This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

10Y US Treasury Auction Saw Strong Demand; Trafigura, Romania, Mapletree Price Bonds; PacifiCorp Downgraded to Baa2

July 10, 2025

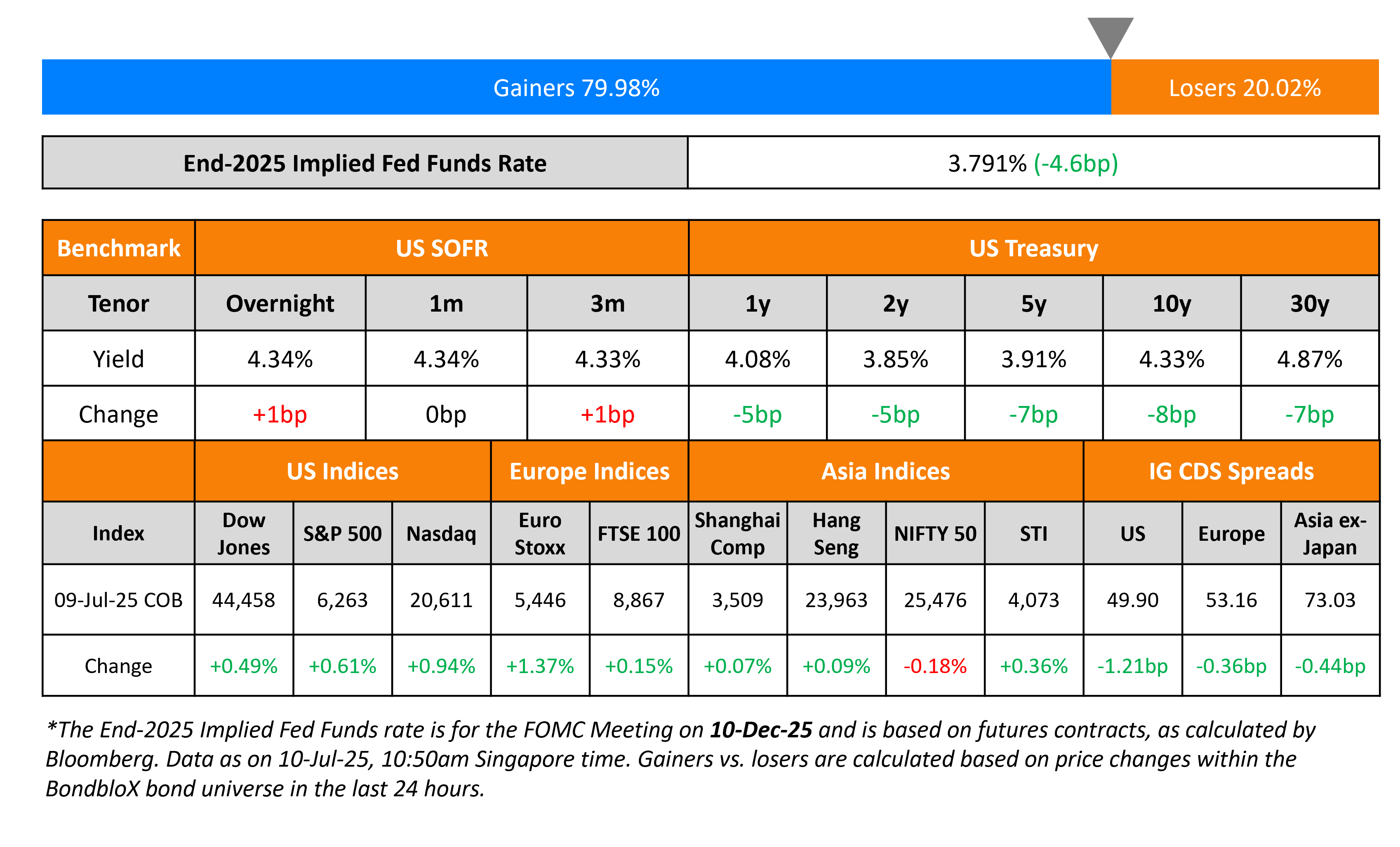

US Treasury yields fell across the curve – the 2Y fell by 5bp and the 10Y eased by 8bp. The move came after the US 10Y Treasury auction saw strong demand as it tailed by 0.3bp and saw a bid-to-cover ratio of 2.61x, higher than the prior six auctions’ average of 2.58x. Separately, US President Donald Trump continued to show tariff letters aimed at Philippines, Sri Lanka and Brazil among others. The FOMC’s June meeting minutes noted that while “a few participants noted that tariffs would lead to a one-time increase in prices and would not affect longer-term inflation expectations, most participants noted the risk that tariffs could have more persistent effects on inflation”.

Looking at US equity markets, the S&P and Nasdaq ended higher by 0.6% and 0.9% respectively. US IG and HY CDS spreads tightened by 1.2bp and 6.5bp respectively. European equity markets ended higher too. The iTraxx Main CDS spreads tightened by 0.4bp while Crossover CDS spreads tightened by 3.3bp. Asian equity markets have opened mixed today. Asia ex-Japan CDS spreads were tighter by 0.4bp.

New Bond Issues

Trafigura raised $500mn via a 5Y bond at a yield of 6.25%, 50bp inside initial guidance of 6.75% area. The senior unsecured note is unrated, and received orders of over $1.1bn, 2.2x issue size. The note has a change of control put at 100. Proceeds will be used for general corporate purposes.

Romania raised ~$5.8bn via a three-part issuance. It raised:

- $2bn via a long 5Y bond at a yield of 5.772%, 40bp inside initial guidance of T+225bp area

- $1.75bn via a long 10Y bond at a yield of 6.642%, 40bp inside initial guidance of T+270bp area. It is priced at a new issue premium of ~6bp over its existing 5.75% 2035s yielding 6.58%.

- €1.5bn via a tap of its EUR 6.75% 2039s at a yield of 6.53%, 40bp inside initial guidance of MS+415bp area

The notes are rated Baa3/BBB-/BBB-. Proceeds will be used for budget deficit financing and redemption of public debt.

Mapletree raised S$400mn via a 15Y bond at a yield of 3.048%, 25.2bp inside initial guidance of 3.3% area. The senior unsecured note is unrated. Proceeds will be used for general corporate purposes, including the refinancing of existing debt.

New Bonds Pipeline

- EnfraGen hires for $ 7NC3 bond

Rating Changes

-

Moody’s Ratings downgrades PacifiCorp to Baa2; outlook stable

- Fitch Downgrades Polaris’ IDR to ‘BBB-‘; Outlook Negative

- Fitch Downgrades Wizz Air to ‘BB’; Outlook Stable

Term of the Day: Short Selling

Short selling is a trading strategy where one borrows a security, sells it on the open market and then buys the same security back later, hoping that the price has fallen since initially sold for. The short-seller essentially borrows and sells the security that he/she may not own, expecting its price to fall. Short selling is a leveraged trade since no initial capital is employed by the short-seller.

Talking Heads

On Credit Traders Betting Everything Will Turn Out Fine in Corporate Bond Market

Martin Coucke, Schroders Plc

“On top of that we sold some protection, so we added some risk through CDS indexes to quickly gain exposure to the greater market”

Herve Boiral, Amundi SA

“very complicated to find any paper on the street…In this context the easiest way to do something is to sell some protection.”

On Powell’s Successor May Struggle to Deliver the Rate Cuts Trump Wants

Mark Gertler, New York University

“A chair can’t act like a dictator…He can’t call in the Marines or anything like that.”

Michael Feroli, JPMorgan

“It’s obviously a concern that the Fed will be less independent…can immediately get the committee to agree to a big change in policy, I think that might be more difficult.”

Brett Ryan, Deutsche Bank

“whoever the next chair is, he is going to have to build a consensus”

On German Spending Ramp-Up Fuelling Business Optimism – Phil Smith, S&P Global

“Confidence is gradually returning to German companies… firms overall remain only cautiously optimistic about the outlook and are by no means fully loosening the purse strings…the related uncertainty expected to limit business investment and growth”

Top Gainers and Losers- 10-Jul-25*

Go back to Latest bond Market News

Related Posts: