This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

Walmart Raises $2bn via Green Bond, Largest Ever by a US non-financial Company

September 9, 2021

Walmart raised $2bn via a debut 10Y green bond at a yield of 1.839%, 25bp inside initial guidance of T+75bp area. The green bond was part of a wider $7bn five-tranche issuance and comes amid efforts to reduce carbon emissions, boost recycling and clean up its supply chain, as per Bloomberg. Walmart intends to achieve a target of zero emissions by 2040 and also aims for a 1bn metric ton cut in emissions from its supply chain by 2030. “It certainly seems like they’re serious about taking a sustainability leadership role within the retail space…I don’t know how other retailers will be able to avoid making similar commitments and changes”, said James Rich, a senior portfolio manager at Aegon Asset Management.

The green issuance by Walmart is the largest by a US non-financial corporate and surpasses NextEra Energy Capital’s $1.5bn deal in June 2021 and Apple’s $1.5bn deal in February 2016.

For the full story, click here

Go back to Latest bond Market News

Related Posts:

Aramco to Refinance $10bn Revolving Loans

April 23, 2021

ADCB’s Profits Surge Over 5x to $300 Million

April 26, 2021

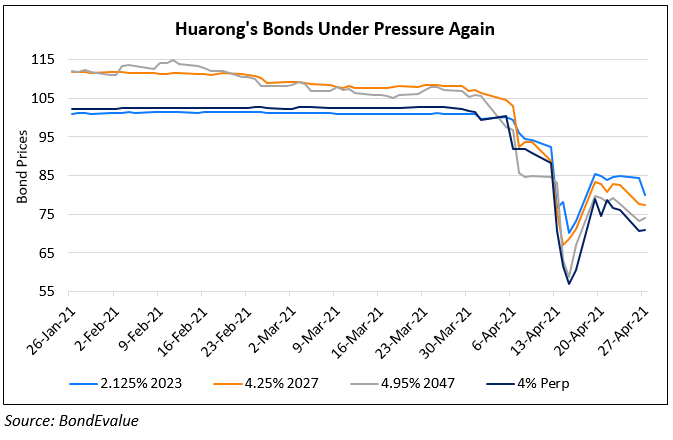

Huarong Downgraded Three Notches To BBB By Fitch

April 27, 2021