This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Walgreens Seals $10bn Acquisition by Sycamore

March 7, 2025

Walgreens Boots Alliance is set to be taken private by Sycamore Partners for $10bn, confirming rumors earlier this week. Sycamore will pay $11.45 per share, a premium of 8%, with additional cash possible from future sales of assets like VillageMD. The deal’s total value is around $23.7bn. The valuation is significantly lower than the company’s $100bn worth a decade ago, caused by shrinking drug margins and increased competition from Amazon and Walmart. Sycamore, known for acquiring distressed retailers like Staples, plans to reduce costs and sell valuable assets. Walgreens has struggled with its in-store business having made costly investments, including acquiring Alliance Boots and other pharmacy chains. However, despite efforts to turn around the business, Walgreens faced declining cashflows, large debts, and store closures. Analysts believe the acquisition reflects Sycamore’s strategy to restructure the company, potentially splitting its assets for sale.

Walgreens’ bonds were trading steady, with its 4.5% 2034s up by 4 points to 86 cents on the dollar, yielding 6.5%.

For more details, click here

Go back to Latest bond Market News

Related Posts:

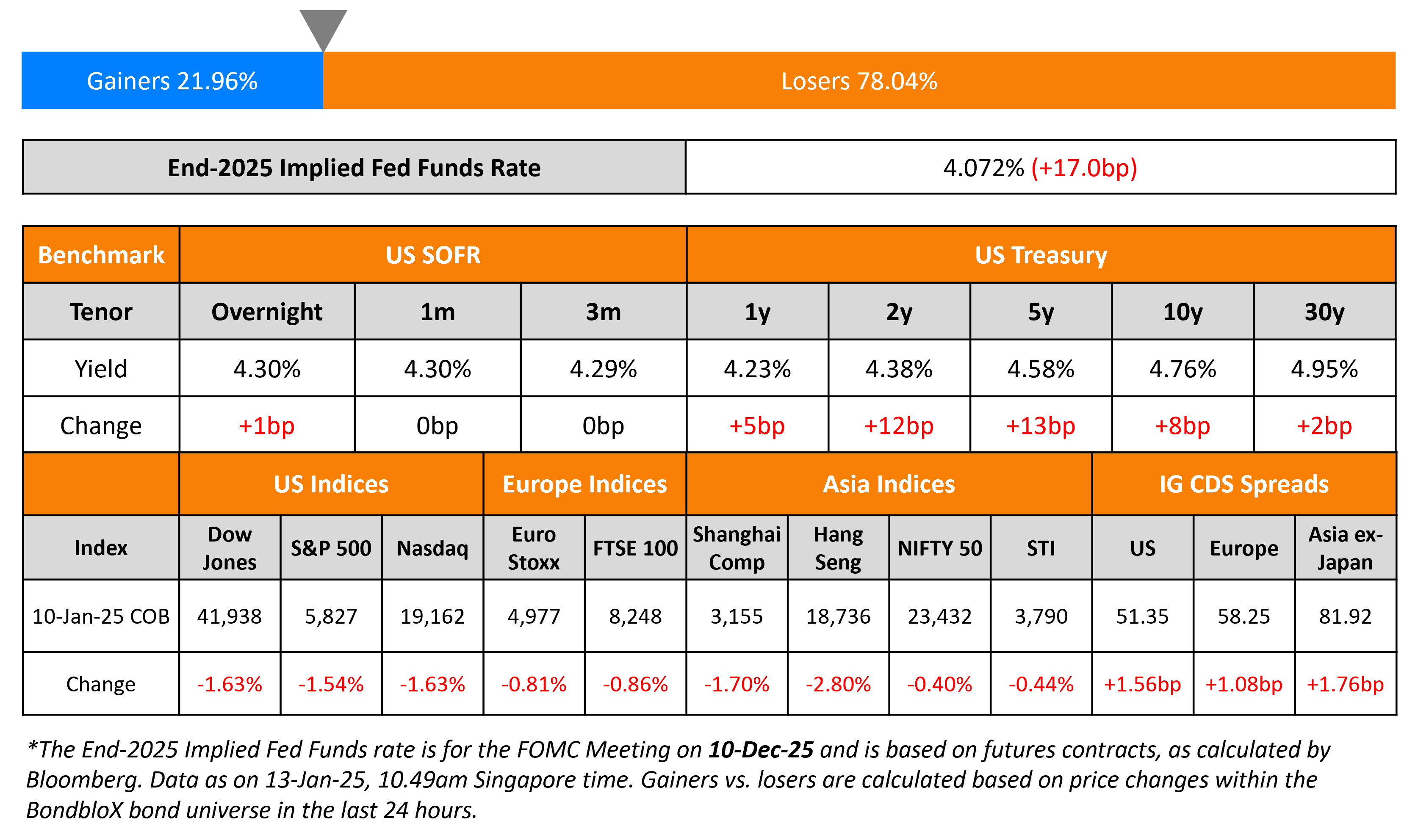

Treasuries Sell-off on Strong Jobs Report

January 13, 2025