This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

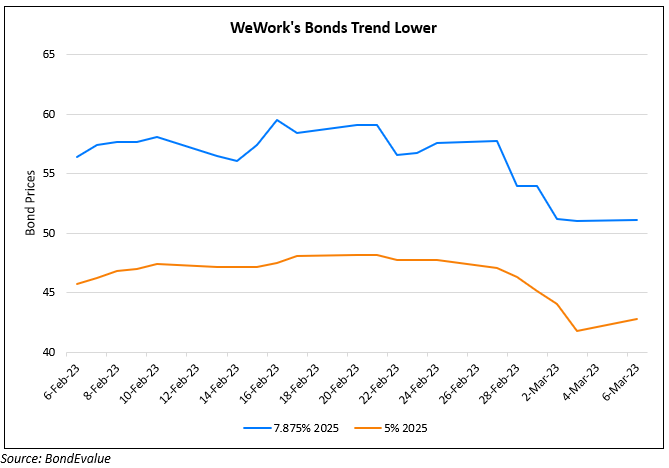

WeWork’s Bonds Trend Lower

March 6, 2023

WeWork’s bonds due 2025 fell by over 10% last week. The company has been facing financial pressures after it recently reported a net loss of $454mn in its 4Q 2022 results. Whilst this was down by around $260mn vs. the same period a year ago, it was still over half of its total revenue during the quarter, which stood at $848mn. WeWork’s cash and cash equivalents fell to $287mn in Q4 vs. $460mn in Q3 indicating the cash burn compared to its long-term debt at $3.2bn. For the full year 2022, the co-working company burned through $733mn of cash. Jonathan Price, a Chartered Fellow of the Chartered Institute for Securities & Investment said, “The company needs to go into Chapter 11, be relieved of most of its debt, and be restructured under a completely new management drawn from the industry, not from outside”.

For the full story, click here

Go back to Latest bond Market News

Related Posts:

WeWork Burns $3.2bn in 2020; Occupancy Fell to 47%

March 23, 2021

WeWork Explores Fresh Equity Raise

March 7, 2022