This site uses cookies to provide you with a great user experience. By using BondbloX, you accept our use of cookies.

Bond Market News

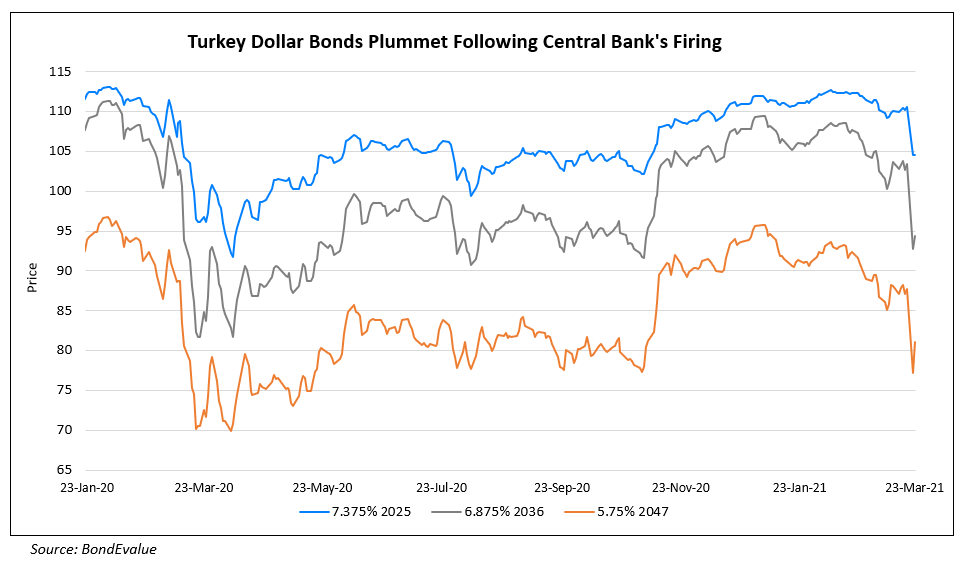

Turkish Dollar Bonds Take a Beating Post Sacking of Central Bank Chief

March 23, 2021

Turkey’s dollar bonds fell sharply across the curve on Monday following news of President Erdogan sacking the Central Bank Chief. Turkey’s 7.375% 2025, 6.875% 2036 and 5.75% 2024 were down 6.0, 10.6 and 10.6 points on Monday to 104.51, 92.79 and 77.18, yielding 6.05%, 7.5% and 5.78% respectively. Other bonds were not spared, falling ~5 points on average since last Friday. Among Turkish corporate bonds, Turkey’s largest private bank IS Bank’s 7.75% 2030 and Turkey’s leading mobile phone operator Turkcell’s 5.8% 2028 fell the most, ending Monday 7.08 and 6.25 points lower to 96.4 and 100.26 on Monday. Turkey is currently rated B2/BB-/B+ and had its outlook recently revised to stable by Fitch noting the improved confidence by the central bank.

Go back to Latest bond Market News

Related Posts: