This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Yuzhou Downgraded to B2 by Moody’s

October 20, 2021

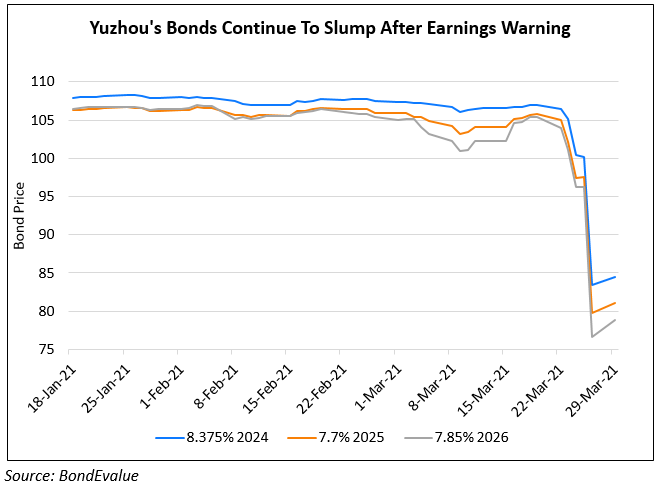

Yuzhou was downgraded by Moody’s to B2 from B1. Its senior unsecured bonds ratings were also downgraded to B3 from B2 due to structural subordination. The downgrade was on the back of Yuzhou’s weakened funding access and expectations that its financial metrics would weaken over the next 6-12 months. Yuzhou’s contracted sales are expected to decline thereby reducing its liquidity buffer. With contracted sales expected to decline and high reliance on sales from JVs and associates, its operating cash flow and liquidity would weaken. Yuzhou $700mn of offshore bonds and RMB 6.5bn ($1bn) of onshore bonds maturing or becoming puttable by end-2022. Given tight funding conditions, using internal cash will reduce the funding available for its operations over the next 12-18 months. As of 30 June 2021, the company had unrestricted cash RMB 25bn ($3.9bn), compared with reported short-term debt of RMB 15.2bn ($2.4bn).

Yuzhou’s dollar bonds were lower with its 7.375% 2026s down 2.8 points to 59.95

For the full story, click here

Go back to Latest bond Market News

Related Posts: