This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

11 New $ Bonds Launched; Lenovo Gets IG Rating from The 3 Majors; Rolls Royce Raises $2.6bn via Bonds

October 15, 2020

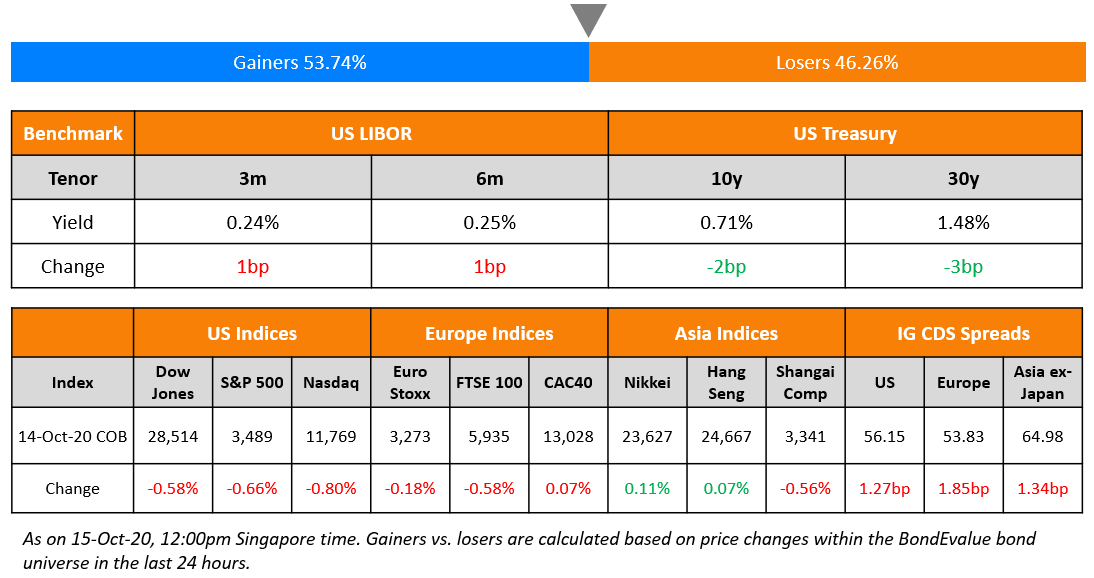

S&P ended 0.7% lower with consumer discretionary, real estate and financials dragging the index, all down over 1%. Nasdaq was down 0.9% with Amazon falling 2.3% and Facebook 1.6% lower. Goldman Sach’s Q3 earnings beat estimates while Wells Fargo disappointed with the stock down 6%. US 10Y Treasury yields edged 2bp lower and the sentiment was weaker as Treasury Secretary Mnuchin called the chances of a pre-election stimulus “difficult”. Elsewhere, G20 extended its debt relief plan to poor countries for the first half of 2021. US IG CDS spreads widened by 1.3bp while HY spreads were flat. European IG CDS spreads and Crossover spreads were wider by 1.9bp and 12bp respectively. Asia ex-Japan CDS spreads were wider 1bp while Asian equities are lower ~0.5% today. The Asian primary market is having a busy Thursday with 11 dollar bond deals announced this morning.

Back on popular demand, our masterclass on Bond Valuation & Risk will take place next Thursday, October 22 at 7pm Singapore/HK. Sign up to learn more about the factors that impact bond prices and risks to bond investing.

New Bond Issues

- Bank of China Group Inv. $ 5/10yr @ T+165/200bp area

- China Merchants Port Holdings $ tap Perp NC3 @ 3.45% area

- Agricultural Bank of China HK $ 3/5yr @ T+130/140bp area

- Union Bank of the Philippines $ 5yr @ T+230bp area

- Country Garden $ 5/10yr @ T+330/365bp area

- Indika Energy $ 5NC2 @ 8.625% area

- DaFa Properties $ tap 12.375% 2022 final @ 13.625% area

- Weifang Binhai Inv. EUR 364-day @ 5.3% area

- Chailease Holding $ 3yr @ 4.125% area

- COFCO HK $ 10yr/ Perp NC5 @ T+190bp/3.5% area

- Taizhou Urban Construction and Investment $ 3yr @ 2.95% area

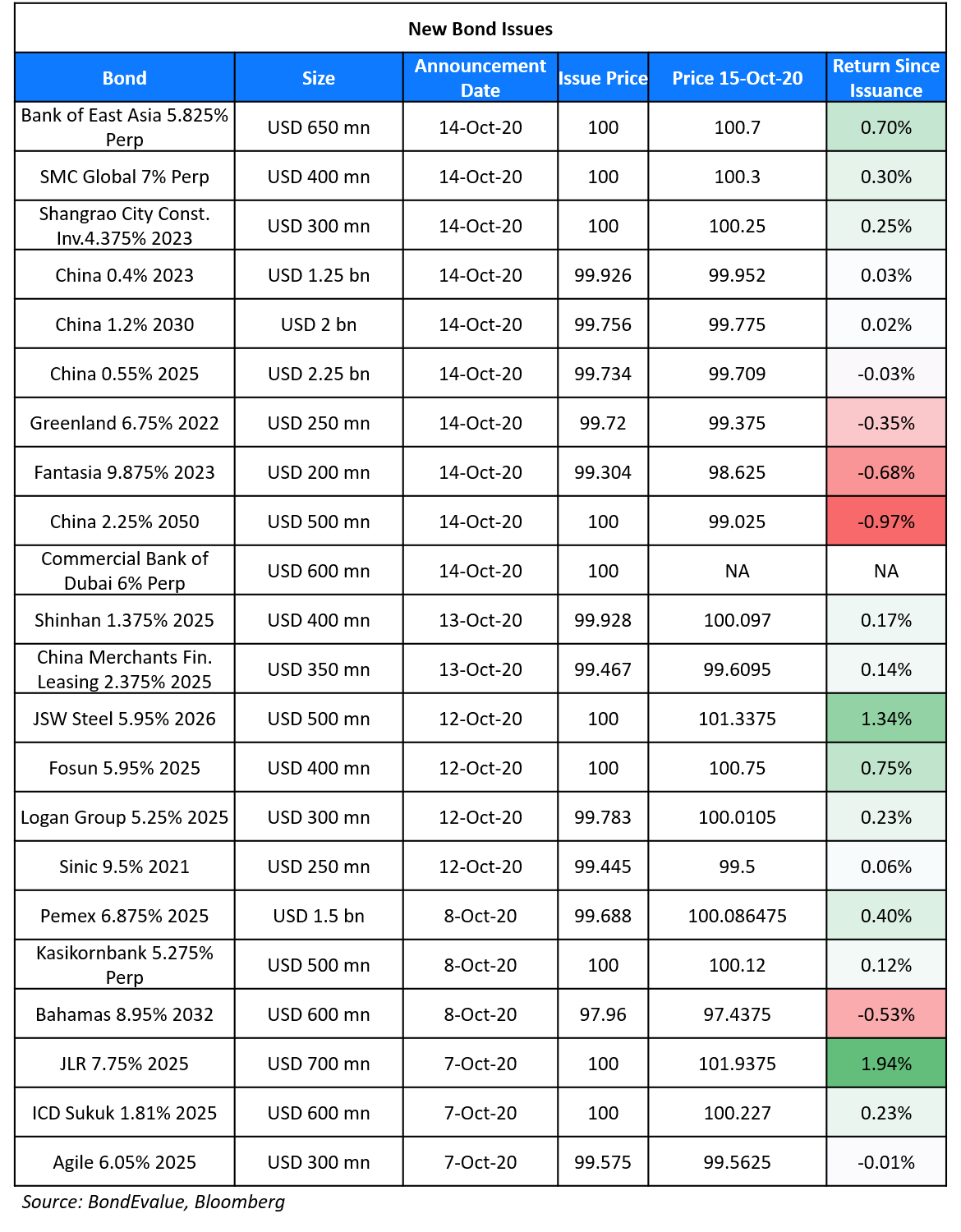

Bank of East Asia raised $650mn via a Perpetual non-call 5Y (PerpNC5) AT1 to yield 5.825%, 42.5bp inside initial guidance of 6.25% area. The bonds, with expected ratings of Ba2/BB, received final orders over $3bn, 4.62x issue size. The bond has a call date in October 2025 and if not called, the coupon will reset the same day and every five years thereafter to the prevailing US 5Y Treasury yield plus the initial spread of 552.7bp with no step-up. The bond has a dividend stopper.

Commercial Bank of Dubai raised $600mn via a Perpetual non-call 6Y (PerpNC6) AT1 bond to yield 6%, 37.5bp inside initial guidance of 6.3785% area. The bonds received final order exceeding $1.2bn, 2x issue size. The bond will have its first call date in April 2026 and if not called, the coupon will reset on October 2026 and thereafter every 6 years to the USD Swap 6Y plus the initial margin of 559.7bp with no step-up. The bond has a dividend stopper. This is the bank’s debut AT1 bond, and also the first dollar bond issuance since its previous debut dollar bond issue in 2013.

Philippine power company SMC Global Power Holdings raised $400m via senior Perpetual non-call 5Y (PerpNC5) bonds to yield 7%, 30bp inside initial guidance of 7.3% area. The bonds received final orders over $1.2bn, 3x issue size. The bonds have a call date in October 2025 and if not called, the coupon will reset on the same day to the prevailing US 5Y Treasury yield plus the initial spread of 669.9bp and step up of 250bp. The bonds also have a dividend stopper and pusher.

Chinese property developer Greenland Holding Group raised $250mn via 1.5Y bonds to yield 6.95%, 25bp inside initial guidance of 7.2% area. The bonds, with expected ratings of Ba2, received orders exceeding $850mn when final guidance was announced, 3.4x issue size.

Shangrao City Construction Investment Development Group raised $300mn via 3Y bonds to yield 4.375%, 42.5bp inside initial guidance of 4.8% area. The bonds, with expected ratings of BB+, received orders exceeding $1.1bn when final guidance was announced, 3.67x issue size.

Rating Changes

Moody’s upgrades Hapag-Lloyd AG’s rating to Ba3; outlook stable

Curacao Long-Term Sovereign Ratings Lowered to ‘BBB-‘ From ‘BBB’ By S&P; Outlook Remains Negative

Bertelsmann Downgraded To ‘BBB’ By S&P On Expectation Of Weaker Earnings; Outlook Stable

Banco Hipotecario S.A. Downgraded To ‘SD’ From ‘CC’ By S&P Following Settlement Of Exchange Offer

Fitch Revises Radiance’s Outlook to Positive, Affirms IDR at ‘B’

The Record-Setting ‘Bubka’ Bond Market of 2020

2020 has been a record-setting year for the bond markets, particularly in terms of new bond issues. We have seen new records being set and subsequently broken time and again through the year, reminding us of Ukrainian pole-vaulter Sergey Bubka. Click the link here to see the list of records set by the bond markets this year.

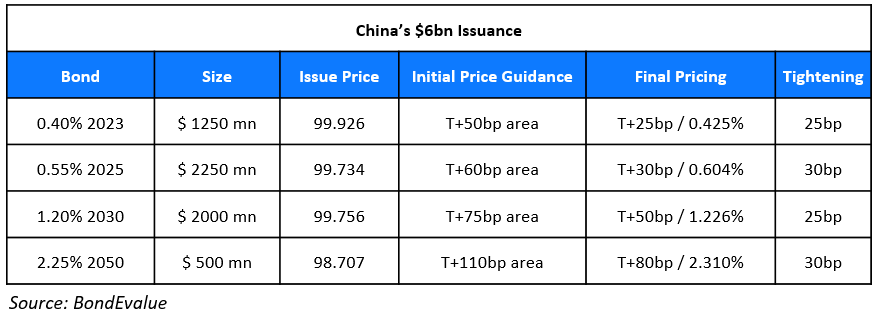

China Raises $6 Billion via Multi-Trancher that Received $27.5 Billion Worth of Orders

The China sovereign’s dollar bond four-trancher drew final orders of over $27.2bn, 4.5x its issue size of $6bn according to IFR. The jumbo issuance comes at a time before market volatility could kick-in ahead of the US election, strained relations on Taiwan and the pandemic. Below are the final details of the issuance:

China last issued dollar bonds in November 2019 with a $6bn four-trancher. The older 2022s and 2039s were down 0.12 and 0.28 points while the older 2024s and 2029s are higher by 0.6 and 0.10 points respectively. The older 2022s, 2024s, 2029s and 2039s are currently trading at a yield of 0.47%, 0.61%, 1.18% and 2.35% on the secondary markets.

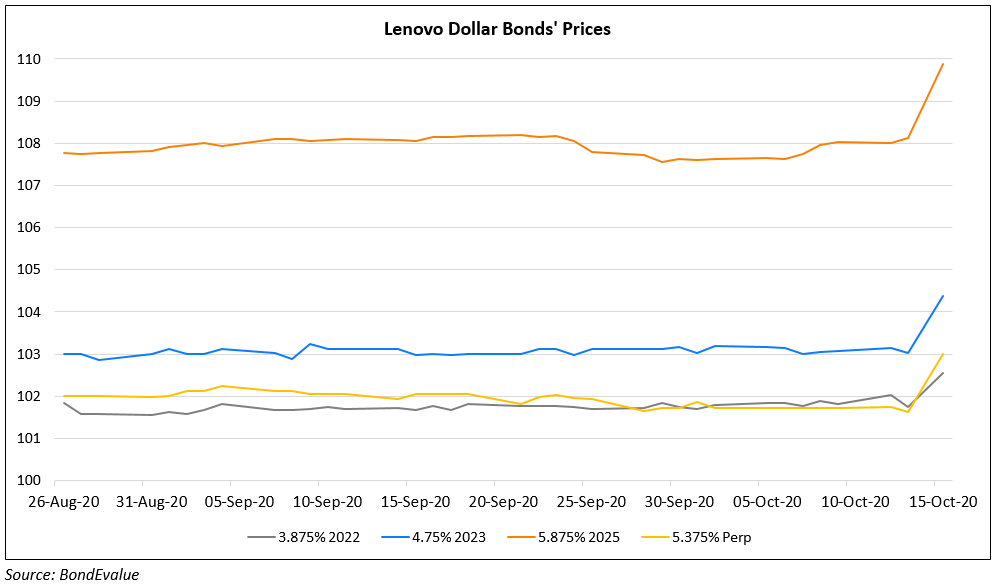

Lenovo Bonds Inch Up on Debut Issuer Ratings of Investment Grade by Major Ratings Agencies

Lenovo Group, the leading PC manufacturer received an investment grade rating from all three major rating agencies as its debut issuer rating. Moody’s, S&P and Fitch rated the group Baa3 (Stable), BBB- (Stable) and BBB- (Positive) respectively.

The rating by Moody’s reflects:

- Diversified revenue streams across geographies (Americas, EMEA, Asia ex-China and China contributing 32%, 25%, 22%, 21% respectively)

- Leading market share (~24%)

- Expected EBITDA margins and leverage improving to 5.1% from 4.7% and ~2.9x from 3.8x respectively by 2022 vs 2020

- Strong cash balances of $3.5bn in June 2020 and expected operating cash flows to cover short-term debt of $2.3bn

Fitch highlighted similar reasons adding to it:

- The PC and Smart Devices segment’s resilience in the face of competition

- Opportunity to capture Covid-19 led digitalisation opportunities and improved services led growth.

- Lenovo’s Funds From Operations (FFO) Leverage was higher than most BBB- issuers it covers whilst adding that cash flow and profit generation would help it drive deleveraging

S&P in its ratings release stated:

- Net Debt to EBITDA to fall below 2x in 2021 from 2.4x in 2020

- Cautious on cash flow volatility due to longer working capital cycles in its Data Center Group, which contributes ~10% of revenues and inventory build-ups in critical components

- Benefits of supply chain efficiencies (30+ manufacturing facilities, hybrid model of in-house and original design manufacturers and reduction in response times) to keep it in good stead

Overall, lower margins (5% vs HP’s 9%, Dell’s 12%) alongside leverage weighed on the ratings. The rating actions were well received by investors as its dollar bonds inched up.

Evergrande’s Hengda Raises $311 Million via Local Currency Bonds

After a disappointing share placement that led to a fall in its dollar bonds and stock yesterday, Evergrande’s property flagship, Hengda Real Estate Group raised CNY 2.1bn ($311mn) via a 5Y non-puttable 3Y onshore bond offering. The bonds priced to yield 5.8%, closer to the near end of the indicative price range of 5.5-7.5%. The proceeds will be used for making bond repayments. Evergrande has $1.6bn of domestic bonds maturing on Friday, according to Bloomberg data. Evergrande’s dollar 8.9% 2021 and 10.5% 2024 bonds were down 1.2% and 3.2% while Hengda’s dollar 11.5% 2022 and 12% 2023 bonds were down 1.8% and 2.5% since the share placement yesterday.

Rolls-Royce Raises $2.6 Billion via Third Largest Junk Issuance This Year

British jet engine manufacturer Rolls-Royce raised £2bn ($2.6bn) via a multi-currency bond issuance on Wednesday. This is the third largest junk bond deal this year after Fiat Chrysler’s €3.5bn ($4.1bn) deal and a €2.25bn ($2.9bn) bond to fund the private equity buyout of Thyssenkrupp Elevators. Details of the Rolls-Royce issuance are as follows:

- $1bn 7Y bond at a yield of 5.75%, 50bp inside initial guidance of 6.25% area

- €750mn 5.3Y bond at a yield of 4.625%, 62.5bp inside wide end of initial guidance of 5-5.25%

- £545mn 7Y bond at a yield of 5.75%, 50bp inside initial guidance of 6.25% area

The new bonds are expected to be rated BB- by S&P and on CreditWatch with negative implications along with its existing debt. Rolls-Royce is a fallen angel, having been downgraded by S&P, Moody’s and Fitch to a junk rating of BB-, Ba3 and BB+ respectively, down from an investment grade rating till April this year. All three rating agencies downgraded the company starting with S&P’s downgrade to BB in late May, Moody’s downgrade to Ba2 in late July and Fitch’s downgrade to BB+ in August. The bond issuance is part of a £5bn ($6.5bn) financing plan unveiled by the company at the start of this month. The company, has been one of the worst hit by the pandemic as demand for air travel plummeted, leading to a sharp drop in demand for its jet engines and a decline in maintenance revenues as airplanes were grounded amid lockdowns during Q2. Rolls-Royce’s dollar 3.625% 2025s are currently trading at 95 cents on the dollar yielding 4.67%, up 1 point since Tuesday this week.

For the full story, click here

Future Group Company Defaults on Local Rupee Debt

India-based Future Group company Future Enterprises Ltd disclosed on October 13 through an exchange filing that it had defaulted on interest payment on two of its local currency non-convertible debentures (NCDs) as it failed to pay interest worth INR151.42mn (~$2.06mn) due on October 12. The company was also unable to service its obligations in respect of the interest amounting to INR 161.1mn (~$2.2mn) on NCD due on Sep 27. Future Group has been struggling with a huge debt pile and averted a default at the eleventh hour making a debut coupon payment on Future Retail’s debut $500mn dollar 5.6% bonds due 2025 in late August. The struggling Future Group has struck a INR274mn (~$3.37bn) deal to sell its retail and wholesale business and the logistics and warehousing business to Reliance Retail Ventures Limited in a bid to overcome its debt woes. Future Retail’s 5.6% bonds due 2025 traded lower by 2.3 points since Tuesday to 79.5 cents on the dollar.

For the full story, click here

Zambia Warns of Default If Bondholders Reject Suspension Request

Southern African nation Zambia warned investors that it would default on its debt if holders of its $3bn dollar bonds reject its request to suspend payments for six months. Bondholders will take a decision on this next week. “Should Zambia fail to reach an agreement with its commercial creditors . . . the republic, with its limited fiscal space, will be unable to make payments and, therefore, fail to forestall accumulating arrears,” the Zambian finance ministry said. The sovereign had a $42mn interest payment due on Wednesday, which can be made within the 30-day grace period. Zambia’s 8.5% 2024s and 8.97% 2027s fell 2.7 and 4 points to 45 and 44.5 cents on the dollar respectively.

For the full story, click here

Alam Sutera Exchange Offer nears Threshold

Alam Sutera stated via an exchange filing yesterday that they received tenders worth $319.52mn for its 6.625% 2022s and $85.50mn for its 11.5% 2021s representing 86.36% and 74.35% of the outstanding amounts respectively until October 13. They also announced extension of the ‘Early Exchange Deadline’ until 17:00 CET on October 20 from the earlier October 13. On September 29, the company announced that the exchange offer would be successful only if 85% of the 2021 and 2022 bondholders chose to participate with the offer concluding on October 20 and new bonds issued on October 29. Those who exchange their bonds before the early exchange deadline will receive $5 in cash for every $1,000 in principal of existing notes. Moody’s had assigned the new notes at Caa1 on September 29 while S&P had mentioned it would likely downgrade them to D if the offer went through given they considered it equivalent to default. Alam Synergy, the SPE which issued the bonds saw its dollar 6.625% 2022s and 11.5% 2021s up 0.48 and 0.75 to 57.5 and 74.9 cents on the dollar respectively.

Term of the Day

Steepener Trades

These are trades placed to take advantage of the yield curve sloping upwards. A steepener trade could be profitable if one of the following occur:

- Short term yields go down faster than long term yields

- Long term yields go up faster than short term yields

- Short term yields fall/remain stable while long term yields rise

- Long term yields remain stable while short term yields fall

Such trades are taken when there are expectations of inflation going higher over time, issuance dynamics favoring long term issues vs. short term issues or relative value plays.

Talking Heads

On long way to go for economic recovery – Richard Clarida, Federal Reserve Vice Chairman

“While economic recovery since the spring collapse has been robust, let us not forget that full economic recovery from the Covid-19 recession has a long way to go,” Clarida said. “It will take some time to return to the levels of economic activity and employment that prevailed at the business cycle peak in February, and additional support from monetary — and likely fiscal — policy will be needed,” he said.

“It may be that there is a simple macro fact that the Treasury market, being so much larger than it was even a few years ago, much larger than it was a decade ago, and now really much larger than it was even a few years ago, that the sheer volume there may have outpaced the ability of the private-market infrastructure to kind of support stress of any sort there,” Mr. Quarles said.

“Will there be some indefinite need for the Fed to provide, not as a way of supporting the issuance of Treasurys, but as the way of supporting a functioning market in Treasurys, to participate as a purchaser for some period of time?” the official said. “I haven’t concluded that’s the case, the [Fed] certainty hasn’t concluded that’s the case, but I do think it’s an open question,” Mr. Quarles said.

“In the face of what I call the market’s failures, (there) is also a question we have to ask ourselves as to whether market neutrality should be the actual principle to drive our… asset purchases programme,” Lagarde said. “I’m not passing judgement on the fact that it should no longer be so, but it warrants the question and this is something that we are going to do as part of our strategy review.”

On the fall in Zambia bonds as coupon payment deadline looms

In a statement from Zambia’s Finance Ministry

“Should Zambia fail to reach an agreement with its commercial creditors (including holders of its Eurobonds)… the Republic with its limited fiscal space will be unable to make payments,” the finance ministry statement said.

Kevin Daly, Aberdeen Standard Investments in London and one of the members of the Zambia External Bondholder Committee

“A consent solicitation (to delay payments) is very, very unlikely to be approved by creditors,” said Daly. “At this stage we just don’t have enough assurances from the government.”

“We think the worst of prices declines are over — some of the coronavirus shock-related disruption now has eased as economies start to reopen,” said Sheng, who expects a risk of high inflation in the next three to five years driven by fiscal and monetary stimulus. “We prefer U.S. inflation-protected Treasuries over nominal bonds.”

“Portfolio construction is being completely taken back to the drawing board because people understand we’ll face these low interest rates for a long, long time,” Mateos y Lago said. “Asset owners are trying to get yield and returns in line with their mandate. Thanks to that you’re seeing capital flow back to emerging markets who direly need that.”

“Debt payment relief for the poorest countries is good news, but it’s a short term solution,” said LeCompte. “We’re disappointed not to have a stronger agreement on a permanent debt reduction process yet, but it’s hopeful that the G-20 is holding a special meeting on this process in the coming weeks.”

“Higher ETF ownership of investment-grade corporate bonds can reduce the ability of investors to diversify liquidity risk,” Cotelioglu, wrote.

“We are projecting a somewhat less severe though still deep recession in 2020, relative to our June forecast. The revision is driven by second quarter GDP outturns in large advanced economies, which were not as negative as we had projected,” said Gopinath.

“Moreover, recovery is not assured while the pandemic continues to spread. While the global economy is coming back, the ascent will likely be long, uneven, and uncertain. Indeed, compared to our forecast in June, prospects have worsened significantly in some emerging market and developing economies where infections are rising rapidly,” she said.

According to International Monetary Fund (IMF)-World Economic Outlook (WEO), Bangladesh’s per capita GDP in dollar terms is expected to grow 4 per cent in 2020 to $1,888. India’s per capita GDP, on the other hand, is expected to decline 10.5 per cent to $1,877 – the lowest in the last four years.

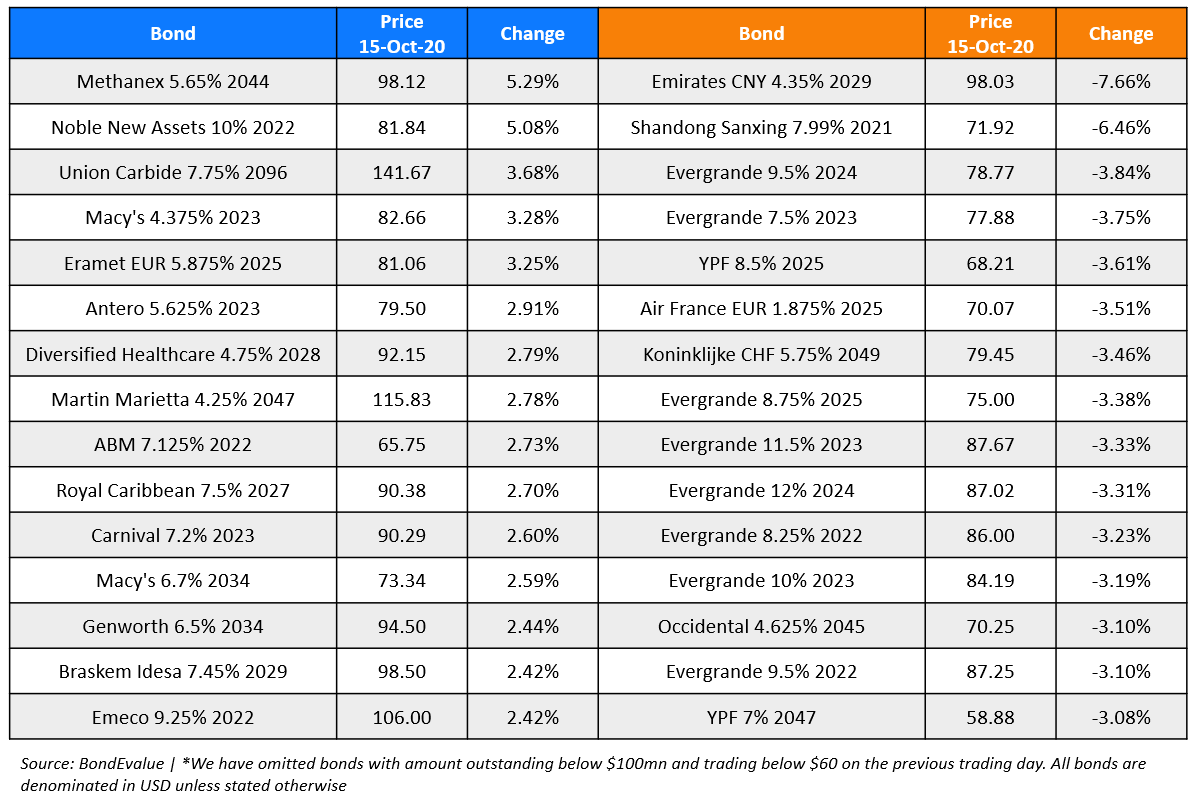

Top Gainers & Losers – 15-Oct-20*

Go back to Latest bond Market News

Related Posts: