This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Novonor Close to Selling Its Braskem Stake

December 16, 2025

Novonor SA has moved closer to selling its controlling stake in Braskem SA to a fund advised by IG4 Capital. A binding agreement was signed with creditor banks to acquire Novonor’s debt backed by Braskem’s shares. The deal includes a 60-day exclusivity period to negotiate a broader transaction that would give IG4 effective control of Braskem, holding just over 50% of voting rights and around one-third of total capital. IG4 would share control with Petrobras and Novonor would retain a 4% non-voting stake. Under the proposed governance structure, Petrobras would chair the board with equal representation to IG4, while IG4 is expected to appoint new senior management. The development follows years of failed sale attempts by Novonor due to Braskem’s mounting challenges, including fallout from the Carwash scandal, environmental liabilities at its Alagoas salt mines, weak petrochemical pricing and heavy cash burn. Braskem has seen a series of downgrades amid deterioration of its financial position, with cash falling to $1.3bn by end-September, net debt rising to $7.1bn and leverage climbing to nearly 15x EBITDA after earnings missed expectations.

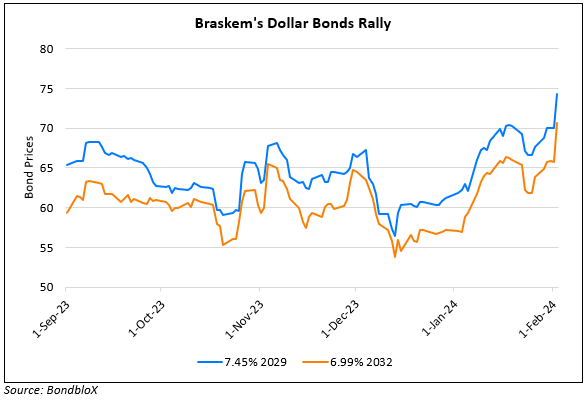

Braskem’s dollar bonds were up by 1-2 points across the curve. For instance its 8% 2034s was up by 1.1 point to 36.8 cents on the dollar.

For more details, click here

Go back to Latest bond Market News

Related Posts:

Braskem Announces ~$1.45bn Share Offering

January 17, 2022

Braskem Idesa Upgraded to BB- by Fitch

March 28, 2022

Braskem’s Dollar Bonds Rally on Reports of Stake Acquisition

February 2, 2024