This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Yango Launches Exchange Offer and Consent Solicitation; Seeks Forbearance on Local ABS

November 1, 2021

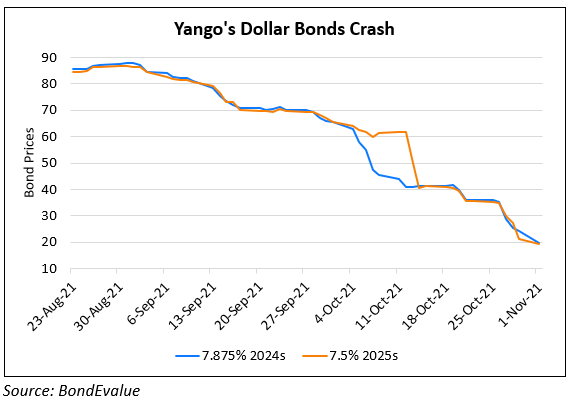

Yango Group has launched an exchange offer and consent solicitation for its dollar bonds as per an HKEX filing. The exchange offer is for three of its bonds – 10% 2023s , 5.3% 2022s and 10.25% 2022s. The minimum acceptance amounts for the bonds are $209.95mn, $170mn and $300mn respectively. For all the three notes, bondholders may receive new notes maturing on September 15, 2022 with $25 in cash plus accrued interest for every $1,000 in principal. Yango said that the offer is intended to “improve liquidity, avoid payment default, and preserve options to stabilize our operations as a going concern”. It also launched a consent solicitation for its 9.25% 2023s, 8.25% 2023s, 7.5% 2024s7.875% 2024s and 7.5% 2025s regarding their cross default provisions. The consent and exchange deadline is November 10, 2021.

Separately, Yango has asked its asset-backed securities’ (ABS) holders to refrain from asking for repayment for a year over concerns it would struggle to pay, as per Business Times. The forbearance was sought on its local RMB 1.27bn ($200mn) 6.5% ABS due November 2022 that give its holders the option to demand repayment next month due to a put option. Yango was downgraded by Fitch last week and its dollar bonds have crashed over 70% in October.

For the full story, click here

Go back to Latest bond Market News

Related Posts: