This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

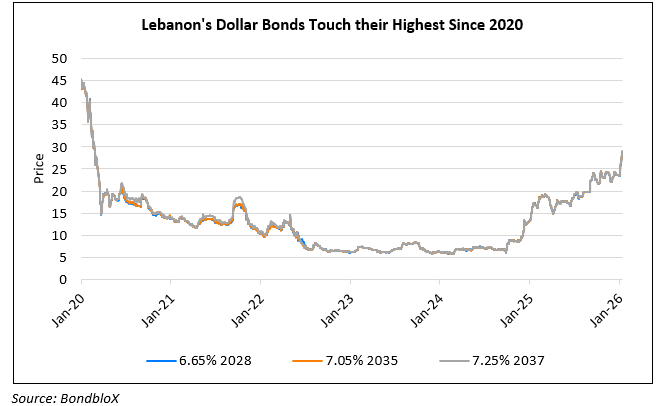

Lebanon’s Dollar Bonds Surge to Their Highest Since 2020

January 13, 2026

Lebanon’s dollar bonds surged to their highest levels since March 2020, post which the country defaulted on about $30bn of international debt. The move is driven by optimism that a proposed banking law could unlock frozen deposits and pave the way for financial reform. Bond prices have risen across maturities reflecting growing investor bets on an eventual debt restructuring and progress toward an IMF-backed rescue. However, opinions of the market participants differ on valuation, with some investors expecting recovery values below current prices, while more optimistic funds believing bonds could rise further if reforms advance and regional risks ease. The rally follows signals from Lebanon’s new leadership, led by President Joseph Aoun, that it is seeking to break years of political paralysis and meet key IMF conditions. Analysts indicate that investors are also monitoring unrest in Iran and its potential impact on the Lebanese government’s ability to implement reforms. S&P had upgraded Lebanon to CCC in August last year. Lebanon’s dollar bonds have surged to 28-29 cents on the dollar from 22-23 cents in December 2025.

For more details, click here

Go back to Latest bond Market News

Related Posts:

Credit rating boost for Ireland & Portugal: EU inches towards recovery

September 20, 2017

China Refutes S&P Downgrade Action

September 26, 2017

Mongolia’s Credit Ratings Upgraded to B3 by Moody’s

January 19, 2018