This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

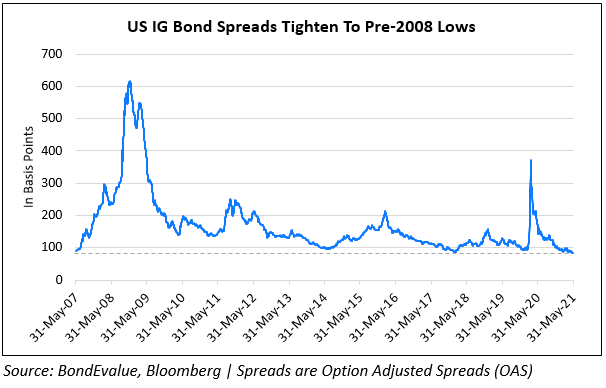

US IG Spreads At 14Y Low

May 31, 2021

US corporate investment grade (IG) option-adjusted spreads (OAS) hit a 14Y low to 84bp over Treasuries. Spreads of both IG and high yield bonds (HY) have been moving lower and the news comes a few weeks after CCC-rated bond spreads hit a 13Y low last month. Bloomberg notes that better earnings, post-pandemic recovery and cheap borrowing costs have helped bring IG spreads to lows even as inflation fears have slowly creeped in. Some suggest that the move across credit markets is overdone with Morgan Stanley strategists saying, “The best days are behind… The combination of extended valuations, less favourable technicals and a slower pace of balance sheet repair suggests that credit markets have progressed to a mid-cycle environment”.

For the full story, click here

Go back to Latest bond Market News

Related Posts:

Brookfield, KKR Seeking to Pump $10 Billion in Aramco Pipelines

January 21, 2021

Softbank Outlook Revised to Stable from Negative by S&P

January 27, 2021