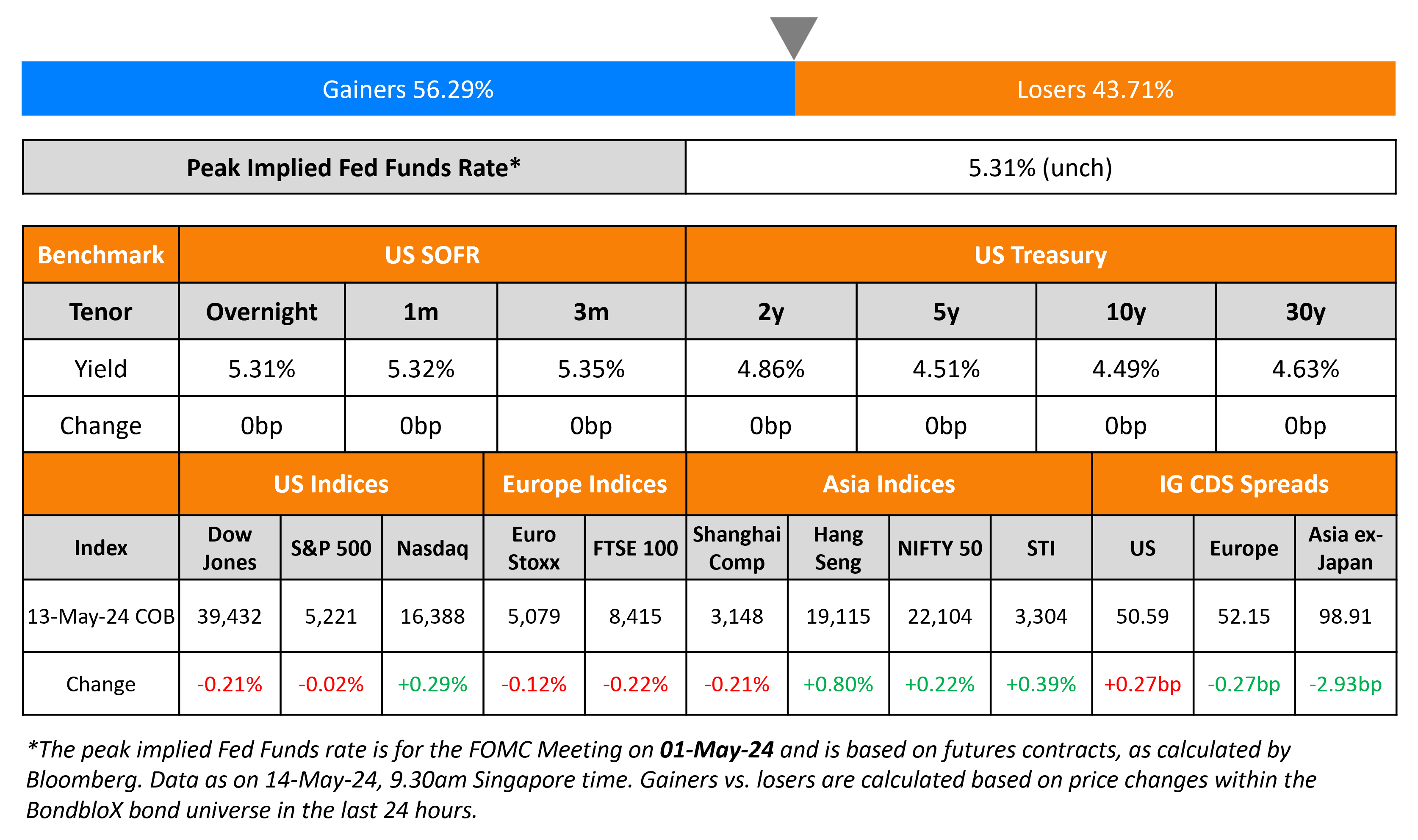

US Treasury yields were stable across the curve on Monday. Several Fed speakers again came forward with their take on monetary policy. Chicago Fed President Austan Goolsbee said that there is not much evidence that “inflation is stalling out at 3%”, adding that policy was “relatively restrictive”. San Francisco Fed President Mary Daly said it may take more time to bring inflation down. Dallas Fed President Lorie Logan said that it was too early to think about cutting rates. Minneapolis Fed President Neel Kashkari noted that officials are “mostly in agreement” to keep rates on hold if concerning inflation data persists. S&P was almost unchanged while Nasdaq was up 0.3%. US IG CDS spreads widened 0.3bp and HY spreads were 1.6bp wider.

European equity markets were lower. Europe’s iTraxx main CDS spreads were 0.3bp tighter and crossover spreads were 1.7bp tighter. Asian equity indices have opened weaker this morning. Asia ex-Japan CDS spreads were 2.9bp tighter.

Only 3 Days to Go

.png)

New Bond Issues

OCBC raised $500mn via a 10NC5 Tier 2 bond at a yield of 5.52%, 42bp inside initial guidance of T+145bp area. The subordinated notes are rated A2/BBB+/A. Proceeds will be used for general corporate purposes. A non-viability trigger event would occur if (a) the MAS notifies the issuer in writing that it is of the opinion that a write-down or conversion is necessary and (b) MAS decides to make public sector injection of capital, or equivalent support. A partial write-off is allowed under its loss absorption terms.

Intesa Sanpaolo raised €1bn via a PerpNC8 bond at a yield of 7%, 50bp inside initial guidance of 7.5% area. The subordinated bonds are rated Ba3/BB-/BB-, and received orders of over €2.75bn, 2.75x issue size. Coupons are fixed until 20 May 2032, and if not called, resets then and every five years at the 5Y MS+435.2bp. A trigger event would occur if at any time, the transitional CET1 Ratio of the issuer on a solo basis, or the Group on a consolidated basis is less than 5.125%. Proceeds will be used for general funding purposes and regulatory capital purposes of the group.

Turk Telekom raised $500mn via a 5Y sustainable bond at a yield of 7.375%, 62.5bp inside initial guidance of 8% area. The bonds are rated BB-/B+ (S&P/Fitch). Proceeds will be used for refinancing of debt, including repurchasing its 2025s under their tender offer. The issuer intends to apply an amount equivalent to the net proceeds for financing/refinancing eligible Projects under its sustainable finance framework.

Toyota Motor Credit Corp raised $2.5bn via a three-part offering. It raised:

- $750mn via a 2Y bond at a yield of 5.235%, 22bp inside initial guidance of T+60bp area

- $750mn via a 2Y FRN at SOFT+45bp vs. initial guidance of SOFR equivalent area

- $1bn via a 5Y bond at a yield of 5.099%, 25bp inside initial guidance of T+85bp area

The senior unsecured notes are unrated. Proceeds will be used for general corporate purposes.

Lufthansa raised €750mn via a 6Y bond at a yield of 4.171%, 35bp inside initial guidance of MS+170bp area. The senior unsecured bonds are rated Baa3/BBB- (Moody’s/Fitch), and received orders of over €2.5bn, 3.3x issue size. Proceeds will be used for general corporate purposes.

New Bond Pipeline

- SMIC SG Holdings hires for $ bond

Rating Changes

-

Freeport-McMoRan Inc. Upgraded To ‘BBB-‘; Outlook Stable

-

Fitch Upgrades Coty Inc. to ‘BB+’; Outlook Stable

-

Fitch Upgrades Ibercaja to ‘BBB’; Outlook Stable

-

Fitch Revises Unicaja’s Outlook to Positive; Affirms IDR at ‘BBB-

-

‘Fitch Revises Abanca’s Outlook to Positive; Affirms at ‘BBB-‘

Term of the Day

Neutral Rate of Interest

The neutral rate aka natural rate or “R*” is the theoretical federal funds rate at which point the US Federal Reserve monetary policy is neither accommodative nor restrictive. In other words it is the short-term real interest rate that is consistent with the economy maintaining full employment and price stability. This rate is inferred and calculated via models and varies based on economic and financial market factors.

Talking Heads

On Consumers Still Strong Even With High Rates – BofA CEO, Brian Moynihan

“There’s a thousand things that could go wrong tomorrow, but right now everything is in pretty good shape”… Consumer spending has climbed 3% to 4% in May YoY… consistent with a slower-growth, lower-inflation environment, but still a positive for the US economy

On Seeing FOMO in the Market Ahead of CPI – Goldman MD, Scott Rubner

“I am starting to see some real FOMO start to develop based on incomings last week… Roaring Kitty is back, the message boards are going crazy this morning… think there is upside risk to the US 60/40 portfolio this week”

On Investor Appetite for Longer-Dated US Bonds Surging – BofA

Powell “triggered a dip buying mentality”… client survey indicates investors’ desire to extend duration climbed to the highest in a year… near its most-elevated level since conducting the survey in 2011… Investors are also bullish on duration elsewhere, with a global sentiment gauge at the highest since 2021.

Top Gainers & Losers- 14-May-24*

Go back to Latest bond Market News

Related Posts: