This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Melco, Far East Launch $ Bonds

April 9, 2024

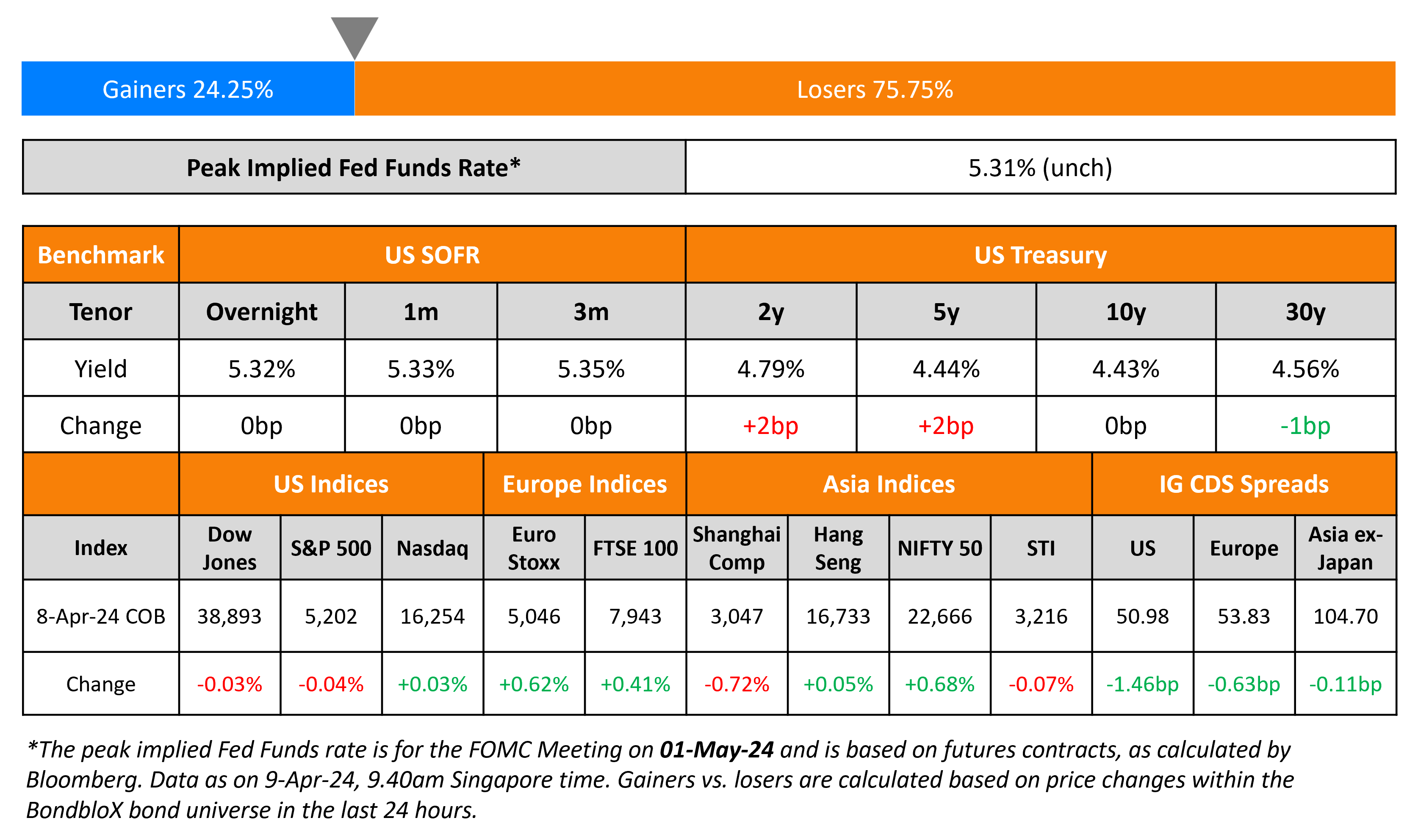

US Treasury yields were stable yesterday. Markets await the CPI report on Wednesday where expectations are for a 3.4% rise in the headline number and for a 3.7% rise in the Core CPI print. US IG CDS spreads tightened 1.5bp and the HY spreads tightened 6bp. The S&P and Nasdaq were almost unchanged.

European equity indices ended higher. European IG CDS spreads tightened 0.6bp and crossover spreads were 0.6bp tighter. Asian equity markets have opened mixed today. Asia ex-Japan IG CDS spreads were 0.1bp tighter.

New Bond Issues

- Melco Resorts $ 8NC3 at 7.75-7.875% area

- Nippon Life Insurance $ 30NC10 at 6-6.125% area

- Far East Horizon $ 3Y at T+250bp area

- Jinan Hi-Tech Holding $ 3Y at 6.8% area

MUFG raised $2.5bn via a two-part deal. It raised:

- $900mn via a 6NC5 bond at a yield of 5.258%, 38bp inside initial guidance of T+110bp area. The new bonds are priced 17.2bp tighter to its existing 5.475% bond due February 2031 (callable in February 2030)

- $1.6bn via a 11NC10 bond at a yield of 5.426%, 30bp inside initial guidance of T+130bp area. The new bonds are priced in-line with its existing 5.406% bond due April 2034 (callable in April 2033)

The notes are rated A1/A-/A-, and proceeds will be used to fund the operations of MUFG Bank Ltd. and Mitsubishi UFJ Securities Holdings Co., Ltd. through loans that are intended to qualify as Internal TLAC debt.

Shinhan Bank raised $500mn via a 10Y bond at a yield of 5.832%, 35bp inside initial guidance of T+175bp area. The bonds are unrated. Proceeds will be used to finance and/or refinance eligible social projects that fall within the “access to essential services” category as set out in Shinhan Bank Sustainable Development Goals Financing Framework.

Commerzbank raised €750mn via a 10.5NC5.5 Tier 2 bond at a yield of 4.907%, 45bp inside initial guidance of MS+260bp area. The new subordinated bonds are rated Baa3/BB+, and received orders of over €3.1bn, 4.1x issue size. The new bonds are priced 20bp wider to BPCE’s 5.125% Tier 2 bond due 2035 (callable in January 2030) that currently yield 4.71%. The new notes are also priced 33bp wider to ING Groep’s 5% Tier 2 bond due 2035 (callable in November 2029) that currently yield 4.58%.

Credit Agricole raised €1bn via a 12NC7 Tier 2 bond at a yield of 4.417%, 35bp inside initial guidance of MS+205 area. The notes are rated Baa1/BBB+/A-.

New Bonds Pipeline

- China Development Bank hires for $ 3Y FRN bond

- LG Electronics hires for $ 3Y/5Y bond

Term of the Day

Macro-Linked Bonds

Macro Linked Bonds are a type of sovereign bond being planned by sovereigns as part of their debt restructuring process. Here, the bond’s coupon payments automatically reduce beginning at a future date if the sovereign fails to meet some of the economic targets linked to their IMF program, thus leading to a step-down in payments. Holders of the MLBs would then agree to grant additional debt relief if needed to achieve certain targets like the IMF’s Debt Sustainability Analysis target.

Talking Heads

On Corporate Bonds Likely to Stay Pricey for Months

Dominique Toublan, Barclays Strategist

“As long as the growth and rates story remains similar to that in 2004-06, we think the backdrop has the potential to keep spreads tight for some time”

Travis King, Voya’s head of US IG Corporates

“We could stay pretty tight for quite a long time”

Matt Eagan, Loomis Sayles PM

“The backdrop for credit is good because we have more or less a soft landing.. (central banks have) pivoted more dovishly”

On Stock moves suggesting belief in ‘no landing’ economy – Morgan Stanley

“However, the macro data and equity market leadership have started to support the no landing outcome… broadening is being led by cyclical industries… which is supportive of the notion that the equity market is beginning to process a better growth environment”

Top Gainers & Losers- 09-April-24*

Go back to Latest bond Market News

Related Posts: