This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

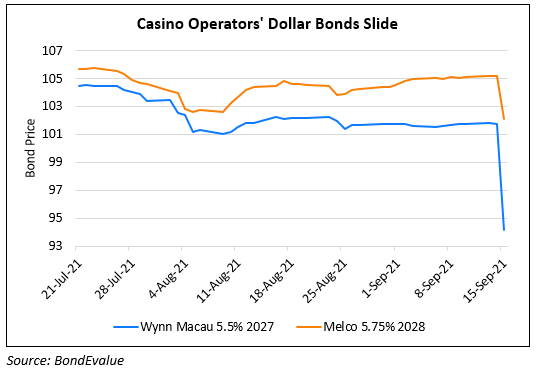

Casino Operators’ Dollar Bonds Drop on Tightened Supervision of Casinos

September 16, 2021

Dollar bonds of Wynn Macau, Melco’s and Sands China fell dropped ~5 points, 3 points and 1 point respectively yesterday after Macau officials said they would change casino regulations to tighten restrictions on operators, including appointing government representatives to supervise companies in Macau. Officials would begin a 45-day public consultation period on September 15 to discuss the legal revisions. Topics covered include: how many licenses (concessions) will be allowed, duration of their terms, the level of government supervision and a proposal to increase local shareholdings of casino companies. “The casino issues are a continuation of what’s been a pretty big crackdown…There’s a debate over whether China is even investable right now. You never like to see increased regulation, increased taxes, restrained movement. That all seems to be the status quo.” said Jason Ader, CEO of NYC-based investment manager SpringOwl Asset Management and a former Las Vegas Sands Corp. board member. The move by Beijing Beijing is another step in its crackdown on business and society that initially focused on tech giants, video-game use and after-school tutoring.

Wynn Macau in particular saw its dollar bonds take a brutal hit. Wynn Macau and Wynn Palace contributed a combined 46% of Wynn Resorts’ Q2 operating revenues at $184mn and $270mn respectively.

Wynn Las Vegas’ 5.5% 2025s are down 2.9 to 103.4 and Studio City’s 5% 2029s are down 4.7 to 92.9.

For the full story, click here

Go back to Latest bond Market News

Related Posts: