This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

US Investment Firm GQG Invests $1.87bn in Adani Companies

March 3, 2023

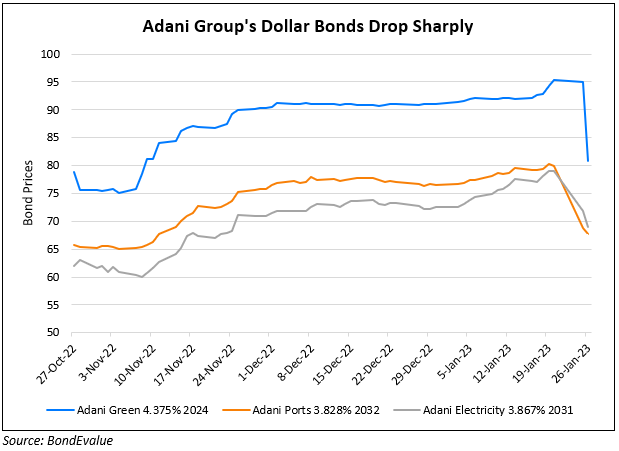

Adani Group companies shares saw an investment of $1.87bn by US boutique investment firm GQG Partners. As Reuters notes, this is the the major investment in the Indian company since late January when Hindenburg came out with their report. GQG, which oversees an AUM of $88bn, is said to have bought shares in four Adani group companies – it took a 3.4% stake in Adani Enterprises for about $662mn, 4.1% in Adani Ports for $640mn, 2.5% in Adani Transmission for $230mn, and 3.5% in Adani Green Energy for $340mn. The shares were sold by an Adani family trust. Rajiv Jain, GQG’s chairman and CIO said, “We believe that the long-term growth prospects for these companies are substantial”, adding that they did a “deep dive” into Adani Group and “disagree” with Hindenburg’s report. Adani group companies’ dollar bonds were trading stable.

For the full story, click here

Go back to Latest bond Market News

Related Posts: